FTR sees a huge decline coming in an indicator that reflects trucking industry prospects, the Gross Domestic Product Goods Transport Sector. The firm expects a 24% drop during the April-June quarter from the first quarter, and little improvement in the following three months. A more pronounced turnaround could take place in the fourth quarter.

FTR sees a huge decline coming in an indicator that reflects trucking industry prospects, the Gross Domestic Product Goods Transport Sector. The firm expects a 24% drop during the April-June quarter from the first quarter, and little improvement in the following three months. A more pronounced turnaround could take place in the fourth quarter.Truckers working the spot market in the reefer segment are likely reaping big rewards right now, with load volumes — and per-mile rates — skyrocketing over the past two weeks. Likewise, van haulers are benefiting from retailer and grocer restocking after panic buying emptied shelves across the country. An uptick in loads of medical supplies and hygienic products is keeping certain haulers busy.

Carriers not working those areas, however, are likely already feeling the pain of the sudden COVID-19 coronavirus-wrought global economic freeze as businesses and plants shut down, workers face job losses, restaurants close, events cancel and millions of individuals stay at home and buy only necessities.

Though the boom for van and reefer on the spot market could persist well into April, freight overall is in steep decline and is expected to further deteriorate. Consulting firm FTR, in its forecast issued Wednesday, using seasonally adjusted annualized rates, forecast GDP to fall 11% from the first to the second quarter. More dramatically, FTR forecast the GDP’s goods transport sector to decline by 24.1% in that period.

Clickhere to view our full coverage of the coronavirus' impact on the trucking industry from the leading industry publications of Commercial Carrier Journal, Overdrive, Truckers News and Trucks, Parts, Service.

For instance, manufacturing is at a standstill as plants close as part of shelter-at-home directives from states and municipalities. It’s unclear when manufacturing can bounce back, given the lingering uncertainty around the virus’ spread and the impact on business and consumer spending that underlies manufacturing output. Likewise, imports from China are non-existent due to the country’s shutdown over the COVID-19 outbreak there, fuel and oil hauling have declined considerably due to lack of demand and plummeting oil prices, and construction activity suddenly faltered from its recent upward swing.

“There’s no question the spot dry van and reefer market is on fire,” said Brian Fielkow, CEO of the 130-truck fleet Jetco Distribution. “It’s great because we’re seeing how trucking takes care of society and keeps shelves stocked and grocery stores and drug stores full and delivers critical equipment. On the other hand, major parts of the economy that rely on trucking have come to a standstill. The story that is going to unfold is that there are going to be haves and have-nots.

“Companies that are nimble and can shift into the right markets are going to stay busy. Others will go dormant.”

Flatbed, which was hot before the COVID-19 shutdown, has fallen into a decline, Vise added. “Flatbed, bulk and dump will be hit the hardest,” he says. FTR forecast truck loadings to fall by 4% this year, versus its original 2020 forecast of a 1.3% gain. The firm projected flatbed loadings to fall by 6% this year and bulk and dump segments to fall by 9%.

Reefer is the lone positive in most forecasts. Truckstop.com analyst Stephen Bindbeutel said the company recorded a boom in load postings last week for reefer and dry van, but a “sharp reduction” for flatbed. Available flatbed loads dipped by 14.3% week over week last week compared to an 8% jump for van and a nearly 40% jump for reefer.

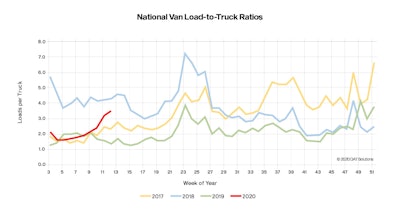

This chart from DAT shows the surge in volume from replenishment activities continues to drive up demand for trucks, as reflected in load-to-truck ratios and rates. The national average van load-to-truck ratio last week was 3.5, up from 3.2 the previous week. That’s the eighth straight week of rising ratios. More dramatically, DAT says, the average ratio is up 150% compared the same week in 2019. For reefers, the rise has been even more dramatic, up more than 20 percent in the most recent week over the preceding, showing fast-rising demand in March.

This chart from DAT shows the surge in volume from replenishment activities continues to drive up demand for trucks, as reflected in load-to-truck ratios and rates. The national average van load-to-truck ratio last week was 3.5, up from 3.2 the previous week. That’s the eighth straight week of rising ratios. More dramatically, DAT says, the average ratio is up 150% compared the same week in 2019. For reefers, the rise has been even more dramatic, up more than 20 percent in the most recent week over the preceding, showing fast-rising demand in March.The van segment could also soon fall on tough times, Bindbeutel said. As the recent scramble plays out, “many carriers could experience a whiplash effect as the restocking pressure ends, only to be replaced by the reality of sharply fewer loads. Dry van could soon experience what flatbed and specialized are starting to experience now.”

In addition to grocery restocking of cold-sensitive items, the produce season will help buoy reefer as the restocking levels out, said Ken Adamo, chief of analytics for DAT. “If you’re a reefer hauler, there’s opportunity out there.”

Flatbed has mostly performed in line with seasonal trends so far, he added, but with oil prices, housing starts and heavy construction being wildcards. For example, though rock-bottom interest rates could spur investment, “it’s a double-edged sword,” he said, as credit standards tighten during a downturn and banks aren’t as willing to lend.

The No. 1 forecasting wildcard for all sectors, however, remains the containment of the COVID-19 outbreak and the extent to which lockdowns continue. FTR’s Clay Slaughter, chief strategy officer, likened the economic effects to “multiple hurricanes all at once with no end” in sight.

An extended quarantine, combined with government policies that could prove ineffective at mitigating the economic fallout, might tip the U.S. into “a deep and painful recession,” said Chris Pickett, chief strategy officer at Coyote Logistics. However, virus containment and a shorter economic stall, combined with potentially effective stimulus packages out of Washington, could hasten a rebound.

Coyote forecasts spot market rates to remain elevated throughout the year, mostly due to choppy surges in freight, said Pickett. The situation renders most shippers’ transportation planning for the year useless already.

“It’s important to keep in mind that it’s not just the net increase or decrease in total truckload demand, it’s the nature of the underlying freight flows,” he added. “Whatever transportation plan folks came into 2020 with, whether you are a shipper or a carrier, is pretty much out the window at this point. Given the demand and supply shocks, across the market we’re seeing a profound shift from planned contract moves to unplanned. Since most unplanned lanes don’t often have a contract rate on file to tender against,” pricing on those loads will be dictated by the spot market.

After the likely economic bloodletting in the second quarter, FTR predicts the third quarter will be flat in that trough before small growth in the fourth quarter. The firm predicts the economy to gain steam into 2021, with freight activity potentially reaching where it was in the first quarter of 2019 by mid-2021.