Previously in this series: How to change your decision-making for successful self-dispatch

I first discovered the discipline of economic behavior psychology by accident, and it helped transform my thinking. I recommend reading or listening to Dan Ariely’s “Predictably irrational: The hidden forces that shape our decisions.”

It took years for me to realize that the cost to haul the loads I was choosing often varied more on a per-mile basis than I had been (irrationally) assuming. Trying to select the loads based on the information showing on the load boards, or received from a broker on the phone, was playing out with more inconsistency in bedrock profit than I wanted. There just had to be a better way to more quickly evaluate the profit in any load -- with a better measure of accuracy in the evaluation.

After all, just because we’ve made decisions one way all these years doesn’t mean we’re doing it right.

Before we dive into the method I ultimately arrived at, here are a few questions to ask yourself and/or a load’s broker to get to the broader business decisions or a single load’s details -- you’ll need both to make the right evaluation:

- Just what is limiting your load choices, whether time (hours of service), equipment type or specs, a desire to stay within a particular region, or self-limiting decisions like your personal “do not haul” list?

- How much gross revenue will you need to cover cash flow obligations at home and for the business?

- What is the minimum rate per mile or per day for any load you need to turn an adequate profit?

With clarity on questions 1 and 2 in hand, to get toward 3, let’s start with costs -- fixed costs should be simpler to calculate and maintain control over given they only change when you add or subtract a payment. They’ll include any truck note, such as it may be, insurances, plates and permits, ELD service/cell phone and/or other services you subscribe to.

Total these monthly and divide by the number of days you are under a load in any given month. You could average for the year, but a more effective cost calculation may be to recalculate every month based on your prior month’s or prior quarter’s activity.

Let’s game out an example with this operator’s monthly numbers:

- Truck payment: $2,500

- Insurance: $800

- Plates/permits: $200

- ELD, cell phone, bookkeeping and other services: $225

With a grand total of $3,725 in monthly fixed costs, this operator’s quarterly average 18 days every month under a load yields this fixed cost per day calculation:

$3,725 divided by 18 days = $207 per day under load in fixed costs.

There’s another fixed cost I would encourage you to consider, though -- your own salary, whether you’ve already got a self-pay structure set up for purposes of satisfying an S Corp tax filing structure or not. Doing this at a level strong enough to be able to cover your family’s home costs will allow you to essentially bake income adequacy into your subsequent cost calculations and load evaluations.

Let’s say this truck owner’s driver salary is set at an even $1,250 per week, or $5,000 monthly.

$5,000 divided by 18 days = $278 per day under load in salary

Total fixed cost per day, then, before this owner even starts his truck: $485 per day

[Related: Cost increases are coming -- your rates need to reflect that sooner than later]

Handling variable costs is a trickier prospect, particularly in a time like the present with inflationary pressures on fuel, maintenance and wear items like tires and brakes. A variable cost per mile of a buck or more can be the norm, and it can change quite quickly. In such an environment (always, really), it’s important to re-calculate your variable costs for load evaluation often. Also: consider variable costs in relation to time -- not just miles/distance.

Extending the owner-operator example above, let’s say his prior quarter’s numbers told him he was not quite to $1/mile in variable costs, yet his fuel receipts had been on the rise, certainly enough to add another several cents/mile to the variable costs equation for an even $1/mile

He’s looking at a brokered 1,100-mile haul (including deadhead) advertised at $2.50/mile whose pickup and delivery schedule he learns will easily eat up 2.5 working days.

1,100 miles X $1 = $1,100 in variable costs

Calculating fixed costs for this load: $485 per day X 2.5 days = $1,213 in fixed costs

Total costs: $2,313

Cost per day: $925

Cost per mile: $2.10

You might consider this your rock-bottom rate for this load -- covering your need for an income but not leaving anything to reinvest in the business. Fortunately, as noted, this broker’s suggested rate, at $2,750 all-in, leaves more than $400 in profit, or about 15% for a profit margin, to sock away in an emergency fund or reinvest toward other business efforts.

Armed with up-to-date cost per day and cost per mile figures, you can turn more confidently to evaluation both of any load’s value and your own rate structures.

Confidence will help in your sales efforts when it comes both spot broker negotiations and/or shipper contracts. Learning to negotiate is learning to be a salesperson, after all. Never assume that capacity is nipping at your heels -- that there’s always going to be some other trucker right around the corner willing to do it for less. Like as not in most cases, there’s room to negotiate, and to fully consider the services that need to be clear for everyone’s protection, no matter what the current market averages might be.

[Related: Comparing costs -- and strategies to profit, ultimately]

The devils always in the details, of course.

How you begin the conversation is important to establish the control you want. Ask the other party to “tell me everything you can about this load." Then, listen closely, careful not to lead the caller to just tell you what you want to hear.

The bottom line can involve much more than price per mile or day. Items and services such as fuel surcharge, securement assistance, payment for deadhead, adjustments to the pickup or delivery dates to allow more efficient hours utilization, detention or layover payments, or consideration for higher risk environments or freight, tolls, truck ordered not used. ... The list goes on. Be careful not to leave services on the table without clear recognition, in writing on the rate con, that you and the customer/broker are on the same page. You can cut your risk in the event of a service failure.

It all sounds simple, but getting in a hurry and day-to-day stress can derail a well-laid plan quickly. Who can’t recall the time a broker called and we agreed to haul the load -- yet the moment the call disconnected we knew we’d made a mistake with a rushed decision?

For me, the real difference-maker came in the form of renewed focus on each and every load as a separate, stand-alone job that has to offer the profit to meet my business goals for the investment I make in the contract. Each load that meets the needed criteria is a new job, a new contract opportunity.

What would you say if someone asked what it would cost for you to haul a load? I didn’t know the answer, either, before I focused more closely on keeping my bookkeeping current and saw that my cost for every load was different. You can’t afford to operate on just the assumption of adequate profit for your business. Hopefully this series has given you plenty to think about and maybe moved you a few steps closer to the finish line, particularly for those of you who plan to one day expand beyond a truck and bring on drivers.

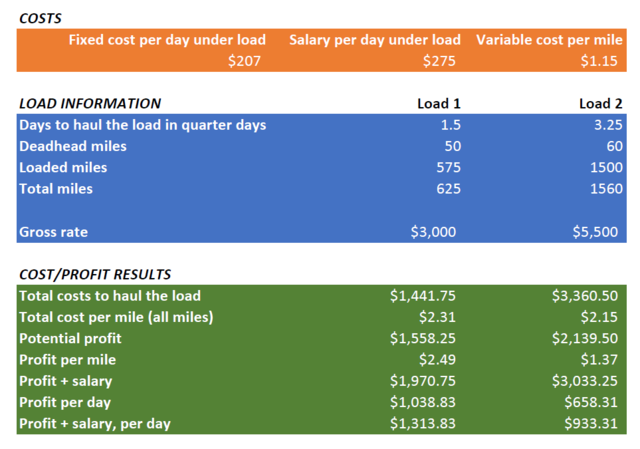

Following find a comparison of two loads that could give you further ideas about how to make your own comparisons.

Find more information about load planning, selection and negotiation, among a myriad other topics, in the Overdrive/ATBS-coproduced "Partners in Business" manual for new and established owner-operators, a comprehensive guide to running a small trucking business. Click here to download the newly updated 2022 edition of the Partners in Business manual free of charge.