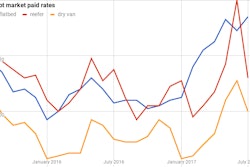

“Hurricane Harvey is proving that one man’s disaster is another man’s opportunity,” noted Ken Harper with this week’s spot market update, including the charts below. “That probably sounds callous given the massive, heartbreaking destruction, but as we used to say in Vietnam: there it is.”

James Jailllet talked with DAT’s Mark Montague a bit about all of this earlier in the week, fyi:

So let’s talk availability — last week, volumes nationally were down , largely due to Harvey wreaking havoc on the nation’s top market for flatbeds, and the No. 3 and No. 4 market for vans and reefers respectively.

Now that the Port of Houston is operational, and 80 percent of the refineries are back on line, Harper adds, we expect that to change.

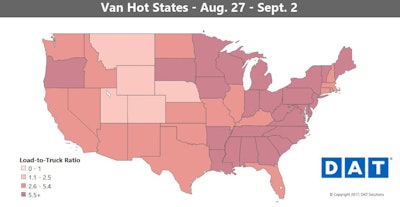

An expected shift in supply lines “we’re seeing this week,” Harper says, “as Atlanta, which normally can offload Houston, appears to be the hub for Hurricane Irma preparations from Florida up through the Carolinas and the Southeastern states.” Columbus, Ohio, meanwhile, has taken on more of the burden for freight heading into the Northeast. ”

In terms of supply chain shifts, Columbus, Ohio, a perennial top 10 market, has dramatically increased freight volumes heading to the Northeastern states. These states normally would be served in larger part by Atlanta, which again, is moving freight in advance of Hurricane Irma.

Add the fact that these natural disasters are “coming on top of a robust economy, per a recent report from the Institute of Supply Management,” and for the freight market broadly you’ve got a recipe for potentially continuing good things for truckers.

Outbound van volumes in Houston fell 73 percent last week, as expected. But as noted above, that is expected to change fairly rapidly, all things considered.

Outbound van volumes in Houston fell 73 percent last week, as expected. But as noted above, that is expected to change fairly rapidly, all things considered.Hot van markets: The loads that did move out of Houston paid significantly more last week, with outbound average rates up 20 percent. Dallas rates also soared, with prices spiking on many intrastate lanes. The Dallas to Houston lane jumped up from $2.40 to $4.00 per mile for an average. DAT’s never seen anything close to that on this lane, but remember it does remain extremely hard to find a load coming out.

Not so hot: Prices out of Stockton, Calif., showed the least movement, and volumes were off by 14 percent. It isn’t clear how big of a role Harvey played in that, but Northern California has also experienced widespread fires and a heat wave with triple-digit temperatures.

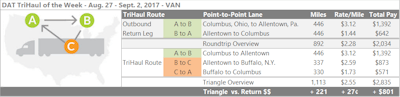

Columbus, Ohio, as noted, is another market that’s seen prices jump higher post-Harvey. The lane to Allentown, Pa., paid an average of $3.12 per mile last week. The return trip averaged just $1.44 per mile, however. If you can make the 900-mile roundtrip in two days, you might just go for it, at an average of $2.28 per loaded mile. But If it’s going to stretch to a third day, recent rate increases in and out of Buffalo, N.Y. make the return from Allentown area ripe for a split with Buffalo as the new inflection point. Rates hit a $2.59 average going in last week, and Buffalo to Columbus averaged $1.73. It would add about 220 miles to the roundtrip, and $800 in revenue.

Columbus, Ohio, as noted, is another market that’s seen prices jump higher post-Harvey. The lane to Allentown, Pa., paid an average of $3.12 per mile last week. The return trip averaged just $1.44 per mile, however. If you can make the 900-mile roundtrip in two days, you might just go for it, at an average of $2.28 per loaded mile. But If it’s going to stretch to a third day, recent rate increases in and out of Buffalo, N.Y. make the return from Allentown area ripe for a split with Buffalo as the new inflection point. Rates hit a $2.59 average going in last week, and Buffalo to Columbus averaged $1.73. It would add about 220 miles to the roundtrip, and $800 in revenue. The effects of Hurricane Harvey on the refrigerated segment were less dramatic than the van impact, but there was still disruption on the spot market.

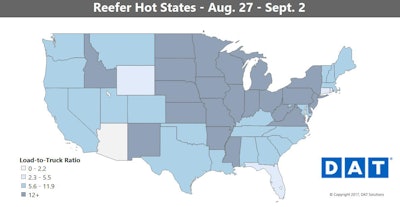

The effects of Hurricane Harvey on the refrigerated segment were less dramatic than the van impact, but there was still disruption on the spot market.Reefer hot markets: Most of the reefer trends down in Texas mirrored van, with the Dallas to Houston lane average also spiking up to $4.29 per mile. Demand is still high through the Midwest, with big gains on some high-traffic lanes out of Chicago. Reefer rates from Chicago to Atlanta averaged 51 cents above the previous week, rising to $3.58 per mile.

Not so hot: Of the top 72 reefer lanes, only 23 had lower rates last week. Volumes have started to taper in Michigan, and rates from Grand Rapids to Atlanta fell 40 cents. Still, rates continued to rise on the lanes from Grand Rapids to Madison, Wis., and to Cleveland.