"It’s been a while," said Mike Hosted, "since it’s been a positive trend or a positive market" during Hosted's semi-annual presentation Tuesday, March 25, for clients of owner-operator business services firm ATBS and other owners. Since July of 2022, maybe even before, rates and demand indicators in one of Hosted's professed favorite leading-indicator markets to watch -- spot freight -- have been plagued by general low levels as well as a series of what he called "false starts."

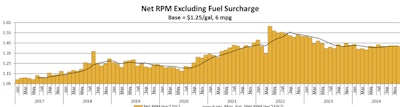

In other words -- multiple brief series of increases that then peter back to levels that on average are borderline profitable for many owners. Hosted cited a post-pandemic floor of around $1.90/mile (excluding a calculated fuel surcharge), from which spot-rates tickers have bounced up and down for years now.

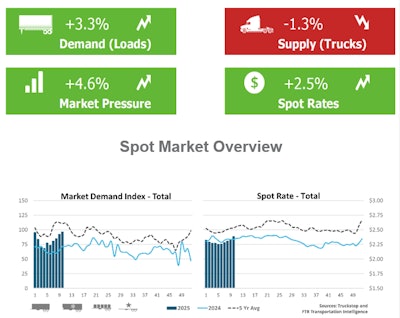

Yet since week 4 of this year, Truckstop's load-to-truck average for the market has risen consistently from 68 loads per truck up to near 100 -- and an all-in $2.42 rate, $2.04 excluding a surcharge. Eight weeks of improvement doesn't make a recovery (and the picture in individual segments are mixed), but the rise has been marked enough to outpace all of the false starts of the last few years, Hosted emphasized.

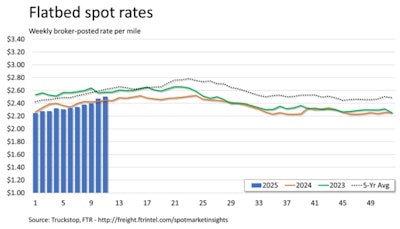

The blue bars for 2025 in the Truckstop/FTR Transportation Intelligence weekly spot-rates snapshot finally showed year-over-year gains this week.Truckstop/FTR

The blue bars for 2025 in the Truckstop/FTR Transportation Intelligence weekly spot-rates snapshot finally showed year-over-year gains this week.Truckstop/FTR

"This is the highest and quickest we’ve gone up in quite some time," said Hosted, calling it the "most encouraging sign we’ve had in the last three years for a freight rebound."

Owner-operator revenues were down in 2024, though income was up

Think of it as a tried-and-true maxim of sorts. When the going gets tough for rates/revenues, owner-operators run more miles and cut costs where they can.

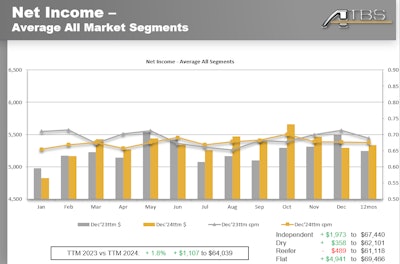

Recent positive market signs follow another tough year where nonetheless, at once and finally, after year-over-year average-income declines in 2022 and 2023, income was up a relatively small amount.

Income was up in 2024 over 2023, though just by a couple percentage points to an average $64K in the "trailing twelve months" (or TTM on the graph) for ATBS owner-operator clients. Lighter-colored bars/lines represent 2024 numbers for lump-sum income/income per mile.

Income was up in 2024 over 2023, though just by a couple percentage points to an average $64K in the "trailing twelve months" (or TTM on the graph) for ATBS owner-operator clients. Lighter-colored bars/lines represent 2024 numbers for lump-sum income/income per mile.

Leased flatbedders gained the most, followed by independents operating with authority among ATBS' client owners.

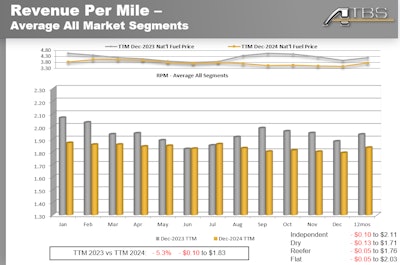

Miles were up overall (plus 3.7%, or 3,400 miles over 2023), and savings at the fuel island, whether through prices falling or improvements in efficiency, made for the biggest difference in 2024. Revenue on the whole, as noted, was down, Hosted pointed out.

There was "a big degradation, 10 cents/mile for our average client," Hosted said. For leased dry van operators it amounted to 13 cents/mile to $1.71 on average and $2.11 for independents. Yet revenue drops were mostly accounted for, particularly for leased clients, by the decline in fuel prices and surcharges on the order of 7 cents for the average owner-operator overall.

Those owners made up the remainder of the revenue losses with other cost reductions: led by more efficient operation to a new high for fuel mileage of 7.12 mpg. Fixed costs were up, though by far less -- just more than a single percentage -- than the 2023 8% jump over 2022, and maintenance showed generally stable trends. Maintenance was up 6.6% but that's expected as owner-operators ran more miles in 2024. Average maintenance costs for all owner-operators still sits around 12-13 cents/mile, though in reality is hugely variable from operation to operation depending on the truck's age. "Get a custom maintenance savings plan" in place, Hosted said, to sock away funds for the unexpected.

Total costs fell 2% for the average ATBS owner-operator client.

[Related: Overdrive's new Partners in Business playbook for an owner-operator career]

In 2024, revenue declines continued to be the rule year-over-year for owner-operators. Yet the next chart shows more of a flat year for revenue when you separate out an average fuel surcharge month to month.

In 2024, revenue declines continued to be the rule year-over-year for owner-operators. Yet the next chart shows more of a flat year for revenue when you separate out an average fuel surcharge month to month.

Hosted saw encouraging signs in both flatbed and reefer for 2024 -- those owners in fact showed revenue gains in 2024 with fuel estimates out of the equation. Conditions are certainly improving for flatbedders the first months of this year, he felt, that segment "generally a precursor to better economic times."

While the housing market isn't going gangbusters by any measure, "commercial construction is up," he added. He pointed to the "massive infrastructure bill passed in 2021," and the notion that "we are finally starting to see those funds turn into construction."

Download all the slides from Hosted's presentation via this link.

Truckstop and FTR Transportation Intelligence's weekly spot market snapshot and accompanying report shows flatbed's spot market strength after the lackluster 2024, also suggesting signs of the strength can't be attributed just to increased activity by importers to avoid metals and/or other tariffs in earlier weeks. (Time will tell if gains are sustained.)

Flatbed spot rates have "risen for six straight weeks," Truckstop/FTR wrote, and as of this Monday sat "2.4% above the same 2024 week -- the strongest prior-year comparison since July 2022." Rates excluding a calculated fuel surcharge were up about 7% year over year, furthermore, and posted-load volumes were up again to their highest level since July of 2022.

Flatbed spot rates have "risen for six straight weeks," Truckstop/FTR wrote, and as of this Monday sat "2.4% above the same 2024 week -- the strongest prior-year comparison since July 2022." Rates excluding a calculated fuel surcharge were up about 7% year over year, furthermore, and posted-load volumes were up again to their highest level since July of 2022.

"The getting's been good for flatbed" on the spot market, "for now," said DAT Principal Analyst Dean Croke during the opening breakfast presentation at the Mid-America Trucking Show. Yet he reflected, still, considerable pessimism for truckload market participants. About the strong start of the year for flatbed, he said, "I don’t know if it’s going to continue or whether it’s going to continue rising to July 4," as is typical for flatbed rates/volumes on the spot market, "or just peter out" as it has the last couple of years.

[Related: Freight analysts forecast headwinds could yield slow-growth 2025]

Hosted sees positive signs, ultimately, when he separates long-term ATBS clients from the other owner-operator clients to analyze the performance data, minimizing the costs of turnover in the data. For "ATBS clients with us more than a year," the middle third is averaging around $86,000 in annual net income, he said.

The top third of clients in that analysis, furthermore, hit $156K for an average in 2024. Over time, both of those high-performing segments bottomed out in income in the second quarter of 2023 and have been adding income as an average ever since.

"They’re actually thriving," said Hosted. "They’re doing better," because they've made changes operationally, examining the profit and loss statement frequently and adjusting.

Hosted noted fleets ATBS works with to improve their programs for leased owner-operators are "expecting 3% rate increases in contracts in 2025," he said, after the long fall in contract rates. Some among them, too, are "aggressively growing their infrastructure for owner-operator capacity."

Over-capacity, however, could remain a drag on rates growth, a sentiment echoed by Croke during the MATS breakfast presentation. As he put it, “We’re still trying to find the bottom of this market in terms of trucks and supply.”