Short answer: Yes, with some qualifiers depending on the segment.

Longer: I spoke with owner-operator Randy Carlson last week briefly about this subject. You may recall Carlson from a podcast talk and some further reporting I did with him about his 2001 Freightliner, powered by a fully mechanical Caterpillar engine of considerably older vintage (some of that reporting from before FMCSA changed its calculus on the ELD mandate pre-2000 exemption, basing the exemption on engine year rather than truck year — pleasant surprise for Carlson). The hauler runs the Midwest from a home base in Minnesota, hauling reefer freight ELD-exempt.

With the end of the week in sight, Carlson had run about 2,250 total miles and grossed “$5,000 or so” on that, or about $2.22/mile on all miles. The average reefer rate nationally in Truckstop.com’s paid rates dataset, however, was well above that, at $2.80/mile for the month of January, but Carlson’s lean operation is still making a good profit. What’s better than the last week’s rates is that pay’s been “consistently pretty good” for him, Carlson says. “Historically, reefer’s always good in the fourth quarter then into the first of the year. Usually by this time it’s getting a little thin, but I haven’t had anything terrible. Rates have been good – fuel went up about 50 cents, but still, at that, the difference in the rate has more than offset that. Hopefully it stays that way.”

There’s been some cool-off in spot market volumes over the last week or three, but rates remain well elevated over this time last year, that’s for sure. So how much of that exactly is accounted for by the rise in fuel?

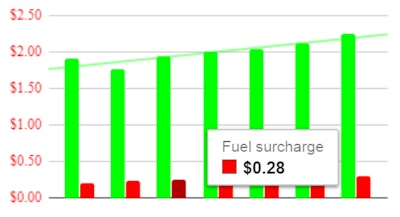

Fuel topped $3/gal. last month as a national average and remains at about $3/gal. as of the latest report from the Department of Energy. It’s been rising since hitting something of a trough in July 2017 at $2.47/gal., as Carlson intimated. In the charts that followed I separated out a typical per-mile fuel surcharge (based on DOE per-gallon averages and 6 mpg for fuel economy, calculated for the per-gallon price above a base of $1.25) from national average paid rates in each segment as tracked in Truckstop.com’s monthly reports that Overdrive gets. Those reports show all-in rates averages, given fuel surcharges in broker-carrier spot negotiations are seldom in fact separated out. The picture the rates tickers present thus doesn’t reflect underlying rate changes minus owner-op’s No. 1 cost, fuel. What you see in the following graphs is a picture of the underlying trends, minus fuel’s volatile effect (the shorter, red bar in each pair in the graph shows my calculated surcharge for each month charted).

All-in dry van rates over the July 2017 to January 2017 period were up by a measure of 20 percent, more than any other segment. Separating out fuel’s effect, the underlying rate was still up almost 18 percent, from $1.90 to $2.24/mile. My average calculated surcharge over the period rose nearly 50 percent from 21 cents/mile to 30.

All-in reefer rates as tracked by Truckstop.com saw substantial gains over this period, moving from $2.40 to $2.80/mile on average, an increase by a measure of 17 percent. Take out fuel’s effect, though, and gains were more muted as a percentage rise — 14 percent above underlying July rates.

As a national average, independent flatbedders using brokerages appear to have benefited in rates per mile the least among the segments over the ELD implementation period of the last several months. Flatbed all-in rates were up just 7 percent over this period, a rise almost totally knocked out by the rise in fuel. Underlying rates, minus the calculated surcharge, rose just 6 cents per mile, from $2.08 to $2.14. Flatbedders leased to carriers, with some own-authority independents mixed in, have been doing quite well as the economy has improved, however, over the last year — as shown clearly in end-of-year 2017 income numbers from ATBS clients recently reported on by Max Heine.

Whatever rate hike you’ve experienced, here’s hoping you’ve been able to benefit — I know the move to e-logs for many has thrown a wrench into total miles to varying degrees. (Carlson noted his one direct-contract contact has experienced frustration with delayed shipments as a result of so many of her haulers moving to ELDs at once. “I’m exempt,” Carlson told her. / “You’re my new best friend,” she said.)

How have you fared these last weeks, whether you’ve moved to ELDs in recent times or not?