“As you can see, we’re a family company,” said Jennifer Moore, right, who runs CLM Morris Trucking with her husband, Carland. The fleet employs five drivers, but was turned down for a PPP loan because they pay their drivers under a 1099 set-up instead of W-2 wages. Left is Morris dispatcher Pauletta Ward. Morris primarily hauls produce, and Moore said she hopes the looming produce season will help boost rates and help them return to running profitably. The fleet has been losing money taking loads at around $1 a mile lately to keep their drivers working and paid.

“As you can see, we’re a family company,” said Jennifer Moore, right, who runs CLM Morris Trucking with her husband, Carland. The fleet employs five drivers, but was turned down for a PPP loan because they pay their drivers under a 1099 set-up instead of W-2 wages. Left is Morris dispatcher Pauletta Ward. Morris primarily hauls produce, and Moore said she hopes the looming produce season will help boost rates and help them return to running profitably. The fleet has been losing money taking loads at around $1 a mile lately to keep their drivers working and paid.A little more than two weeks ago, Robert and Jan Van Liew felt hope for their one-truck independent operation Van’s Logistics fading. Their main accounts hauling loads of West Coast imports and paper products had run dry as the COVID-19-caused economic stall took hold in late March.

To try to make ends meet until business could come back, the Van Liews applied for one of the forgivable bridge loans offered by the CARES Act’s Paycheck Protection Program. But their application fell into pile of others, and funding ran dry before it could be considered.

This week, however, “we’re feeling a lot more hopeful,” said Jan, buoyed in large part by having their application for PPP’s second round of funding approved. They hadn’t received the funds as of Tuesday afternoon, but they were expecting to receive the money by week’s end. The parameters of the loan require that the money be spent on payroll for it to be forgiven. “It won’t help with truck payments, insurance” and other business costs like permits, Jan said, “but it’s going to help us pay our bills.”

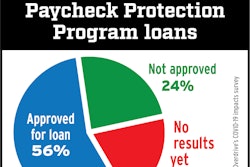

Seemingly, small-business truckers had slightly better luck in PPP’s second round of funding, part of Congress’ expansive efforts at helping prop up small- and medium-sized businesses through the downturn. Still, just 14% of owner-operators and small fleets surveyed last week by Overdrive report having applied and been approved.

Another 26% of the 338 respondents said they had applied but had not yet heard whether they’d be approved or denied, and 8% said they had applied but were not approved. The remainder, 51%, said they had not applied for a PPP loan. The $310 billion refill of the PPP fund, passed by Congress two weeks ago, is expected to run out this week. All told, Congress allocated some $660 billion to the program.

Anecdotes and survey data point to the importance the loans have carried for many owner-operators and small fleets. For those that received them, they’re bounties that help such truckers see tomorrow. Those who missed the money say they’re at risk of losing equipment or their business altogether.

In some instances, fleets and owner-operators appear to simply be hung up in the queue of the millions of applications filed for the PPP loans, according to interviews conducted by Overdrive and the weekly survey data. Other fleets, even those that employ drivers, were denied because of the way they pay their drivers. That’s despite the money being specifically allocated to help small businesses make payroll.

Ron Dobbs, a single-truck independent out of Nashville, Tennessee, parked his 2003 Freightliner Century this week after his seasonal nursery plant freight tapered off. He received a PPP loan and said he plans to live off of that money until rates come back. “You can’t run a truck” at the prices he’s seen on load boards this week, he said.

Ron Dobbs, a single-truck independent out of Nashville, Tennessee, parked his 2003 Freightliner Century this week after his seasonal nursery plant freight tapered off. He received a PPP loan and said he plans to live off of that money until rates come back. “You can’t run a truck” at the prices he’s seen on load boards this week, he said.“They told us no,” said Jennifer Moore, who runs the six-truck, Florida-based CLM Morris Trucking with her husband Carland. They applied through Bank of America, since that’s where they bank already, she said. They pay their drivers on a 1099 set-up, rather than the standard W-2.

“1099 drivers don’t count,” Moore said. Like many other owner-operators and small fleets, the Moores have had to reckon with rates in the $1 range. To keep a steady paycheck for their drivers, the Moores continue to run their five company trucks, even though the business takes a loss on those loads. “It’s been a huge hit,” Moore said. “We’re going into the hole, but if we don’t our drivers don’t get any money and we’re going to lose them. It at least keeps food on the drivers’ plates. I know it’s going backwards, but I don’t know what else to do.”

She and Carland started as a single box-truck operation in 2011 and have since built up the fleet of six trucks. Their primary freight is produce out of Florida, and the Moores are hoping for a rates boost in the coming weeks as produce season ramps up. In the meantime, they’ve had some success, albeit limited, in deferring truck payments and insurance payments, though those are ultimately coming due soon, too.

A PPP loan, should they have been able to secure it, would have helped them meet payroll and use the money from loads run, even at $1 a mile, to meet truck notes and insurance bills, said Moore. They’re now seeking a standard, private loan to try to stay afloat until business picks up. “At this point, a low-interest loan, I can pay it back,” she said. “Things will turn around eventually.”

“We tried to apply, but we were denied,” says Rod Chandler, owner and operator of IdahoRam Trucking out of Burley, Idaho. The one-truck independent pays himself on a 1099 basis, but “the program doesn’t allow for anybody under a 1099” to receive funding, he said.

He’s had his own authority since 2006, hauling heavy-haul loads until the past two years, when he switched to simply working load boards for power-only freight. He doesn’t have a payment on his 2007 Western Star 4900EX, which he recently wrecked and totaled, though he plans to buy the truck back from his insurer and rebuild it. Likewise, he plans to soon start his own independent dispatching service, to help other small fleets manage load bookings and other back-office administrative tasks.

![One-truck independent Robert Van Liew, who runs Vans Logistics with his wife Jan, leased on to larger carrier in recent weeks to help drum up pay. “We’ve been able to keep our authority,” said Jan. “We’re lucky he’s on a dedicated lane and we don’t have to work the spot market bidding these loads. He’s been able to deliver [personal protective equipment] like masks throughout the midwest. It feels good to be helping in that way,” she said.](https://img.overdriveonline.com/files/base/randallreilly/all/image/2020/04/ovd.2020-04-22-1-2020-04-22-13-01-e1587578487639.png?auto=format%2Ccompress&fit=max&q=70&w=400) One-truck independent Robert Van Liew, who runs Vans Logistics with his wife Jan, leased on to larger carrier in recent weeks to help drum up pay. “We’ve been able to keep our authority,” said Jan. “We’re lucky he’s on a dedicated lane and we don’t have to work the spot market bidding these loads. He’s been able to deliver [personal protective equipment] like masks throughout the midwest. It feels good to be helping in that way,” she said.

One-truck independent Robert Van Liew, who runs Vans Logistics with his wife Jan, leased on to larger carrier in recent weeks to help drum up pay. “We’ve been able to keep our authority,” said Jan. “We’re lucky he’s on a dedicated lane and we don’t have to work the spot market bidding these loads. He’s been able to deliver [personal protective equipment] like masks throughout the midwest. It feels good to be helping in that way,” she said.

“I’m using the money to live on,” he said, “to replace not being able to work right now.” He had steady work for the past few weeks hauling loads of nursery-bound plants, “but it tapered off,” Dobbs said.

His 2003 Freightliner Century is paid for, as are his two trailers. “That’s what allows me to sit right now. I feel for these guys that have a big truck note. And my insurance is cheap compared to a lot of guys, because I have a good safety record.”

He’s kept an eye on popular load boards, but rates are too cheap to run, he said. “It costs me around 75 cents a mile just to operate the truck,” he said. “And that’s not paying myself. I’m seeing rates right now at 90 cents. I’ve seen some as low as 58 cents. You can’t run a truck like that.” He’s hoping for a rebound this fall, and for rates to come back. Right now, he said, “too many trucks chasing too few loads.”

Not unlike the PPP loan money. “We don’t know what the future holds, but we’re still here right now,” said Jan Van Liew.