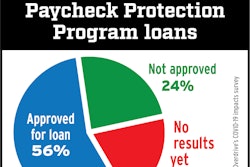

As of a week ago, few respondents to Overdrive‘s COVID-19 reader response survey who’d applied for Paycheck Protection Program loans had been approved for one. These results show only those respondents who applied, who were slightly outnumbered in the survey by those who had sought no assistance through the SBA programs at all.

As of a week ago, few respondents to Overdrive‘s COVID-19 reader response survey who’d applied for Paycheck Protection Program loans had been approved for one. These results show only those respondents who applied, who were slightly outnumbered in the survey by those who had sought no assistance through the SBA programs at all.For the small-business owners who quickly applied for the CARES Act assistance offered through the Small Business Administration in cooperation with banks, help has begun arriving in some cases. I’ve talked to owners who’ve received varying degrees of payments.

The application and acceptance processes have not been easy. The banks and agencies doing the processing were overwhelmed with applications. Different programs were quickly rolled out to the public, and funding was exhausted within days. When round two was introduced, banks and small businesses were still playing catchup.

The easiest route to aid seemed at first to be the Economic Injury Disaster Loans’ quick infusion of $1,000 per employee up to $10,000 to make payroll. It did not require applying through a bank; rather you could go direct to SBA. If received, this amount could later be rolled into the Paycheck Protection Program, applied for separately through a bank.

More than one owner-operator asked me why they received only $1,000, not $10,000. I tried to counsel them through any misunderstanding and emotions that often ran high. I learned that even though many owner-operators opt to establish their business structure as a limited liability corporation, they have little to no payroll records for paying themselves. Instead, their records show seemingly random income transfers as needed for personal use. Many continued to co-mingle income and expenses in one checking account.

These owners could apply for the PPP loan, but like as not they didn’t have a very high taxable income, thus reducing benefits from the aid. (Like most owners, they did everything possible to lower their taxable income.)

Owner-operator Bill Ater’s situation was something of an opposite. When the programs were announced in early April he could already see the freight writing on the wall. He didn’t hesitate to apply through SBA for the EIDL advance and then through more than one financial institution for the PPP, and plenty early on.

His business is set up as an S Corp, with a system to pay himself and his wife, also part owner, weekly. These records were beneficial, we believe, not only in streamlining the application but establishing without a doubt the payroll amount. Because his wife is also an employee of the business, they received not $1,000 but $2,000 in an EIDL advance.

My advice to other owners has been to take the time to establish an appropriate salary for themselves and write a paycheck each week. This is common practice for many owner-operator LLCs or S Corps. Seek guidance from a Certified Tax Preparer on the methods and documentation that are appropriate.

Basic bookkeeping and business management is covered in Chapter 2 of the Overdrive/ATBS Partners in Business manual.

Speaking of tax preparation, more than one owner told me he/she was doing it on their own. With the unprecedented actions taken by lawmakers during this pandemic, I encourage all owners, particularly those who’ve received PPP loans, to use a certified preparer. Many services are not accepting new clients, and there will likely be some new and difficult changes for business owners.

For PPP loan recipients, forgiveness parameters will be a key issue. Diamond Transportation-leased owner-operator Kevin Kocmich, the 2019 Owner-Operator of the Year, shared some good advice he and his wife, Joy, received:

- Open a new checking account only for payroll.

- Deposit all payments received from the SBA into this account.

- Be sure to use all payments received for personal payroll only.

- Calculate the payroll amounts for equal distribution over eight weeks.

Lastly, maintain records of where and what this money was used for.

It’s extremely important to understand how these payments must be used and the record-keeping to go with it. A high percentage of these loans may be forgiven if they’re managed properly or, if not, they’ll be rolled into a low-interest loan.

This is one more reason to seek out professional assistance. You’ll be better set up for future success, too.