Reflecting the thoughts of, among others, Overdrive reader Richard Fassett, who recently suggested owner-operators ought to start the belt-tightening now to prepare for a cyclical economic downturn, analysts with the FTR Associates transportation forecasting firm say the next few years are likely to see such a cyclical event.

Disagreement on timing and severity, however, was on offer July 9 during a special edition of FTR’s monthly “State of Freight” online seminar and Q&A.

FTR Senior Consultant Noel Perry projected a downturn to start as early as late 2016. “The freight economy always slows before a recession,” Perry noted. With activity in rail seeing pronounced slowdowns in commodities relative to oil and gas and others, and slowing growth in international and domestic intermodal with “some signs that it’s starting in trucking,” he added, however, that “there’s reason to hope we’ll be out to 2017-’18 before the economy weakens.”

The bad news: “The global economy is not healthy,” Perry said, referencing the troubles in Greece and elsewhere in Europe. “The Chinese stock market is plummeting down 30 percent or more.” The troubles worldwide are relatively “small this year, but there could be globally-induced recession beginning sometime late next year – it’s not something I’d bet on this time around, but its something to think about.”

Trucking growth in rates and volume have in fact slowed considerably, he noted.

Echoing owner-operator Fassett, “this is a time to be wary,” he said.

Find more intel, including the free State of Freight newsletter series, at FTR’s website.

FTR Director of Transportation Jonathan Starks emphasized slow growth as the hallmark of the end of a recovery. “The recovery is weakest when it’s new and when it’s old. The positive part of that is, because we’ve grown relatively slow in the service side of the economy, we haven’t built up a lot of the imbalances that we typically do” on the end of a recovery. The severity of such imbalances compound any downturn’s effect.

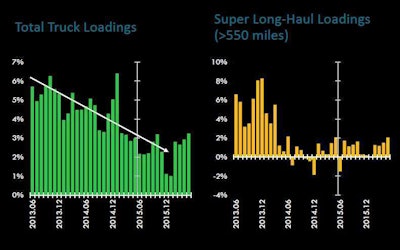

Starks outlined FTR’s projections for freight through the end of the year and beyond, with loadings up slightly in year-over-year comparisons.

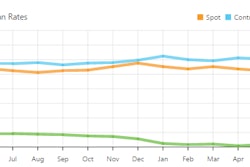

At once, Starks pointed to distressing signs for long-haul owner-operators in the spot market, where, despite rates controlled for fuel fairly close to levels relative to performance last year, market demand overall is measuring at “half of what it was in 2014.” He cited the Truckstop.com Trans4Cast market demand index for that measure. “It speaks to the loosening of the capacity situation” as year-over-year growth in total truck loadings (particularly on the long-haul side, reflected in the graph at right) has slowed considerably with sluggish industrial-economy and business-investment measures. Still, with consumer activity continuing to prop up the economy, Starks projected “better growth as we start into next year.” Of those “super long-haul loadings,” most reflective of what’s happening on the spot market, he said, “we’re seeing a lot of weakness right now.”

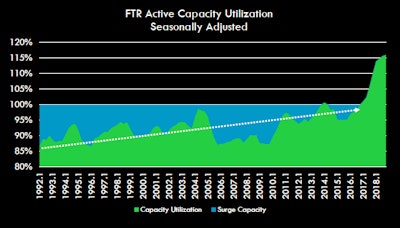

At once, Starks pointed to distressing signs for long-haul owner-operators in the spot market, where, despite rates controlled for fuel fairly close to levels relative to performance last year, market demand overall is measuring at “half of what it was in 2014.” He cited the Truckstop.com Trans4Cast market demand index for that measure. “It speaks to the loosening of the capacity situation” as year-over-year growth in total truck loadings (particularly on the long-haul side, reflected in the graph at right) has slowed considerably with sluggish industrial-economy and business-investment measures. Still, with consumer activity continuing to prop up the economy, Starks projected “better growth as we start into next year.” Of those “super long-haul loadings,” most reflective of what’s happening on the spot market, he said, “we’re seeing a lot of weakness right now.” If rates are flat or even down a little, where’s the capacity crunch / driver shortage so many talk about so often of late? asked Overdrive reader Kurt Keilhofer in this story from yesterday. According to analyst Noel Perry, such pressures have loosened this year to “normal” status in a recovery. Nonetheless, Perry sees future regulatory impact as potentially dramatic by 2017-’18, provided FMCSA is able to do what they say they’re going to do, particularly relative to speed limiters and electronic logging devices. In 2017 when speed limiters and ELDs and other important changes hit the real world, the trucking industry “will have to hire a whole bunch of extra drivers. If the FMCSA continues with their agenda, the regulatory risks are real,” he said.

If rates are flat or even down a little, where’s the capacity crunch / driver shortage so many talk about so often of late? asked Overdrive reader Kurt Keilhofer in this story from yesterday. According to analyst Noel Perry, such pressures have loosened this year to “normal” status in a recovery. Nonetheless, Perry sees future regulatory impact as potentially dramatic by 2017-’18, provided FMCSA is able to do what they say they’re going to do, particularly relative to speed limiters and electronic logging devices. In 2017 when speed limiters and ELDs and other important changes hit the real world, the trucking industry “will have to hire a whole bunch of extra drivers. If the FMCSA continues with their agenda, the regulatory risks are real,” he said.