It’s not necessarily one’s age or experience that defines the ability to succeed as an owner-operator. Consider the first half of 2020, which has been marked by unprecedented events and reactions. Yet one critical observation amid this tumult: Not everyone is failing. There are always new opportunities that emerge out of these disruptions.

To that end, here are a couple suggestions to consider at this midpoint of the year.

- If you’re not keeping good records and measuring your financial health, how can you make good decisions?

A new owner often sees driving miles as the focus, full stop. You’ve probably said it yourself: If the wheels aren’t turning, I’m not earning. With unpaid bills staring you down, it’s difficult to remain calm. A new owner client said it to me last week. This man and others are so worried about not driving every available moment that it is interfering with possibly better, more profitable load selections.

- The devil’s in the details: Those surviving and thriving now know their cost to operate their business. Secondly, they use this information to help control business and personal spending.

Those who know operating costs can make educated decisions, including those that reduce fixed costs. Owners who have had a profitable first and second quarter were able to adapt quickly, having a full and calculated control of their business. They may have had to change the customers and freight, as I’ve suggested to some clients. Some may have needed to pull a different type of trailer.

Van and reefer freight have been more consistent for many owners versus platform and more specialized freight, though that’s by no means a rule. Now, as demand returns in some sectors, manufacturing has begun to resume to replenish inventories.

Another driving force for rising demand: the cost of money. The Federal Reserve’s funds rate (the interest banks charge each other for loans) sits at just 0.25%, nearly 90% below the year-ago rate of 2.25%. While business lending rates haven’t dropped nearly as much proportionally, the cost of borrowed capital is down. Businesses are taking advantage of it, as with the coronavirus-related lending programs created through the CARES Act. Cheap money could create new opportunities for you.

If you’ve been too busy driving to consider your business costs or borrowing opportunities, maybe your best move now is to reset the breaker that has tripped from your overload.

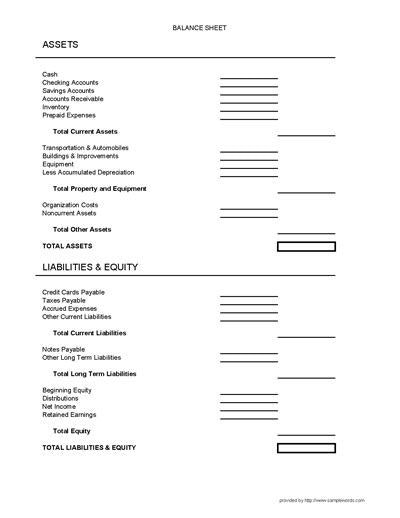

A good starting line could be to look beyond profit and loss and complete a mid-year balance sheet. What’s a balance sheet? It is simply a picture of your assets v. your liabilities on any given date. Over time, it’s an excellent way to monitor your personal and business progress. If you haven’t been creating a balance sheet at the end of each year, now is a good time to start. Apply discipline to keep up with it at regular intervals.

There are many versions of balance sheets, and this is just one (click through the image to enlarge). If you need help interpreting this example or creating one, email me at this link.

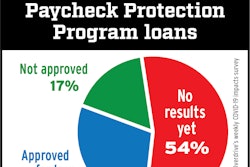

There are many versions of balance sheets, and this is just one (click through the image to enlarge). If you need help interpreting this example or creating one, email me at this link.Doing this now is important because of the dramatic financial changes for many owners as they have assumed new debt in recent months from various sources. It could be a Paycheck Protection Program loan (some that will not be forgiven) or the acceptance of a more traditional U.S. Small Business Administration loan. I’ve talked with owners who’ve accepted 30-year disaster loans from SBA (3.75% interest, deferred for 12 months) and are using them now as working capital, as designed.

How has such an acceptance changed your debt-to-asset ratio?

Many have added credit card debt, both business and personal. If you have, what is your plan to get this paid off? Combined with the trend of generally lower gross and net income that has developed, the longer you put off planning, the more difficult and expensive it will be to maintain control.

Many people rely on their credit score as a measurement of financial health, but you need a much bigger picture to make wise decisions. Once you begin tracking more of your operation’s numbers, you’ll gain a better window on the progress you’re making – or not – toward your goals. That will also help you the next time you’re talking to a banker. The picture you present to a potential lender will be all that more persuasive with your arsenal of information.

At once, keep it simple. If these tasks appear too difficult, it’s unlikely you’ll do them effectively. It’s always been true that a small business lives and dies by the health of its customers. A similar connection can be made with business’ supporting partners. If you need help, ask. There are so many resources online. Don’t hesitate to talk to your bookkeeper, tax preparer or banker, too.