A huge swath of truckers and motor carriers received loans from the Paycheck Protection Program, the $650 billion forgivable loan program established to help small- and medium-sized businesses maintain payrolls during the COVID-19 economic downturn.

More than 100,000 trucking companies received as much as $12 billion in PPP loans from the program instituted in April by Congress and the Trump Administration, according to publicly available data analyzed by Overdrive.

To put the 100,000 into perspective, that would be nearly 20% of all carriers with DOT operating authority. The 100,000 who applied for the PPP loans, though, certainly includes plenty of leased owner-operator businesses, too, without DOT numbers. But the total number of DOT-registered carriers also includes private fleets and bus company passenger carriers, so the percentage of for-hire trucking companies that received PPP money likely is significant.

According to surveys conducted throughout the COVID-19 pandemic by Overdrive and sister publication CCJ of owner-operators and fleets of all sizes, more than half of all fleets and owner-operators surveyed said they applied for PPP loans, and about half of those said they had received money.

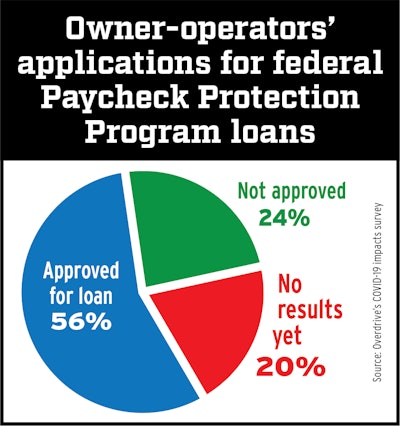

This graph show results among independents and small fleets who did apply for PPP loans as of June 9. Slightly more than half at that time had been approved.

This graph show results among independents and small fleets who did apply for PPP loans as of June 9. Slightly more than half at that time had been approved.For PPP awards across all industries, loans of more than $150,000 represent nearly 75% of total PPP dollars approved, but only a relatively small share of the number of loans. According to SBA, about 87% of all loans were for less than $150,000.

Those percentages held true for trucking companies, too. More than 91,000 trucking companies took in just more than $2.1 billion in loans under $150,000. Nearly 11,000 carriers received loans of over $150,000, yet accounted for between $5 billion and $10 billion in funds awarded (loan data from the U.S. Small Business Administration, which administered the program through participating banks, was listed in ranges for loans over $150,000.)

Trucking companies’ total haul of $7-$12 billion could total as much as 2% of the more than $500 billion in PPP funds distributed so far. SBA estimates some 51 million companies received PPP money.

The volume and amounts of loans indicate the extent to which motor carriers were exposed to the downturn when it was in its trough in April. Likewise, interviews conducted with owner-operators and small fleets in April and May highlighted the importance those loans played in keeping small-business truckers afloat when freight volumes and rates hit a wall.

Among those who received loans and are now working through the forgiveness application process are owner-operators Bill Ater of Forth Worth, Texas, and Kevin Kocmich of Litchfield, Minn. Both haul platform freight, Ater with a 1999 Freightliner and a step deck he owns, leased to Landstar. Ater’s PPP loan totaled about $13,000, covering payroll for himself and his wife, who’s a part-time employee of the business, and rent and utilities at the shop where he keeps and works on the unit. Speaking earlier this week, he’d hauled a grand total of four loads since March 19, he said, citing load availability issues and rates just not worth the effort.

Owner-operator Bill Ater’s 1999 Freightliner.

Owner-operator Bill Ater’s 1999 Freightliner.“It’s not good,” he said. “Things are picking up a little bit. There’s some freight, and it looks like it pays halfway decent, but look at where it’s going. If you’ve got to deadhead 500-600 miles to get the next load you can just add those miles to your accounting” for the per-mile rates on the load you’re looking at.

The amount of Kocmich’s PPP loan was in the same ballpark as Ater’s. The amount didn’t meet the level of income reduction he’s taken this year in his operation, leased to Diamond Transportation and hauling oversize freight with a 2020 Peterbilt 567 and 2009 XL Specialized RGN with slide-out outriggers for over-width equipment.

He applied for the PPP with the assistance of his accounting firm, ATBS. As advised, he approached use-of-funds requirements for the loan to be forgiven by making regular transfers from a business account to a personal account as payroll. “ATBS made that really simple for me,” Kocmich said.

“I haven’t penciled it out thus far” to truly know just how off the business is compared to last year, Kocmich said. Without the loan, he guesses he may have gotten by, but “we would’ve had nothing left. We’ve stayed out here working to keep up on the bills.” Speaking early this week, he said, “We’re probably breaking even, if not a little profitable. It’s a tough year and it’s not over with yet.”

The unprofitable deadhead situation Ater described is the reality for Kocmich, too. “We’re bouncing farther to get the better loads,” Kocmich said. Few, even in his often-lucrative oversize freight niche, have been grossing more than $2 per mile.

PPP loans received by trucking companies ranged in amounts from those of less than $10 (yes, ten dollars) to those upwards of $5 million and potentially as high as $10 million.

Ater and Kocmich are in the middle of the forgiveness process, awaiting final determination. Banks will forgive those loans if businesses that received them use the money according to the rules stipulated by the PPP program.

Two weeks ago, Congress reopened PPP applications through August 8. The move followed enhanced flexibility for borrowers when it comes to use of PPP funds to determine forgiveness.