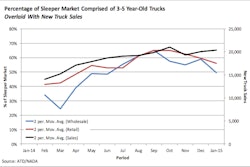

The price of new equipment has never been higher, for one. And though used-truck prices have shown signs of coming down for later-model equipment (particularly two-three-year-old tractors that are out there on the market), four-year-old models are actually bumping up a bit of late, according to analysis by the America Truck Dealers.

And below find the thoughts of owner-operator Richard Fassett, who wrote in with a warning. The operator watches the stock market and other indicators and says he interprets recently published jobs numbers and additions to the capacity of trucks on road to predict supply-and-demand dynamics to send freight rates tumbling by October.

There’s no way that there will be more freight than there was in 2007, and we will have more drivers on the road than at that time.

By January you will see an increase in bankruptcies in the trucking companies. That will continue till the supply and demand issue evens out which could take how long?…

Owner-operators better tighten their belts now. If I’m seeing the cards right, there is rough water ahead. I’m seeing load boards shrink due to this already.

Best of luck to all. You have been forewarned.

Fassett’s note reminded me of a recent conversation I had with Commercial Fleet Financing’s president Matt Manero, who predicted a cyclical downturn in the wider economy in the 2016-17 time frame. If he and Fassett are both right, October sounds like a decent-enough prediction for more tepid conditions for rates and freight to begin leading it all over the edge.

But hey, the future is hard to predict. What do you think? Is Fassett’s gut on it correct?

On a related note — the Federal Reserve is expected to announced tomorrow whether it will raise interest rates in light of economic improvements. Currently at historically low levels, those rates have led down the cost of borrowing for owner-operators with good credit in recent years. But with little wiggle room to cut rates farther in the case of an economic downturn, for the fed such low rates put them in a potential future bind. The ups and downs in short-term lending rates to banks that the fed controls ultimately are reflected in the cost of borrowing in the wider lending markets, but even so, what’s your thought on the route they ought to take? Here’s New York Post financial writer John Crudele on the situation. Plenty fall on both sides of the issue — Manero, for instance, believes that if they do raise rates, it will likely be to split the opposing camps’ difference and only boost rates a quarter of a percentage point or so, with a minimal effect on credit markets. Weigh in in the poll or drop a comment below.