For those who applied for and received loans under the Paycheck Protection Program, the COVID-19 relief effort for small businesses administered by the SBA in collaboration with banks, the rules for those loans have been changed.

Congress passed and the President has signed into law the Paycheck Protection Program Flexibility Act of 2020, which extends the baseline period recipients have to spend the funds. That period was eight weeks originally. Now, loan recipients will have 24 weeks, among other changes.

The baseline covered period change is fundamental to all PPP loans, but recipients who were issued loans before June 5 can choose to continue under the eight-week option. “If you got your loan prior to June 5, you can elect to go back to the eight-week period” in terms of your accounting for use-of-funds and for application for forgiveness of the loan’s terms, said Chad Halstead, partner with the Katz, Sapper & Miller CPA firm, in a webinar hosted Friday. For loans issued after that date, the 24-week period is now the standard rule.

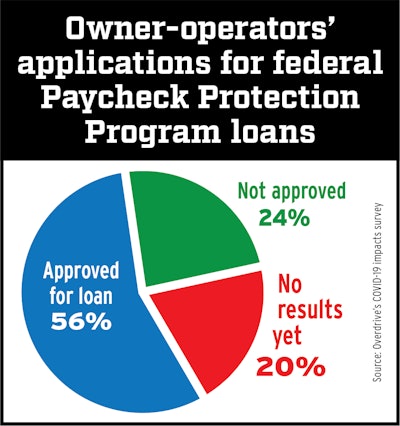

One month following the first PPP-related results from Overdrive‘s ongoing periodic pandemic-impacts surveys of small fleets and owner-ops, a much larger share of survey respondents reported having been approved for loans, fewer waiting for determinations. With results as of earlier this week, the chart here obviously excludes businesses that didn’t apply for the SBA-program funding at all, a majority of owner-operator businesses at 55 percent of total respondents.

One month following the first PPP-related results from Overdrive‘s ongoing periodic pandemic-impacts surveys of small fleets and owner-ops, a much larger share of survey respondents reported having been approved for loans, fewer waiting for determinations. With results as of earlier this week, the chart here obviously excludes businesses that didn’t apply for the SBA-program funding at all, a majority of owner-operator businesses at 55 percent of total respondents.For self-employed one-truck owner-operators who’ve already received funding prior to the change and have been utilizing the loan, either fully or partially, to pay themselves (or small fleet owners covering rent and utilities, payroll and more) over an eight-week period, sticking to that time period for use of funds remains a viable option, Halstead said. There doesn’t seem to be a deadline, either, for making your decision on whether to take the option.

Halstead added that’s one of two big questions he’s gotten from the many different kinds of businesses his firm serves:

If I got my loan prior to June 5, when do I have to decide whether I want to use the extended 24-week period or the eight-week period — before the eight-week expires, or do I get the benefit of hindsight to do it after?

“There isn’t a specific time frame to make that election,” Halstead said. “You can size it up in July or August,” for instance, if you’re nearing the end of your term now, before making the forgiveness application — you now have 10 months to do that after the covered period is over, and repayment of the loan with interest is newly deferred until the forgiveness amount is determined. From a cash-flow perspective, the delay in payback timing here could be a useful tool for anyone who expects a large chunk of change will not in fact be forgiven, said Halstead.

“You have 10 months to submit for loan forgiveness, then the lender has 60 days to do their analysis, and then it goes to the SBA. They have 90 days for making their determination,” he said. Thus, “you could push out payment up to almost a year, or maybe in excess of a year – [the repayment amount is] still going to incur interest at 1%, but from a cash flow perspective” repayment delay could be helpful if you’re struggling and expect a “significant unforgivable amount.”

If I need more than eight weeks but don’t need a full 24 weeks to use all of the funds — can I apply for forgiveness as soon as I build up enough expenses, whether that’s at 12 or 13 weeks or whatever the number is?

“I think you have to see it through before you apply for loan forgiveness,” says Halstead. “During that 24-week period, you are required to maintain salary” and adhere to any of the “wage reduction rules” for your staff “throughout the entire period” to get total forgiveness, ultimately.

That’s where these changes may present something of a trap for owners, given freight uncertainty for the rest of the year. (Though recent signs have been fairly positive, it’s clear the pandemic is not behind us as COVID-19 cases and hospitalizations have spiked in some of the earliest-“reopened” states in the southernmost parts of the country east and west). While the new legislation clearly does provide some flexibility for businesses who’ve already received loans and could use the increased time period to spend more of the funds, the greater time for loans received after June 5 makes full forgiveness perhaps less-easily-attainable for anyone in a situation where they’re forced to downsize or drastically cut pay when it comes to employees. The stability of a principal customer, or a broker, could play in hugely there, as could public actions aimed at containing outbreaks that threaten to overwhelm hospital systems. Before electing to shift to the 24-week option, consider all of it carefully.

“This pandemic has stretched further than a lot of people first thought that it might,” said Halstead. For some businesses, “it’s not going to be so easy to keep that pre-COVID workforce maintained. … [Try to determine] if you’re going to have to have salary reductions and take a haircut on your forgiveness amounts. It’s not that easy of an analysis.”

Other applicable changes in the PPP flexibility legislation

**Forgiveness parameters — payroll doesn’t have to be such a high share of your use of the funds. The prior parameters required at least 75% of the loan to be used for payroll costs. “They’ve changed that to needing to only be 60 percent of payroll costs,” said Ryan Halser, the Katz firm’s senior tax accountant. That’s regardless of whether you received the loan before or after the new law. “You will be able to have a proportional amount of forgiveness if you don’t hit that number.”

**Changes in forgiveness in counting full-time-employees and potential staff reductions. A business’s forgivable amount won’t be reduced because of a reduction in employees if it can show:

- An “inability to rehire those who were employed on Feb. 15 and inability to rehire similarly qualified employees before the end of the year,” said Hasler.

- “An inability to return to the same level of business activity due to compliance with mandated safety requirements/social distancing.” (Probably not applicable to most trucking operations.)

**A new minimum-maturity term length for loans received after June 5 of five years. Those received prior retain their two-year maturity (when any repayment is required to be completed), though the legislation didn’t specify whether “it’s acceptable to change the date to five years” via renegotiation with the bank, said Hasler, essentially leaving it up the bank and the borrower, advisers believe.

“From a bank’s standpoint,” said Halstead, “this is not an attractive asset particularly — a 1% loan. Banks aren’t necessarily going to be knocking on your door” to make such a change, “but it is now allowable under the law. If you do have a good relationship with your bank and have a significant amount of your PPP loan that may not be forgiven, you may be able to get a little greater flexibility with a five-year term.”

**Payroll-tax deferral terms for employers. The new legislation makes clear that PPP borrowers can defer the employer’s share of payroll taxes (Social Security and Medicare) through the end of this year, providing an “interest-free loan on this, basically,” noted Halstead. Fifty percent of the deferred amount will come due at the end of 2021 and the rest at the end of 2022.