After getting tight during the 2008-2009 recession, credit standards for owner-operators eventually loosened. That’s now changing a little.

Fair Isaac Corp., which created the FICO credit scores used by many lenders, is adjusting its computations to more severely score individuals who are late with payments and have other habits indicating a bad credit risk. It’s likely to have the biggest impact on people with average credit ratings, between 650 and 700.

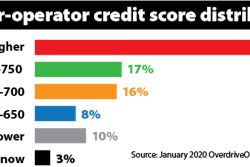

“Those in the middle will get about a 10-point bump up or down,” says Matt Manero, owner of Commercial Fleet Financing, one of the nation’s largest independently owned truck lenders. Based on his business, an increased share of borrowers are in that category. Typical customers had scores slightly above 700 during 2019, but this year they’re closer to 680.

New standards in credit rating take into account more data on individuals’ credit card management and other financial practices to more accurately predict repayment behavior.

New standards in credit rating take into account more data on individuals’ credit card management and other financial practices to more accurately predict repayment behavior.“A key factor to the algorithm and its change is it puts more emphasis on trends,” Manero says. “If you’re trending to be paying off your bills and debt over the last 12 months in very good fashion, you’ll get a little bit of a positive bump.” Likewise, those with poor debt management will lose points.

It’s yet another area where more personal data is being gathered, crunched and monetized. As FICO itself puts it, the new scoring “incorporates trended credit bureau data to further enhance predictive power” by “leveraging the most comprehensive data available.”

Financing a truck is already “a nightmare” for those with bad credit, Manero says. “You can’t buy a truck and do 25% interest rates and finance it over 36 months. It just doesn’t support that debt service.”

So what rates are available today? Manero cites this range, using the example of an owner of three power units with three years of business experience, though other factors also have a bearing:

- Above 700: 6% to 8%.

- 650-700: 8% to 10%

- 620-650: 10% to 16%.

- Below 620: As high as 40%. In most cases, the rates are too high to be affordable.

This FICO scoring change isn’t huge, and of virtually no interest for those at the polar ends of the credit scale. However, it sends a reminder to tend to the basics of getting or maintaining a good score.

Pay bills on time. Avoid taking out personal loans and too many credit cards. Ideally, pay off credit card balances every month. Otherwise, keep balances low, meaning under 25% of the card’s borrowing limit. If you’re buried in debt, devise a plan (or find someone to help you do so) to systematically reduce it every month.

Such standards are more than a matter of simply doing the right thing. They’re practices that can save you thousands of dollars over the years, at the same time giving you the stability to survive the next severe downturn.