When the end of the of month coincides with the end of the quarter, good things usually happen for carriers on the spot market, as everybody with inventory that needs to get off the books moves it. March 31 and April 1 saw hints that the Spring freight season might have finally arrived.

Spot truckload freight volume was up 11 percent nationally while the number of truck posts dipped 5.5 percent during the week ending April 2. Fewer truck posts is typically associated with fewer carriers hungry for loads.

March is usually a transition month, borne out by the month-over-month and year-over-year DAT freight volumes. Spot market loads posted in March showed volume 42 percent higher than in February — but 28 percent lower than the same period in 2015.

Here’s how the last week played out in vans and reefers.

The national average dry van load-to-truck ratio was 1.9, meaning 1.9 available van loads for every truck posting on the DAT load board network (a ratio of 3-plus usually works in carriers’ favor). Van rates, however, even with the low ratio, are climbing in the most popular lanes, especially in the Southeast and South Central regions, both of which are where you expect produce season to take reefers out of the van market since they’re needed for temperature-controlled fruits and vegetables.

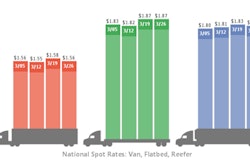

The national average dry van load-to-truck ratio was 1.9, meaning 1.9 available van loads for every truck posting on the DAT load board network (a ratio of 3-plus usually works in carriers’ favor). Van rates, however, even with the low ratio, are climbing in the most popular lanes, especially in the Southeast and South Central regions, both of which are where you expect produce season to take reefers out of the van market since they’re needed for temperature-controlled fruits and vegetables. Outbound rates rose a penny each in Charlotte (to a $1.82/mile average), Atlanta ($1.73), and Dallas ($1.52). The popular roundtrip between Dallas and Houston saw rates go up in both directions: that 480-mile round produced an average of $1.97/mile. Dallas to Houston was the higher-paying lane, but Houston had more loads and a higher load-to-truck ratio favoring the carrier. The national average van rate on the spot market was up a penny to $1.57/mile.

Outbound rates rose a penny each in Charlotte (to a $1.82/mile average), Atlanta ($1.73), and Dallas ($1.52). The popular roundtrip between Dallas and Houston saw rates go up in both directions: that 480-mile round produced an average of $1.97/mile. Dallas to Houston was the higher-paying lane, but Houston had more loads and a higher load-to-truck ratio favoring the carrier. The national average van rate on the spot market was up a penny to $1.57/mile. Reefers coming out of McAllen, Texas, fell a nickel for an average of $1.80 per mile, as that Rio Grande Valley border town dropped to No. 5 overall for reefer load posts, behind Atlanta, Los Angeles, Tucson, and Dallas. As a national average, the spot reefer rate was unchanged at $1.58 per mile.

Reefers coming out of McAllen, Texas, fell a nickel for an average of $1.80 per mile, as that Rio Grande Valley border town dropped to No. 5 overall for reefer load posts, behind Atlanta, Los Angeles, Tucson, and Dallas. As a national average, the spot reefer rate was unchanged at $1.58 per mile. Produce freight is shifting north to areas like Central California, where Fresno rates jumped 7 cents to a $1.86/mile average. The reefer load-to-truck ratio was 3.2 last week, a slight improvement over last week and, fingers crossed, a sign of better things to come.

Produce freight is shifting north to areas like Central California, where Fresno rates jumped 7 cents to a $1.86/mile average. The reefer load-to-truck ratio was 3.2 last week, a slight improvement over last week and, fingers crossed, a sign of better things to come.