Updated July 18, 2022, to include information about the 2022 2290 filing season.

ATBS Business Consulting Manager Chris Goodsell notes that early in Form 2290 filing season for working independents there's plenty of time to avoid e-file service fees by just mailing in traditional paper forms from the IRS.

ATBS Business Consulting Manager Chris Goodsell notes that early in Form 2290 filing season for working independents there's plenty of time to avoid e-file service fees by just mailing in traditional paper forms from the IRS.

The summer of 2020 was remarkable in many ways – a spot freight surge began to change rates dynamics in fundamental ways as the COVID-19 pandemic scrambled supply chains, the virus itself was moving all around the nation, and nearly every in-person trucking event to speak of was canceled. Plenty tax deadlines had been extended, furthermore, from the spring in order to give U.S. citizens and businesses relief in an increasingly topsy-turvy time, in economic terms.

One deadline, however, would stand firm – the Aug. 31 date on which most independent owner-operators and fleets of all sizes must file Form 2290 with the Internal Revenue Service to pay annual Heavy Highway Vehicle Use Tax.

There was no relief on the deadline in 2021, either, and for 2022, July 1 as usual marked the opening of the 2022-'23 filing season..

For single-truck owner-operators running continuously throughout the year, the HHVUT isn't a heavy lift at a maximum of $550 per truck. As such, it's a tax that can be easy to overlook, with penalties for late payment or nonpayment as with other filings, business service firm ATBS said in a recent reminder/primer on the subject: "It's an important tax for owner-operators to be aware of and to be prepared to address every year."

Some exceptions to that rule apply for operators in lease-purchase agreements with carriers and/or leasing companies, said Chris Goodsell, ATBS business consulting manager. The owner of the truck is required to pay the tax. Thus, if you're leasing the truck, the title remains with the carrier or leasing company until your purchase at the end of the term. "Is the carrier filing the 2290 or does the owner-operator file it?" Goodsell notes a question that comes up often enough. A number of carriers might chargeback the cost of the tax with the terms of the lease, handling it through settlement deductions, or a leasing company could require the operator to file the tax in the terms of the lease contract.

In any case, one important item ATBS notes that 2290 filers will need is an employer identification number. That includes owner-operators whose businesses are sole proprietorships and who file taxes routinely with their Social Security numbers for identification.

Need for an EIN routinely pops up as an issue for owners who've recently bought equipment to get into business, Goodsell said. Owners can obtain the EIN "right through the IRS. You can walk through it pretty easily," he said, later sending along this link for more information about the process. (Goodsell made note that even though it’s an online portal for the application, it’s limited to 7 a.m. to 10 p.m. Eastern for operating hours.)

ATBS doesn't offer 2290 filing services itself, noted President Todd Amen, essentially because the form is generally simple to file online -- a requirement for fleets with 25 trucks or more. Smaller fleets still have the option of paper filing, though the convenience of online systems have attracted many an independent owner-operator to e-file service providers, even including fees for use of those services ranging from as low as $10 to more than $40 for a single power unit.

"This time of year," said Goodsell, given the Aug. 31 deadline is still two months out, "if they don’t want to pay that fee, mail it in. You’ve got time. A lot of people who wait and get really close to the deadline and need to file quickly – e-file’s the way to go."

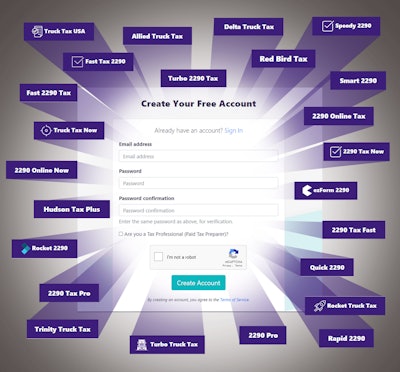

There are a lot of options for e-filing. In August of 2020 Overdrive reported on something of a scrum among providers on the Internal Revenue Service's list of IRS-approved "modernized e-file" services for 2290 filing. At that time, 24 providers listed there were separate business entities marketing what appeared to be essentially the same product, and by the end of the 2020 filing season, that number had grown by three to 27 by a count conducted last month.

The IRS, in response to Overdrive's queries at the time, noted the agency was aware of competing providers' complaints about a supposed gaming of the system, but couldn't comment further.

Queried again in 2021, though, IRS spokesman James E. Southwell went further to say that all 27 companies listed had individual employer identification numbers and had all met "suitability and testing requirements to become an Authorized e-File Provider" in accordance with guidelines set forth in the agency's Publication 3112.

With some minor variations, login at each of the 24 websites identified with last year's report appeared to flow much like it does in this illustration, which shows the company names and websites then at issue. The same login at one worked functionally on any of the others.

With some minor variations, login at each of the 24 websites identified with last year's report appeared to flow much like it does in this illustration, which shows the company names and websites then at issue. The same login at one worked functionally on any of the others.

When the 2021 approved 2290 e-file providers' list finally debuted, a check of it just ahead of the July 1 opening of filing season that year showed a grand total of 21 providers, 20 of which appeared to be in the control of the same provider, identified in prior reporting as a Missouri-headquartered business called Union Group Labs.

Absent from the list were well-known names in trucking like J.J. Keller, Express Truck Tax, and others. Asked if the 2021 list was a work in progress at the time given the 2290 tax season was just getting under way, Southwell noted "we continually update the web page as new content becomes available. However, while it is possible, I wouldn’t assume that additional providers will be listed. Your audience would probably best benefit from an early reminder (or even repeated reminders) so they can get started in time to complete the task by the due date." (As previously noted, the 2290 filing deadline for any owner trucking in July is Aug. 31.)

Also absent from the list July 2, 2021, was the Delta Truck Tax business, which the 2020 IRS provider list showed as headquartered at the address shown in the picture in Nashville on Charlotte Pike, Suite 992. Queried about the company, the clerk manning the desk inside the FedEx drop location, a relatively small storefront in a strip mall, noted it was common for all manner of businesses to use the address for mail delivery/forwarding. As of July 18, 2022, the same address for the former Delta Truck Tax was being used by the 2290Trucking.com business.

Also absent from the list July 2, 2021, was the Delta Truck Tax business, which the 2020 IRS provider list showed as headquartered at the address shown in the picture in Nashville on Charlotte Pike, Suite 992. Queried about the company, the clerk manning the desk inside the FedEx drop location, a relatively small storefront in a strip mall, noted it was common for all manner of businesses to use the address for mail delivery/forwarding. As of July 18, 2022, the same address for the former Delta Truck Tax was being used by the 2290Trucking.com business.

With the update, the number of companies on the list that appeared to be using the same backend ID'd above had grown by three, for a total of 23, accounting for slightly more than half of the full list.

Not much appears to have changed about list dynamics in 2022 but for a larger number of total entities listed as of July 18, 2022, at 56 total. If you need to e-file Form 2290 this year, you can access the most current version of the list via this link.

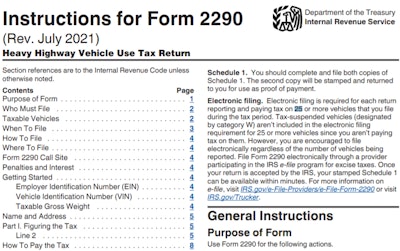

Here'are links to the Form 2290 itself and instructions.

[Related: IRS list of highway tax 2290 e-file providers flooded with apparent shell companies]