This story is the December issue’s cover piece — find a digital edition of the magazine, on its way to subscribers’ mailboxes, via this link.

This story is the December issue’s cover piece — find a digital edition of the magazine, on its way to subscribers’ mailboxes, via this link.About five years ago, John Taylor, who drives for a sizable fleet, picked up at a shipper that insisted on him using its tracking technology on his phone. He told them no, as did his company.

“Finally, I remembered an old throwaway phone I got when I broke my regular phone,” he says. “It had minutes on it.”

He gave the shipper that old phone’s number and set up the tracking. When he stopped in San Antonio for a trailer repair, he tossed the phone in a trailer southbound to Laredo. “We were going west.”

Such active pushback on what has become something of a norm for many independents and others – the profusion of third-party services that track load progress – illustrates yet another norm.

“We all have a subscription to trust issues,” quips owner-operator Dean Carnahan, hauling leased to a small Chicago-based fleet most often in support of the auto industry. He and others recognize such issues aren’t confined to owner-operators and drivers, but include parties all along the supply chain.

Tracking technologies have furthered trust for some haulers – and brokers and shippers – by verifying what any party says regarding a load’s location. Yet as Taylor’s anecdote shows, owner-operators haven’t exactly gone gently into tracking’s new world order. At his carrier, which uses the PeopleNet system for mobile communications, and at thousands of others, tracking for dispatch and security purposes has long been a reality.

Furthermore, with the electronic logging device mandate now in play, untold thousands of owner-operators and small fleets otherwise untethered to an expensive early generation of onboard communications devices now are part of in-carrier tracking via their ELDs.

Increasingly, though, the additional layer of tracking technology in evidence in Taylor’s case is coming from customer brokers and shippers as package tracking has become ubiquitous in the consumer world. Brokers and third-party tracking companies claim shippers and receivers are demanding such tracking from their freight transport service providers as a matter of course.

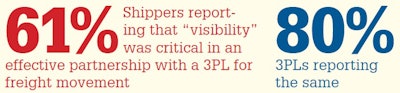

To an extent, however, there’s evidence that the rise in broker-provided tracking services comes more from brokers and third-party logistics services themselves than from shippers. A recent study showed that eight in 10 3PL survey respondents viewed the ability to provide “visibility” as a crucial IT-related function of a 3PL. Only six in 10 shippers, meanwhile, concurred.

In the “2018 Third-Party Logistics Study,” sponsored in part by 3PL Penske Logistics, respondents were asked “which information technologies, systems or tools must a 3PL have to successfully serve a customer in your industry classification.” While detailed freight tracking is clearly important to shippers and 3PLs, it can create data overload for a large shipper, says Joe Carlier, vice president of global sales for Penske. The company is working toward providing the shipper “a single source of visibility on all the transportation that we have.” Another goal is to keep the system as simple and nonintrusive as possible, minimizing the data generated and who has access to it.

In the “2018 Third-Party Logistics Study,” sponsored in part by 3PL Penske Logistics, respondents were asked “which information technologies, systems or tools must a 3PL have to successfully serve a customer in your industry classification.” While detailed freight tracking is clearly important to shippers and 3PLs, it can create data overload for a large shipper, says Joe Carlier, vice president of global sales for Penske. The company is working toward providing the shipper “a single source of visibility on all the transportation that we have.” Another goal is to keep the system as simple and nonintrusive as possible, minimizing the data generated and who has access to it.The very word tracking itself, partly as a result of antipathy to mandated ELDs and related privacy concerns, has acquired a sort of dirty-word connotation. Some object as a matter of principle: No one needs to know precisely where I am every second. Others point to more tangible concerns – over themselves, their freight or even national security issues – about tracking information getting into the wrong hands because too many parties along the chain have access.

Partly due to such sensitivities, you won’t hear tracking as often anymore from shippers and brokers. Instead, such parties now talk copiously of supply-chain visibility, with hints of an Orwellian spin on the technology’s positive aspects.

Things weren’t always quite so complicated.

In 2011, the well-known multifunctional Trucker Tools smartphone app grew from the simple Truck Stop Coupons app. Soon after, the project of Overdrive parent company Randall-Reilly and the Salebug company took on magazine branding as Overdrive’s Trucker Tools, though the Overdrive affiliation has since ended.

Its functions included Load Track, pitched in part to independent owner-operators as a way to satisfy broker/shipper customers’ visibility demands without resorting to expensive software. It also could virtually eliminate check calls by automatically sharing location.

A key function within Trucker Tools’ tracking then, which remains the case, says current company chief executive officer Prasad Gollapalli: “When we launched tracking, we made it transparent to the driver” and “put him in the driver’s seat of his tracking. He can pause the track” if he’s on break.

That’s not always obviously the case for third-party applications brokers and shippers would require carriers to use, though most apps do allow for pause.

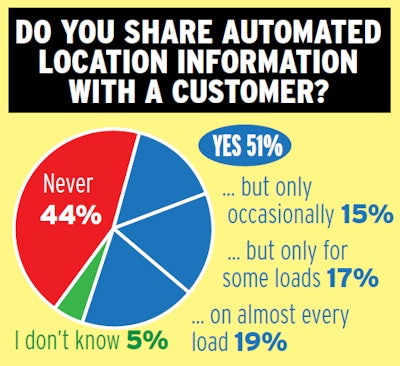

Automated location sharing with a carrier, broker or shipper is a reality for about half of Overdrive’s mostly owner-operator readers.

Automated location sharing with a carrier, broker or shipper is a reality for about half of Overdrive’s mostly owner-operator readers.Around the same time that Trucker Tools’ Load Track function debuted, the Macropoint third-party tracking service, launched eight years ago, began to make headway among brokers and shippers. Macropoint – now Descartes Macropoint after its acquisition by Descartes – targeted its tracking services directly to brokers and shippers as a way to cut down on phone time with drivers. That allows freight partners to effectively “manage by exception” and be able to track a load via a driver’s phone or his onboard dispatch or e-log system, says Brian Hodgson, vice president.

The exception? All that brokers’ shipper customers care about, says owner-operator Carnahan: “Whether we’re going to be late.”

Macropoint, Hodgson says, “really invented tracking in the broker space.” It still is “a benefit to both brokers and dispatchers,” eliminating many calls, and the company could even track a flip phone via location triangulation between cell towers. In efforts to “minimize the work that the driver has to do” to opt in to the service for a particular load, he adds, much of the functionality could be enabled via text message with a link or a series of replies.

Today, Descartes Macropoint boasts a virtual network of more than 1 million drivers. As to Big Brother worries among drivers that the broker they hauled for three years ago still can see where they are today, Hodgson notes that’s not how it works. Tracking in Macropoint only “starts when a load is assigned” and ends upon delivery. “We take data and privacy very seriously.”

Services such as Macropoint, says Carnahan, “ultimately make my life easier,” giving him direct contact with the broker in an operation that for all intents and purposes is self-dispatched. Having that technological connection in place, too, further entrenches him, and his carrier, as a known quantity in the broker’s network.

“They’re not going to bother us” with intrusive check calls “because we’ve done nothing to promote that kind of attention.” With a high level of service to go along with the relationship with the broker, he adds, “we won’t see the kind of micromanagement others do.”

And others do see it, even with tracking enabled. La Crosse, Wisconsin-based small fleet owner-operator Rob Hallahan’s biggest question for brokers that require carriers to opt in to third-party trackers such as Macropoint on their loads: “Why doesn’t anybody use it properly?”

Brokers or shippers using third-party trackers, Hallahan adds, “shouldn’t have to ever call a driver.” Yet before he expanded to five trucks this year from a one-truck operation, it wasn’t uncommon for him to shut down in the wee hours after getting loaded late in the day and driving through much of the night, only to receive a call waking him up about the time the broker’s office opened.

“If we wanted to be legit and legal about our hours, we should go on-duty when we answer that phone,” Hallahan says. “You just destroyed my 10-hour break.”

Hence the value to drivers of trackers that actually provide the ability to start/stop the track and systems that enable easy sharing of hours of service status information with freight partners. That might be the element of “visibility” growing the fastest, says Hodgson.

While not all ELDs “can provide location data on a real-time basis” – some will be set up to ping only once an hour when in transit, the minimum number of location updates – ELDs generally provide “more reliable data typically and have minimal impact on the driver,” Hodgson says. “If it’s a small carrier with five to 10 trucks, they can all opt in” to provide tracking information when necessary with a single start-up without the need to repeatedly initiate tracking of individual drivers’ phones.

Both Macropoint and Trucker Tools have moved toward greater levels of sophistication within the last year, opening up a sort of cooperative freight network for their broker customers and the brokers’ carrier partners. Both tout “predictive” capabilities.

With its new “Smart Capacity” platform, Trucker Tools is building on the carrier-centric capabilities in its application — easy proof of delivery, invoice management and more in addition to tracking, Gollapalli says. Such features “help carriers find freight days in advance from the broker” and better manage time, he says.

“It’s not just freight matching” in the old sense of the word but also “better reloads” booked in advance from brokers on the platform, he says. From the broker’s side, the system is designed to offer up the best carrier in the network to take a particular load.

Say a carrier is in Atlanta and can take a load to Dallas or elsewhere, Gollapalli says. “He looks at which load he should take to get a better reload. We tell him to go to another place to find a better reload” at a better rate. “The name of the game is continuous utilization.” Many owner-operators “take a very good load, and then after that they take two bad loads that wipe out the profit.”

If that all sounds familiar, that’s because Trucker Tools’ Smart Capacity system in essence adds a layer of technological sophistication on top of familiar advance load planning around hot markets. It’s also part of the benefit operators are seeing from in-house platforms at technology-enabled brokers – upstarts Uber Freight and Convoy, old hand C.H. Robinson and many others – and load-board stalwarts Truckstop.com and DAT. Sophistication of those online platforms continues to grow as well.

Descartes Macropoint’s new capacity matching platform, introduced this year, aims to do similar for its broker customers and carriers that opt in for more dynamic visibility. “The objective,” Hodgson says, is “really to try to help find that capacity” and “provide more asset utilization for the driver.”

As seems to always be appropriate of late when it comes to all things tech, welcome to the future.

Next in this series: For small fleets, tracking can be ELD fringe benefit