Policies that charge lower premiums in return for you assuming high deductibles, often $2,000 to $5,000, are helpful if you rarely visit the doctor. After meeting the deductible, the policyholder pays a portion, often 20%, of the medical bills.

Policies are available with deductibles as high as $10,000. However, if you raise your deductible too high, you’re in effect paying for health care out of your pocket and buying only catastrophic coverage, a safety net to cover ailments that produce five- or six-figure bills, such as a major heart attack or cancer. If you’re older than 40 with a family history of medical problems, or if you’re someone who is unlikely to use health care on an ongoing basis, you might not want such a high deductible because you probably rarely would receive any benefits.

High-deductible plans, many available via the Affordable Care Act's heath insurance exchanges, can be more affordable when they’re associated with a Health Savings Account for tax-exempt health saving and spending. HSAs are part of many plans on the health insurance exchanges and allow unspent contributions to roll over year to year.

The major qualifier remains having a policy with a high deductible and limits on uncovered out-of-pocket expenses. Of course, these factors are also a big part of the root of the savings, because premiums on such policies tend to be lower.

A high deductible means you’re likely to pay 100% of your routine health care. Should anyone on your policy need major care, the policy kicks in after the deductible is met.

Advantages of using HSAs include:

- A wide range of qualifying expenses, including chiropractic services, over-the-counter pain relievers and other items that traditional insurance wouldn’t approve.

- Some health care providers discounting services for their HSA clients.

- Your taxable income being reduced by whatever you put into the HSA.

[Related: This tax break survived, and can benefit you]

Unlike money put into an Individual Retirement Account, which gets taxed upon withdrawal, HSA funds are never taxed if they’re spent on health (though there is a 20% penalty for funds not used on health). After you turn 65, you can spend it on things unrelated to health, but such spending is taxable.

"I think that is a big deal!" said Overdrive 2024 Trucker of the Year Alan Kitzhaber about the tax-free nature of HSA contributions, as he made clear in the second part of his 2025 story designed to give advice to aspiring owners after his long career, with more than 4 million miles in the rear view and rolling toward a comfortable retirement.

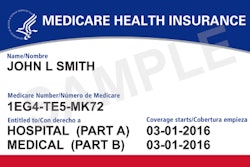

Read next: Understanding Medicare: If you're getting close to 65, it's crucial