How’s your business fairing so far under the economic stop? Are you planning to use any of the aid options available (which includes unemployment expanded beyond employees to independent contractors through later this year)? Drop a comment below or email [email protected].

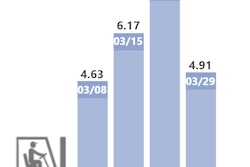

How’s your business fairing so far under the economic stop? Are you planning to use any of the aid options available (which includes unemployment expanded beyond employees to independent contractors through later this year)? Drop a comment below or email [email protected].Perhaps unsurprisingly, spot rates in all three major segments in March climbed a few cents each. That might not be the per-mile gains quite expected, given the surge of goods dumped on the spot market last month as part of restocking efforts nationwide — they’re more significant, though, when you consider the price of diesel nationally fell about 30 cents a gallon over the course of the month, worth another five cents a mile for most truckers working the spot market.

According to Truckstop.com, per-mile national averages for reefer and dry van segments climbed 7 cents each — to $2.30 a mile for reefer and $2.07 a mile for van. Flatbed rose 4 cents a mile, to $2.43, holding its footing as the strongest segment for rates despite the bleak outlook for flatbed freight.

Clickhere to view our full coverage of the coronavirus' impact on the trucking industry from the leading industry publications of Commercial Carrier Journal, Overdrive, Truckers News and Trucks, Parts, Service.

We reported Monday on the emergency unemployment options newly available to the self-employed as part of the wave of relief funding coming from Washington — upward of $600 a week from the federal government should work completely dry up as a result of COVID-19 impacts specified in the legislation.

The Coronavirus Aid, Relief and Economic Security (CARES) Act also provides a few other aid options for small businesses to make ends meet during the fallout ongoing.

First, the Paycheck Protection Program allows small businesses — including independent contractors and sole proprietorships — to secure short-term bridge loans to help make payroll (including paying yourself) and meet other monthly obligations, such as debt payments. If the money is used for purposes of payroll and other pre-existing monthly payments, the loan is required by the CARES Act to be forgiven.

Applications for those loans for small fleets, available through standard lenders like banks and credit unions, will be accepted starting April 3, according to a notice issued Wednesday by the National Association of Small Trucking Companies.

The rules are still a little murky for independent contractors and sole proprietors, but the Small Business Administration says it plans to finalize the process and rules around those loans this week. Likewise, the CARES Act requires SBA to expand and more quickly process so-called Express Loans, intended to help provide a short-term cash infusion, if needed.

The CARES Act also provides an additional $10 billion in funding to the SBA’s economic disaster grants program — applications for which are available this link.

How’s your business fairing so far under the economic stop? Are you planning to use any of the aid options available (including the beefed up unemployment)? Drop a comment below or email [email protected].