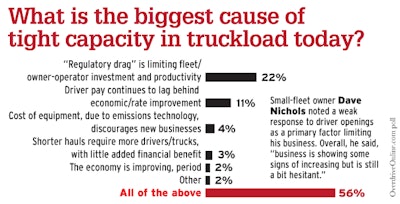

Polling of Overdrive readers earlier in the year yielded these thoughts on the cause of overall capacity shortages in truckload — if reports are correct, capacity could be taking an opposite turn among very-small to mid-size carriers as a result of improved spot-market rates.

Polling of Overdrive readers earlier in the year yielded these thoughts on the cause of overall capacity shortages in truckload — if reports are correct, capacity could be taking an opposite turn among very-small to mid-size carriers as a result of improved spot-market rates.“If the driver is looking for freight when he needs it, the load he needed has already been moved by someone else.” –Internet Truckstop CEO Scott Moscrip

ITS’ Scott Moscrip was quoted in a report this week by Overdrive sister publication CCJ‘s Kevin Jones, speaking to the importance of the growing sophistication of company load-board tools in the hands of owner-operators who, more and more, are using them in likewise sophisticated ways.

With all the sophistication going around, brokers have followed suit, as Jones reported: “When ITS was founded 19 years ago, 99 percent of the freight that was posted was for same-day pickup; today, that’s only 25 to 30 percent. Similarly, truckers using the company’s load board wisely have seen empty miles decline from about 15 percent to 5 percent.”

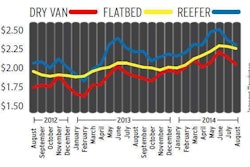

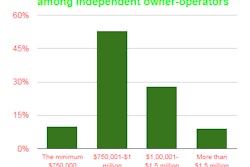

Owner-operators with their eyes on real-time demand data are well-positioned to capitalize on a large volume of freight — and attendant good rates — available from brokers in the spot market, rather unique this year, as we’ve reported on recently, including in posts to the Channel 19 blog and other reporting. Many around the nation are well aware of what’s going on, as Jones notes, citing a surge in new-carrier registrants:

Moscrip doesn’t see capacity growing. The large carriers, rather than buying new equipment with seats they can’t fill, have become aggressive in their freight selection and are shifting less profitable loads to the spot market. Because of the opportunities on the spot market, fewer and fewer mid-size carriers are entering into contracts, particularly long-term contracts.

“Rates are going to drive capacity,” he says.

Read Jones’ full piece via this link.

And stay tuned for a related Overdrive feature on tactics and larger strategies relative to capitalizing on the freight market today, slated for the October issue.