The U.S. economy’s late-2017 and early-2018 roar hit a noticeable drag as fall 2018 came on. Though the economy is nowhere a recession — GDP and employment are still growing and the stock market is at all-time highs — uncertainty seemingly is surrounding the trucking sector.

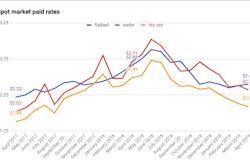

As noted by Overdrive Senior Editor Todd Dills on Tuesday, metrics show freight volume is lagging year over year, and an expected upswing in March (after a seasonally slow January and February also dogged by weather events) didn’t materialize. Year over year comparisons obviously don’t favor 2019, as 2018 was one of the strongest freight markets on record, leading to record-high rates and soaring income for owner-operators.

Comparisons to 2018 aside, trucking-specific indicators have been dull in recent months, signaling the definitive end to the roughly year-long up-cycle in late 2017 and into 2018. Below is a look at some of those indicators, including truck and trailer orders, freight tonnage readings and and more, along with analysis from the firms that produce and distribute these reports.

Of note, most analysts blame 2018’s explosive growth as causing some indicators, such as equipment orders, to sag. As Steve Tam of ACT Research noted about the recent dive in truck orders: “Economic and freight growth are slowing, but both are still growing. And in the context of retreat from record levels, it is no wonder truck buyers continue to pursue incremental profits, as evidenced by the number of unbuilt units in the backlog.”

However, it’s not just equipment orders that are declining. But let’s start there.

Trailer orders in March hit their lowest point since September 2016.

Trailer orders for March reached 13,500 units according to FTR, the lowest monthly total since September 2016 and the smallest figure for March since 2008. March’s orders declined 43 percent month-over-month and 52 percent year-over-year. FTR’s Don Ake says, however, the sharp drop in trailer orders may be due more to lack of build slots, rather than underlying economic issues.

“This low order number is not surprising. Backlogs had fallen little so far in 2019, and are at unreasonable levels,” he says. “Fleets still need more trailers, based on the robust production, so demand has not changed in the short run. The weak orders are totally the result of the lack of available production openings. However, cancellations will continue to be a factor due to a large, fluid, backlog.”

Truck orders, likewise, have hit a roadblock.

North American Class 8 truck orders hit 15,200 units in March, according to FTR – the third consecutive month with order activity below 20,000 trucks. March 2019 was the lowest March order total since 2010, was 8 percent below February and down 67 year-over-year. ACT Research Vice President Steve Tam says March marks the fourth consecutive month with orders falling meaningfully below the current rate of build.

Likewise, FTR’s Ake says build rates haven’t slowed. “Fleets are still putting more trucks in service and competing in a still decent freight market,” he says. “It is expected that Class 8 sales will moderate sometime before the end of the year, as industry capacity begins to catch up with the freight surge that began in 2018.”

Tonnage sagged in the first quarter.

The American Trucking Associations’ monthly Truck Tonnage Index, a measure of the amount of freight moved by for-hire carriers, fell 2.3 percent in March from February, rounding out a first quarter plagued by weather-related hang-ups, says ATA Chief Economist Bob Costello. “In March, and really the first quarter in total, tonnage was negatively impacted by bad winter storms throughout much of the U.S.,” he said. “While I expected tonnage to moderate in the first quarter, the late Easter holiday and the winter storms made it worse. It is likely that tonnage will improve in the second quarter, although year-over-year gains will be significantly below the 2018 annual increase of 6.7 percent.

Compared with March 2018, the tonnage was up 1.6 percent, down from February’s 3.9 percent year-over-year gain. During the first quarter, tonnage was up 3.8 percent from the same period in 2018.

‘Trucking Conditions’ have retreated to neutral territory.

Market conditions for trucking companies continued to sour in February, according to FTR’s monthly Trucking Conditions Index. The index fell to its lowest reading since August 2017, reflecting weaker economics surrounding freight volume and the rate environment for carriers, FTR says.

The index in recent months has moved to a more neutral position, where FTR expects it to remain throughout 2019 and into 2020. However, the index has inched “close enough to neutral that negative TCI readings are now a possibility,” should market conditions deteriorate further, says Avery Vise, FTR’s vice president of trucking.