The late March decline in freight appeared to be hitting small carriers harder than larger fleets, and a bigger share of the smaller operations expect things to get worse, based on a survey of Commercial Carrier Journal readers.

There were 47 respondents owning or driving for fleets of fewer than 10 trucks in the survey of CCJ readers, meaning a wide margin of error in those results. Respondents with 10 or more trucks totaled 192. The survey was made during March 25-30.

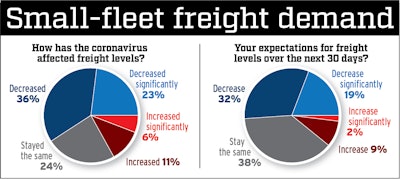

There were 47 respondents owning or driving for fleets of fewer than 10 trucks in the survey of CCJ readers, meaning a wide margin of error in those results. Respondents with 10 or more trucks totaled 192. The survey was made during March 25-30.Almost six in 10 respondents who own or drive for a fleet of fewer than 10 trucks saw freight demand drop during March as the coronavirus pandemic began to derail the economy, according to a small sampling of small-fleet results gathered March 25-30. Among the 192 respondents with 10 or more trucks, 41% in the same week reported weaker freight.

“Clients cancelling pickups due to plant shutdowns,” commented one small-fleet respondent.

Another wrote, “90% loss in business in just a few days.”

Asked to rate the final week of March as the worst or best week ever, using a 10-point scale, almost one in five small-fleet respondents gave it the top rating as the worst. More than three-fourths rated it 1-5 (out of 10) as the worst.

Earlier in the month, trucking industry analysts said freight was strengthening as a tough winter season abated. Reports of slowdowns increased as businesses of all sizes made job and spending reductions as the pandemic forced cutbacks nationwide.

Based on fuel purchases for the entire month, though, members of the National Association of Small Trucking Companies, heavily rural-based long-haul truckload carriers, “are running just as hard or harder than they did in previous months,” said David Owen, NASTC president, referring to volumes purchased in the association’s discount fuel program.

He speculated that the $2 trillion federal relief plan will help trucking. “There’s only so many times you can do that, but I think it bought the economy maybe six weeks,” he said.

Roughly half of small-fleet and larger-fleet survey respondents expect the freight market to worsen over the next 30 days.

About a fourth of the larger fleets expect increased demand for freight, but only 11% of small fleets say the same. Among the fleets most expecting steady, if not increased, freight are those heavy in refrigerated.

Moeller Trucking of Ohio is one. The fleet pulls mostly food in reefer trailers, with a small group of milk tankers as well. “Our customers have been slammed” with efforts at restocking grocery stores after big bulk buying by consumers throughout this month, said Dan Moeller. The fleet recently added two owner-operators who “had been hauling dry vans and lost all their freight.”

Moeller imagines a possible slowdown “once the shelves get restocked,” but “we’re not hearing any of that from our customers.”

About 40 owner-operators lease to Moeller Trucking at present Dan Moeller says.

About 40 owner-operators lease to Moeller Trucking at present Dan Moeller says.Among small carriers in the survey, 19% said they have decreased their driver workforce. “Not calling back drivers to work for an extended period of time,” wrote one respondent. Apparently many fleets are trying to hold on to drivers and other employees by keeping them busy: 64% said their response to diminished business has included “increased cleaning of facilities.”

Also, 17% of the small fleets are pursuing new lines of business.

Owen said NASTC has canceled its April New Entrant Survival Training seminar. In the next 30 days it’s likely to decide on whether to cancel its annual fall symposium. NASTC has remained open and fully operational, with its staff working remotely. —Todd Dills contributed to this report.