The number of loads on DAT load boards was up 5 percent and truck posts were up 3 percent last week, an indication that the economy continues to hum along.

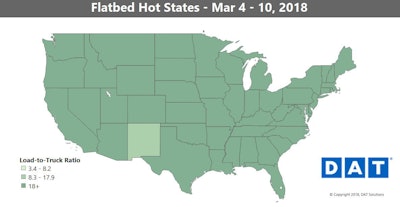

Unless you’re a flatbed hauler, in which case there’s a little more going on than just humming. The flatbed load-to-truck ratio hit an all-time peak last week: 88.5, up 11 percent from 79.9. It was 61.8 a month ago. Flatbed rates made big gains, too, especially in the southern U.S.

While neutral week-to-week conditions for reefers and dry vans were on display last week as a general rule, flatbed demand has continued to surge, and load posts are far out-pacing truck posts.

While neutral week-to-week conditions for reefers and dry vans were on display last week as a general rule, flatbed demand has continued to surge, and load posts are far out-pacing truck posts.The number of flatbed load posts jumped 11 percent last week while truck posts fell 1 percent. That combination sent rates higher on 50 of the top 78 flatbed lanes. The national average rate was $2.50/mile, up 11 cents compared to the previous week.

Hot markets: Houston is the biggest market for flatbed loads. Volumes were up 11 percent there, which pushed rates higher on outbound lanes. Phoenix still has the lowest outbound rates among the most active flatbed markets, but rates increased sharply last week.

Not so hot: It’s hard to find fault with flatbed rates and volumes. But compared to the Sunbelt, markets in the Midwest and Northeast have not kept pace. Rates on several key lanes were lower last week:

Pittsburgh to Grand Rapids, Mich.: Down 42 cents to $3.42/mile

Cleveland to Harrisburg, Pa.: Down 41 cents to $3.99/mile

Rock Island, Ill. to Indianapolis: Down 41 cents to $3.26/mile

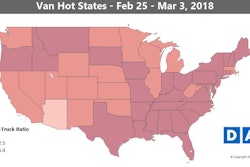

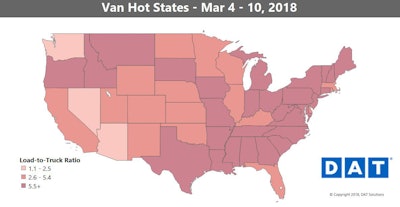

Van rates held onto the gains they made in the prior week and mostly stayed put.

Van rates held onto the gains they made in the prior week and mostly stayed put.Van overview: At $2.14/mile, the national average van rate was unchanged — and that’s good news. Van rates generally held firm despite a 1 percent dip in volume and a 3 percent rise in truck posts. It was a mostly neutral week in terms of van rates on the Top 100 lanes: overall, 51 lanes were up, 39 were down, and 10 were unchanged. The van load-to-truck ratio was 6.8, down slightly compared to the previous week.

Hot markets: Buffalo rebounded after several weeks of declining volumes, and two key lanes produced healthy rate increases. Buffalo to Chicago was up 21 cents to $2.11/mile while Buffalo to Columbus, Ohio, averaged 20 cents higher at $2.36/mile. Dallas rates outbound edged up an average of 3 cents per mile compared to the previous week. Does a 3-cent bump make Dallas a hot market for spot rates? It was that kind of week for van freight.

Not so hot: Memphis fell, and Memphis to Columbus, a key regional lane for van freight, was down 37 cents to $2.28/mile. Most lanes from Stockton, Calif., slipped on volumes that were 9.5 percent lower.