Trucking news and briefs for Thursday, Nov. 30, 2023:

Lawmakers considering ‘rolling stock’ tax exemption

The Massachusetts legislature has proposed bills that would bring the state in line with 37 other states that have no sales tax or use tax on “rolling stock,” which includes trucks, trailers, and parts for their operation.

Using a rolling stock tax exemption, truck owners in certain states can save when buying equipment and parts.

A list compiled by the American Transportation Research Institute shows where exemptions are in place for parts and equipment, current as of 2018. Take note of the text at the bottom for explanations of the dollar figures in the chart, based on a hypothetical truck and trailer purchase.

According to ATRI’s chart, a truck buyer in Massachusetts paying $145,000 for a tractor-trailer combination would pay $2,266 in sales tax on the equipment, along with $375 in sales tax on an assumed $6,000 worth of parts each year, including tires.

If the Massachusetts bills were to pass and be signed into law, the owner in the above scenario would be exempt from paying those taxes.

The Specialized Carriers & Rigging Association has voiced its support for the bills in both the Massachusetts House and Senate. “The rolling stock initiative will help bring safer, cleaner commercial vehicles to the Commonwealth while also supporting the growth of the specialized transportation, crane, and rigging industries in the state.”

SCRA added that passing the bills would “bring Massachusetts in line not only with the entire New England region, but all 37 states that have no sales or use tax on rolling stock.”

[Related: Parasitic costs: 15 ways to eliminate and save, build value as an owner-operator]

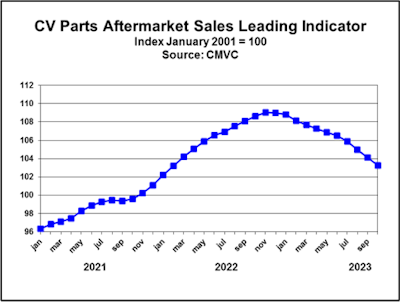

Reduced aftermarket parts demand could signal further pricing improvements

The Commercial Motor Vehicle Consulting (CMVC) firm, which tracks the aftermarket parts market among other things, reported Wednesday that its Parts Aftermarket Sales Leading Indicator (PLI) fell for the 11th straight month in October.

CMVC President Chris Brady noted that the fleet environment “has changed substantially over the past 12 months,” resulting in lower aftermarket parts sales.

Fewer sales could yield a positive for owner-operators in reduced parts pricing and improvement in parts availability -- both areas presented significant challenges for years after the COVID pandemic.

The PLI is designed to forecast inflection/turning points in aftermarket parts sales due to changes in fleets’ business environments as a result of cyclical changes in trucking.

The index peaked in November 2022 when parts sourcing for owner-operators and fleets was at its most difficult.CMVC

The index peaked in November 2022 when parts sourcing for owner-operators and fleets was at its most difficult.CMVC

As reported in Overdrive early this year, nearly 70% of respondents to a late-2022 Overdrive survey centered on part purchasing issues indicated that the difficulty and delays associated with sourcing parts either got worse or stayed about the same in 2022 as it was in prior years. Only 19% of respondents said their parts sourcing had gotten easier.

CMVC’s Brady said that while the commercial vehicle population is expanding, there are a number of factors impacting aftermarket parts sales, “including new and used truck operators upgrading their fleets and returning average age back to a norm, increasing supplies of idled trucks on the used truck market and trucks staying on the used truck market for a longer period of time due to the soft freight environment, and a downward trend in fleet capacity utilization indicating the rate at which the truck population is depreciating is slowing.”

Brady added that those factors “are more than offsetting an expanding commercial vehicle population resulting in lower parts aftermarket sales.”

[Related: Owner-operators navigate rocky parts-procurement landscape]

Two truckers hit big on Maryland scratch-offs

The Maryland Lottery reported this week that a long-haul truck driver based in Forsyth County, Georgia, turned $30 into $100,000 after getting lucky with a scratch-off ticket.

The unnamed driver told the Maryland Lottery after winning that he occasionally buys lottery tickets while out on the road, winning small amounts here and there.

The particular scratch-off that made him $100,000 richer -- the $100,000 Ca$h ticket -- grabbed his attention because “the ticket looked flashy and I figured it would be nice to win some extra money,” he told lottery officials.

The $100,000 Ca$h game has been available since September. It started with 65 top prizes at the $100,000 level, and 58 remain.

Also benefiting from selling the winning ticket was the Love’s Travel Stops location in Hagerstown, which receives a $1,000 lottery bonus.

Earlier in November, another trucker bound for Baltimore to pick up a load of tractors stopped at the Pilot Flying J in North East, Maryland, and also won the top $100,000 prize from the $100,000 Ca$h game. Maryland Lottery reported Nov. 16 that Tennessee-based Thomas Spangler frequently plays scratch-offs when he stops for a meal and fuel. His previous top lottery wins were $2,000 in Pennsylvania and $2,000 in Tennessee.

“The family says there’s great luck, good luck, bad luck and Spangler luck,” he joked after winning the big prize. “I couldn’t believe it. ... Nothing like this has ever happened to me. It couldn’t have happened at a better time.”

The Pilot Flying J that sold the ticket also receives a $1,000 lottery bonus.