Previously in this series: Highway robbery: A clouded transparency

• Tools to check broker credit histories and ratings for intel on business health via load board services’ rating systems and other third-party services have multiplied in recent years. DAT today provides owner-operators the opportunity to review brokers using its load boards, and Truckstop.com offers credit letter grades. Both offer other common metrics on brokers’ payment speed and more. Find an in-depth July 2017 feature on the topic via this link.

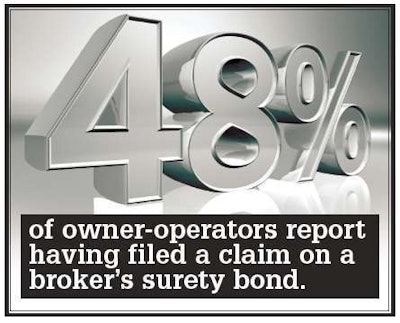

Results from a 2013 poll showed nearly half of owner-operators had at one point or another filed against a broker’s required bond. For more recent results of polling about scam scenarios operators have experienced, follow this link.

Results from a 2013 poll showed nearly half of owner-operators had at one point or another filed against a broker’s required bond. For more recent results of polling about scam scenarios operators have experienced, follow this link.• In 2013, nearly half of owner-operators reported having resorted to that last-ditch effort to collect from a freight-payment scofflaw: filing against a broker’s required surety bond or trust. That same year, Overdrive published a how-to for those needing to file, whether to spur a broker to pay or to mitigate against a broker’s business failure. Find the how-to at this link.

• The Baxter Bailey & Associates freight-specialized collection agency publishes a periodic list of brokers about which it’s received multiple collection inquiries, occasionally indicating either fraudulent or failing companies. You can subscribe to e-mail alerts via BBCollects.com. The collection firm will handle payment claims as low as $500. Carriers making collections pay for the service as a percentage of the final collection.