Reefer haulers are well-positioned for keeping steady miles through the coronavirus crisis. The outlook in other niches isn’t so bright.

Reefer haulers are well-positioned for keeping steady miles through the coronavirus crisis. The outlook in other niches isn’t so bright.Thursday’s report of a record-shattering 6.6 million unemployment claims filed in one week – double the equally stunning 3.3 million of the week before – made it clear that the coronavirus pandemic was slamming the brakes on the economy. Trucking would not escape the jolt. Some industry forecasters expected no significant turnaround until fall.

Clickhere to view our full coverage of the coronavirus' impact on the trucking industry from the leading industry publications of Commercial Carrier Journal, Overdrive, Truckers News and Trucks, Parts, Service.

So a big question remains: Is there any other freight that will stay in demand throughout the crisis and pass muster with edicts restricting non-essential commerce?

It seems easier to list the hauling niches with dim prospects: events, oil, construction, port drayage, automotive sales and manufacturing, as well as most other industrial production. It adds up to a possibly big hit on dry van freight, an even bigger hit on flatbed.

“Companies that are nimble and can shift into the right markets are going to stay busy,” said Brian Fielkow, CEO of the 130-truck fleet Jetco Distribution. “Others will go dormant,”

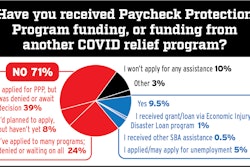

Some small fleets have built dedicated routes with a stable of loyal shippers, but loyalty stretches only so far, as most independents knew even before this downturn. Furthermore, many owner-operators with their own authority, unlike large fleets, have little or no cash reserves. We reported this week on a survey of fleet readers from Commercial Carrier Journal, a sister publication of Overdrive’s, that quantified just how much the smallest fleets are suffering relative to larger ones.

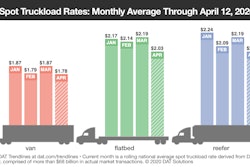

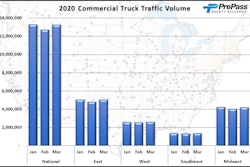

Still, the expected downturn for trucking has been slow taking shape, as measured by rates. Spot rates averaged for March actually did well, climbing over the month for dry van, reefer and flatbed, thanks partly to very strong demand early in the month. Freight demand is visualized regionally in an interactive map showing consulting firm FTR’s analysis of Truckstop.com data by state. The map shows rates in the three segments staying strong (relative to each state’s historical data, as explained on the site) through the most recent update, March 29.

Forecasts indicate that demand for most non-food freight will begin eroding in April, especially for flatbed. Even so, there could be occasional relief for independents in the spot market as the crisis drags on. Rates are expected to remain elevated throughout the year, mostly due to choppy surges in freight, said Chris Pickett, chief strategy officer at Coyote Logistics. Whether good rates on sporadic freight will be enough for independents to get by is another question.

Leased operators, as well, should have a good idea by now of their fleet’s stability. Normally it’s wise to stick with a fleet if your relationship, miles and pay are good, but these are not normal times. Make a sober assessment of what’s in store for you.

By all means, take advantage of unemployment benefits and anything else applicable in the national stimulus plan. Just don’t expect those measures, even with a 13-figure dollar amount to fund it, to magically jump-start trucking to levels you’re used to.

– James Jaillet contributed to this column.