Find the previous part in this series on the so-called “Uberization of trucking” via this link.

Access all of the component parts via the page at this link.

“We launched a little less than a year ago,” company cofounder Mike Schreiber says. “A big portion of that time we spent beta testing and making iterations of the system.”

With a “2.0 release in November,” he adds, the company’s going on about six months since it “went full-scale into the market.”

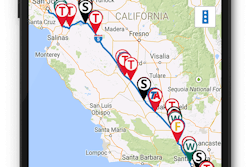

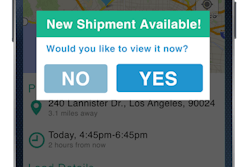

The company hopes to be a long-term solution for both shippers and independent carriers using the system to match, rather than a temporary value. “The general idea of the whole system is to bridge the gap between the shipper and the independent truckers that operate in the spot market,” he says. “The process on the spot market is so time-consuming – this causes shippers and carriers to miss out on opportunities to connect.”

Before today’s technology, “that was OK,” Schreiber says. Brokers handled the inefficiencies for a fee. “Now, new technology has come.”

While brokers also can utilize the DashHaul platform, there’s “been a little push-back from them to the instant rate” concept, Schreiber says. “Their business model is to negotiate off-line to try to get that highest-spread margin. They’ve used the system, but it’s seldom.”

Some newer brokers, however, with some smaller carrier relationships already are coming on to utilize the system to “find capacity,” Schreiber adds, then describing the pitch to such entities. For a load the broker can’t move with an in-network carrier, “instead of making 100 phone calls, hitting the load boards, keep the revenue coming [by using DashHaul].”

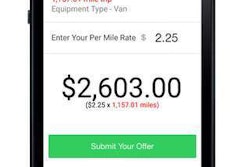

With the exception of the previously mentioned custom-set rates for high-volume shippers, rates in DashHaul’s system are based on an algorithm that Schreiber says takes into account available equipment, market capacity and location. Within the system, there’s “no opportunity for negotiation,” he adds. “We work really closely with carriers as well. We had a brokerage company for almost three years before we decided to launch this. We built it for the carrier to try to get them better rates, quicker payment, more load options and better lanes. Our primary focus when we developed it was on the independent carriers and the smaller firms.”

On payment terms, Schreiber describes the approach as “100 percent transparent with pricing and payment terms.” With the initial launch in 2013, DashHaul charged a 3 percent transaction fee to both carrier and shipper, built into the rate.” Today, “We’ve eliminated the percentage from the carrier side altogether” and the company takes “3 to 6 percent on the shipper side, depending on different variables.”

At the end of the day, the focus is primarily on delivering shippers for the company: “What we found out: Direct shipper rates are decent rates that truckers can make a good living from. The 15-25 percent in between that should be going to the carrier is what drives down those rates.”

Payment following proof of delivery delivered via a smartphone picture or scan into the system will remit in 24-72 hours, Schreiber says, via next-day paper check or direct deposit.

NEXT: Keychain Logistics seeks to prove out the “future of trucking”