There’ve been a few pieces in the always headline-hungry online financial press lately about J.B. Hunt’s April 15 quarterly earnings call, where earnings expectations for the first quarter were apparently dashed by company executives who cited a myriad of limiting factors. Expectations of a March upsurge in intermodal freight did not exactly materialize. (Nor did any real March pickup in volumes in advance of the spring freight season on the spot market where so many of you operate, though there have been some positive signs in the last week, at least according to some of my load-board-watching sources. At once, as one trucker asked last week, where in the heck is all the Florida produce we usually see at this point? Volumes, he noted, just don’t seem to be building there and elsewhere like they have this time of year in the past. Independents: What are you seeing in your operation?)

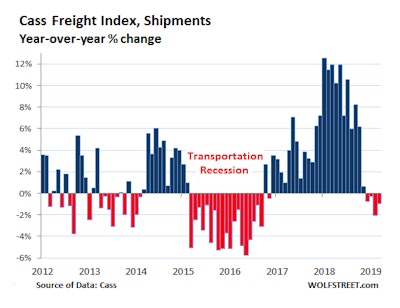

Some watchers are tempted to see signs of a recession coming in such less-than-stellar corporate performance, and the “Wolf Street” blog called J.B. Hunt’s earnings (revenue up significantly, but net not so much) further evidence of something of a u-turn for trucking after a couple of years of largely improved freight volumes, rates and performance. Note: the bars in the graph below don’t represent volumes overall but rather percentage change from the same month in the prior year. Blue bars show the extent to which freight volumes generally exceeded the prior year, red to the negative.

Monthly year-over-year percentage change comparisons based on the Cass Freight Index went to the negative in December and have been negative since that time, though still not near the comparably-negative levels seen in the most extreme months during the “transportation recession” of late 2015-’16. Read more about all this at WolfStreet.com’s story on the J.B. Hunt earnings call via this link, or click through the image to the source.

Monthly year-over-year percentage change comparisons based on the Cass Freight Index went to the negative in December and have been negative since that time, though still not near the comparably-negative levels seen in the most extreme months during the “transportation recession” of late 2015-’16. Read more about all this at WolfStreet.com’s story on the J.B. Hunt earnings call via this link, or click through the image to the source.While I’d say it’s likely right we’re in for a slower year and a softened market for pricing compared to last year — bad news for independents in the volatile spot market — there’s some good news in that earnings report that the financial press cast as a negative on the whole. For drivers, though, it represents a positive in some ways.

As the Motley Fool site’s story on the earnings call put it:

J.B. Hunt management knew this was shaping up to be a tough quarter. Low unemployment has left J.B. Hunt and other truckers scrambling to find drivers, and the company cited higher driver compensation as a negative.

Pay the drivers already? Pay the drivers already.

Now if only the freight markets would pick up…

Waste-haul powered by electricity

Electrification as a heavy-vehicle-powertrain trend continues, and this item comes not as a moonshot from the much-hyped Tesla or Nikola companies, but from a longtime American stalwart. In advance of the WasteExpo show (early next month in Las Vegas), where Mack will share more detail on the fully electric Mack LR version, there’s one going into service for NYC’s Department of Sanitation, as the department’s Rocky DiRico explains in this brief video recently released by Mack:

Mack also announced earlier in the year a partnership with large refuse fleet Republic Services to “build and operate a fully electric Mack LR refuse truck to help their fleet achieve zero emissions goals,” as the company put it in a February press release.

Rather than push toward electrification in longer-haul operations, it’s significant that Mack is focusing its efforts in “closed-loop” applications like this, where the truck returns home for charging every night. WasteExpo attendees might expect to see results from Republic Services’ and Mack’s work together, given the partnership with Mack was set to “test the benefits a fully electric LR can offer in its day-to-day operations,” noted Jonathan Randall, Mack Trucks senior vice president of North American sales and marketing.