The Detroit Series 60 in Bill Ater’s 1999 Freightliner — as clean, perhaps, as the owner-operator’s forgiveness application for his Paycheck Protection Program loan, stalled in process at the moment with the credit union through which he applied for PPP to begin with.

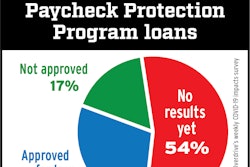

The Detroit Series 60 in Bill Ater’s 1999 Freightliner — as clean, perhaps, as the owner-operator’s forgiveness application for his Paycheck Protection Program loan, stalled in process at the moment with the credit union through which he applied for PPP to begin with.Among those who received loans as part of the Paycheck Protection Program, as we wrote late last week in this analysis of just how much money went to how many carriers in trucking through the PPP, are owner-operators Bill Ater of Forth Worth, Texas, and Kevin Kocmich of Litchfield, Minnesota.

Both, when I spoke them last week, had begun the process of working through the applications for forgiveness of the PPP loans, having received their loans prior to the early June legislation that shifted loans disbursed after the date of its passage to allow for a 24-week use-of-funds period rather than the eight-week standard both Kocmich and Ater decided to stick to.

Use the funds in that eight-week period after receiving the loans in certain ways, with at least 60% of the funds going to maintain payroll, and the loan or at least a portion of it would basically turn into a grant, the PPP program offered small businesses.

Owner-operator Kocmich worked closely with his tax preparer and business services firm, ATBS, to both apply for PPP funds and, now, work through the forgiveness process, he said. “They’re planning on having everything filled out” on the forgiveness application — Form 3508 or Form 3508EZ, as ATBS spells out in its ebook detailing rules and regs around PPP loan forgiveness. “I just have to sign it” and send it on to his bank, Kocmich added. “ATBS made it really simple for me. They prepared [the initial application] for us and then our bank when we did it the first time. They had everything they needed, check-marked and signed, all the pages and paperwork.” When he presented it to his bank at the time, “They said, ‘Holy moly, you guys are on the ball.’ It was the easiest thing.”

His process for accounting for the use of the funding was as ATBS had recommended early on for one-truck operators. Create a business checking account to house the loan and disburse eight payments from it to a personal account over the course of eight weeks. The process translated to “paying us a salary,” Kocmich said. “I hope it all works.”

When we spoke last week, Kocmich was expecting to hear more from ATBS about his forgiveness application this week. A couple days after we talked, though, Treasury Secretary Steve Mnuchin appeared to express favor in testimony before Congress for an idea that came from a couple banking lobbyists to automatically forgive PPP loans under $150,000, which would no doubt include those distributed to owner-operator businesses like Kocmich’s and Ater’s if not all owner-operated small fleets.

Ater noted he’d heard that news when I checked in with him about his own PPP forgiveness application this morning. Automatically forgiving those loans would save owner-operators like him some work, no doubt, but the same can be said for banks, given a huge percentage of all the loans that have been distributed were under that $150,000 threshold. That’d be a lot of forgiveness applications they’d not have to process.

Bill Ater applied for his loan not through his main bank but through a local credit union, after he heard early on in the existence of the PPP that his main bank had been prioritizing larger commercial clients. That choice to apply through Texas Trust Credit Union has thrown a bit of wrench into the forgiveness process as it is now, he told me last week.

According to Ater, the credit union utilized a third-party servicing firm to process all of the PPP business moving through their institution. Ater had pulled the forgiveness application straight from the Small Business Administration’s website and completed it himself — no issues that he could see. “I filled out the EZ form for the PPP forgiveness,” he said. “It’s three pages. I’ve got all the documentation needed” for payroll and other expenses.

When he sent that over to his contact at the credit union, the reply came back: “We can’t file it.” Turned out the banker was waiting on the third-party servicer to get its forgiveness processing in place. For Ater, it feels like a bit of a nuisance hanging over the immediate future for him. “I’m thinking, ‘I want this out of the way,’” he said. “According to the SBA, you present the forgiveness application to your lending institution. Now this guy’s telling me I have to wait and do it online” when the third-party processor gets its ducks in a row.

Congress, too, if that idea Mnuchin appeared to back comes to fruition in new legislation aimed at further economic aid to those impacted by the economic downturn COVID-19 has brought about. Time will tell — reports suggest Congress hopes to work out Senate/House differences as soon as this week for a new aid package, as boosted unemployment benefits enabled by CARES Act legislation are set to expire at the end of this month.