Previously in this series: Struggling small fleets stung by aggressive cash advance lenders

For a short video explaining Merchant Cash Advance lending and the escalating debt it can create, follow this link to the first installment of Part 3 in the Cash Flow Crisis series.

For a short video explaining Merchant Cash Advance lending and the escalating debt it can create, follow this link to the first installment of Part 3 in the Cash Flow Crisis series.The U.S. Federal Trade Commission this month took its most significant action yet to rein in fraud and abuse by merchant cash advance providers, who have snared businesses, including truck fleets, in escalating debt traps.

After an FTC small-business lending forum a year ago, the agency this year issued a report detailing concerns about the MCA industry. Then on June 10, it filed a lawsuit against three New York-based MCA providers and their principals. On the same day, the state of New York filed a similar lawsuit against the same parties and another individual.

The lawsuit filed by New York Attorney General Letitia James claims one of the defendants threatened one MCA client: “I know where you live. I know where your mother lives.” She said that effective interest rates on MCA customers sometimes exceeded 1,000%.

The lawsuit filed by New York Attorney General Letitia James claims one of the defendants threatened one MCA client: “I know where you live. I know where your mother lives.” She said that effective interest rates on MCA customers sometimes exceeded 1,000%.The state and FTC actions seek restitution for customers. The state also asks for damages and the cancellation of all loans by RCG Advances and related firms.

In actions apart from MCAs, this week and last month the agency sent warning letters to lenders or related entities addressing “potentially misleading marketing” related to this year’s federal Paycheck Protection Program.

An MCA agreement is a form of factoring that requires repayment of the advance based on a percentage of future receipts. Payments are drafted nightly from the business checking or credit card account.

ICYMI: For more detail on merchant cash advances, see the first installment of Part 3 of this Cash Flow Crisis series, which shows how thousands of trucking-related entities have often experienced the problems described in this story. The third installment will address the aggressive use of confessions of judgment included in many MCA contracts.

|

The FTC and New York lawsuits name as defendants RCG Advances, LLC (formerly known as Richmond Capital Group, LLC and also doing business as Viceroy Capital Funding and Ram Capital Funding); and Ram Capital Funding LLC. The lawsuits also name individuals related to those businesses: Robert L. Giardina, Jonathan Braun and Tzvi Reich. New York’s filing also names Michelle Gregg.

The FTC’s lawsuit charges the defendants with “allegedly using deception and threats to seize personal and business assets from small businesses, non-profits, religious organizations, and medical offices,” the agency said. The providers are also cited for requiring so-called “confessions of judgment,” through which an MCA borrower forfeits the right to contest collection actions by creditors upon default — those actions can include seizing business or personal property, including bank accounts.

The FTC complaint was filed in the U.S. District Court for the Southern District of New York. The case will be decided by the court.

New York Attorney General Letitia James says the firms collected more than $77 million on the loans and that effective interest rates sometimes exceeded 1,000%.

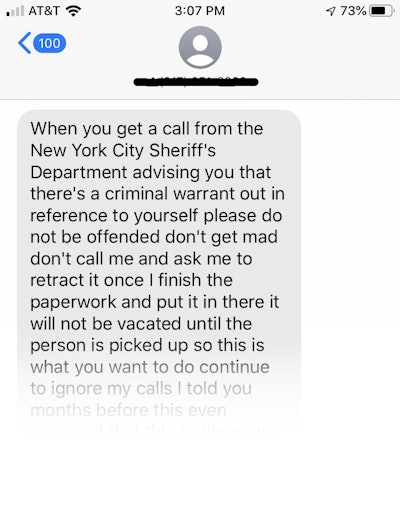

A small-fleet owner received this text from a merchant cash advance provider. It shows the kind of threatening language described in lawsuits by the FTC and the state of New York. The fleet owner, who is considering filing a lawsuit against the provider over inflated fees, declined to speak for attribution.

A small-fleet owner received this text from a merchant cash advance provider. It shows the kind of threatening language described in lawsuits by the FTC and the state of New York. The fleet owner, who is considering filing a lawsuit against the provider over inflated fees, declined to speak for attribution.“The complaint alleges that, since at least 2015, the defendants have deceived small businesses and other organizations,” the FTC said in a statement, “by misrepresenting the terms of merchant cash advances they provided, and then used unfair collection practices, including sometimes threatening physical violence, to compel consumers to pay. The FTC also has alleged that defendants have made unauthorized withdrawals from consumers’ accounts.”

The FTC’s announcement of its filing also alleges: “The defendants also fail to deliver the full amount of financing promised by withholding an array of upfront fees from the funds they deliver to customers, despite promising ‘no upfront costs’ on their website.” The fees can reach “tens of thousands of dollars, and are either poorly disclosed in contracts or not disclosed at all. The complaint further cites internal company emails showing the defendants directing their agents to charge higher fees to consumers than allowed by the contract.”

Overdrive was unable to reach the three companies by phone or email. A Better Business Bureau of New York site lists complaints against RCG Advances.

News reports from two years ago say Braun, a principal of Richmond and related entities, was sentenced to 10 years in prison for being the “kingpin” of an international operation smuggling marijuana into the United States.

The New York lawsuit says Braun “has regularly called merchants’ representatives and harassed, insulted, sworn at, and threatened them.”

That filing says Braun repeatedly called one business owner to demand money. “Braun warned the owner not to ‘f*** with’ him and threatened to ‘destroy’ the merchant and make his life a ‘living hell.’ Braun threatened, ‘I know where you live. I know where your mother lives.’ Braun said, ‘I will take your daughters from you,’ and, ‘You have no idea what I’m going to do.’”

The FTC statement also notes threats “including telling one consumer that they would ‘break his jaw’ if he did not make his payments and, in another case, threatening to ruin a consumer’s reputation by falsely accusing him of being a child molester, if he did not pay.”

The state lawsuit cites another example where a merchant, after explaining falling behind in payments due to a drop in revenue, “received not payment reconciliation from Respondents but instead a series of vivid threats in calls from Braun. Braun threatened that he would come to the principal’s synagogue in Brooklyn and “beat the s*** out of” him and “publicly embarrass” him. Braun warned the man, “I am going to make you bleed.”

These kinds of “potentially abusive collection tactics” by MCAs were among concerns raised by an FTC report, issued in February, on its forum held a year ago with stakeholders in business lending. It listed four points about MCAs:

- “Very high costs – including, in some cases, estimated APRs in the triple digits.” Among the “negative long-term consequences” is borrowers “being forced to renew their advances or take out multiple MCAs at the same time.”

- Two MCA providers at the forum said some of their competitors fail “to lower merchants’ daily payment amounts to reflect drops in their sales.” That’s “potentially unlawful” because it violates contract terms, said FTC. One selling point for MCAs is that because repayment is based on a fixed percentage of the borrower’s revenue, when business slows down, repayment drops proportionally.

- “Use of potentially abusive collection tactics by MCA providers and their agents,” including the use of confessions of judgment. The FTC prohibits COJ use in personal credit contracts, but “it generally does not apply to contracts with small business.”

- “Some MCA providers and their marketers may engage in aggressive, and potentially misleading, marketing practices.” The providers often use large networks of brokers and lead generators to reach potential clients.

Such “aggressive” marketing became an extreme annoyance for one-truck independent Chris Morgan of Gordonville, Virginia. He recalls filling out at least one application for a small-business loan in 2015. Though he never accepted an MCA, he got on calling lists from MCA providers and others.

“These calls came in at a rate of eight to 15 a day. All of them had the same pitch, and each one had a different phone number.” Ditto for email and postal mail. No matter what requests he made to be taken off lists, the solicitations continued.

Morgan knew the practices violated the Telephone Consumer Protection Act. It prohibits use of an auto-dialer or prerecorded voice to place calls to a cell phone without prior consent.

“This went on for two years, and I had three of them sued and we won all three,” he said. Two of the parties were not MCA providers, but marketing firms connected to the providers. The third was a large fleet interested in recruiting him. Morgan declined to give further details on the parties or the settlements, one of which is still in the works.

Another marketing concern raised in the FTC forum was the failure of too many business lenders to clearly state an APR. “Others instead express it as the ‘total cost of capital’ – i.e., the total overall dollar amount consumers will pay in fees or costs beyond repaying the principal,” said the FTC forum’s report. “Additionally, other finance providers use yet other metrics, like ‘interest rate,’ ‘fees’ or ‘factor.’

“Both Forum panelists and outside research suggest that, as a result of this wide variation in disclosures, small business owners often struggle to understand the central features of financing products.” A Federal Reserve study found that confusion resulted in consumers “frequently underestimating these costs as a result.”

Consumers often lack the “heightened understanding of business financing necessary to effectively comparison shop and find the most appropriate products,” panelists said. While consumer-advocate panelists said the APR is the best way to measure loan products, finance company representatives argue that when loans are to be repaid in an estimated number of months instead of a fixed number of years, as is the case with MCAs, it’s more understandable to present the cost of capital as a fee instead of a percentage.

In the notifications related to the Paycheck Protection Program, the FTC and the U.S. Small Business Administration on May 14 issued similar “warning letters to two companies that may be misleading small businesses seeking SBA loans as a result of the coronavirus pandemic,” said an FTC statement. On June 24, the agencies said similar letters had been sent to six more companies for the same reason.

The letters ordered the recipients to remove deceptive claims, mostly implying direct connections with SBA, and to remediate any harm to small-business clients.

SBA, working with banks, has administered loans under the PPP. Because of its favorable terms – loans are forgiven for borrowers who meet certain criteria – in recent months it has been the primary lending program pushed by small-business lenders. It’s believed that hundreds, if not thousands of motor carriers have filed for financial aid through the first and second rounds of PPP.

The May 14 letters were sent to IT Media Solutions, which offers consulting services for lenders and lending marketplace clients, and Lendio, the nation’s largest online business loan marketplace. Lending marketplaces refer applicants to lenders in their network, trying to match borrowers with the best type of loan they can be eligible for. MCAs are often recommended for borrowers with the lowest credit.

This week’s letters were sent to California-based TF Group, doing business as Taycor Financial; SBADisasterLoan.org; California-based Small Business Advocates – Los Angeles, doing business as SBA Los Angeles; New York-based Madison Funding Partners Inc.; Florida-based NYMBUS Inc.; and New York-based USAFunding.com.

Officials with Taycor and Lendio said they were not directly part of the problems addressed by the FTC.

Taycor Head of Marketing Eric Foster said the company severed the link from disasterloanassistance.com to Taycor’s website “as soon as we found out that they were misrepresenting themselves as the SBA.” Taycor is “providing all the information we have about them to the FTC,” he said. “We have no direct relationship with that site or its owners other than the fact that they were sending some of their web traffic to us.”

The letter to Lendio noted its ties with Merchants Advance Network and its website, manfunding.com. The FTC-SBA announcement said MAN “has claimed it was an authorized SBA loan packager for PPP and has advertised its services for a $495 fee, despite the SBA prohibiting lead generators or other agents from charging fees to PPP loan applicants.”

Lendio was unaware that MAN listed Lendio as a partner on its website, said Brock Blake, Lendio CEO. “We don’t even know who they are,” he said. After the FTC letter, Lendio sent a cease and desist letter to MAN.

Blake said the FTC and SBA showed no particular concern about Lendio’s own marketing. “I’m not sure why we got drug into it,” he said.

Analysis of uniform commercial code filings with states show that thousands of trucking-related entities have obtained MCAs. The UCC filings are liens that a creditor uses to establish that it has an interest in a debtor’s personal or business property that was pledged to secure financing.

UCC filings over the last five years show that 9,400 businesses with U.S. DOT numbers had 12,000 UCCs tied to loans that appear to be MCAs, though some could be other types of loans. These entities would be trucking fleets and owner-operators with authority principally, but also freight brokers, freight forwarders, motor coach companies and others. The filings were gathered by RigDig, a trucking industry data subsidiary of Overdrive’s publisher, Randall-Reilly.

Have you had bad experiences with a merchant cash advance? Comment below or write [email protected].

Next in this series: How borrowers, sometimes unknowingly, sign away their assets in MCA contracts