The Motive electronic logging device provider and operations platform has added fuel-fraud detection tools to its Motive Card fuel-card product, in efforts to detect and stop fraud before a bogus purchase happens. The threat for owner-operators from fuel-card skimming thieves is well-known, as evidenced in coverage earlier in the year or other fuel-payments providers' theft-protection protocols.

Motive joined them this week by integrating telematics data from the Motive platform to give owner-operators and fleet managers who use the Motive card the precise data and controls they need to effectively identify and decline fraudulent transactions. In a 30-day trial, the company reported, its new fraud control features identified more than $250,000 worth in 1,200-plus unauthorized transactions.

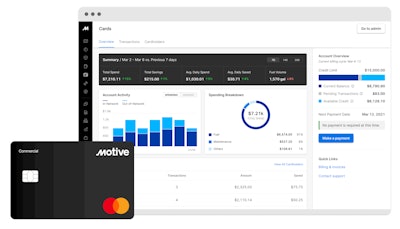

“The Motive Card does so much more than save us time and fuel costs, it alerts us to potentially fraudulent activity and declines those transactions. We haven’t had any fraud since using the Motive Card,” said Alex Amort, vice president of compliance for Cascade Environmental. “Because we’re able to manage our fleet and expenses in one dashboard, we have much closer control over our operations, can stop fraud before it happens, and can better coach our drivers on fueling policies and efficiency.”

Motive estimates around a fifth of a fleet's spending is "lost to fraud or theft, leading to an average revenue loss of nearly $1 million per year for companies in the trucking, logistics, construction, oil and gas, and other sectors,” said Motive Financial Products Vice President Hemant Banavar.

Motive estimates around a fifth of a fleet's spending is "lost to fraud or theft, leading to an average revenue loss of nearly $1 million per year for companies in the trucking, logistics, construction, oil and gas, and other sectors,” said Motive Financial Products Vice President Hemant Banavar.

A few of the new functionality's highlights:

- Vehicle and Spend Location Mismatch: Card customers can set up alerts and auto-decline controls if the vehicle location does not match the fuel card transaction.

- Fuel Type Mismatch and Fuel Level and Spend Mismatch: Alerts allow fleet managers to detect fraudulent transactions and take prompt action, such as freeze the card or block the merchant when the fuel level or type do not match the vehicle.

- Category Level Spend Limits: Customers can set transaction limits by merchant type, times of day, days of week, billing cycle, and transaction locations for more precise control over fuel and other purchases. For example, customers can allow one-time hotel transactions for immediate driver needs, set lower limits at home improvement or grocery stores, and higher limits for fuel and maintenance purchases.

[Related: Fuel payments providers boost theft protection amid explosion of card skimming]