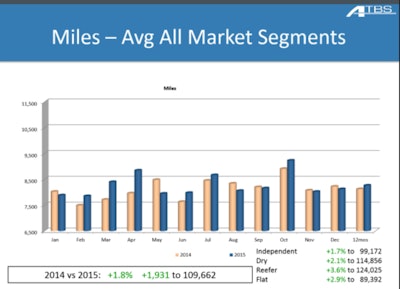

Reversing a longstanding trend among owner-operator clients of the ATBS business services firm, miles run were up in 2015 among all segments toward yet another record year for net income, says ATBS President Todd Amen. ATBS clients, largely leased operators but including a sizable subset of independent truckers with authority with various trailer types, “broke $60,000 in net income for the first time since we’ve been tracking this data,” more than 13 years.

The 2015 $61,167 income figure is computed as an average among all segments, separating out the top and bottom 10 percent of high and low earners.

Here’s the breakdown by segment:

Independents with authority: $63,375, up from around $60K in 2014

Dry van: $60,557, adding about $6,000 over 2014

Reefer: $52,782, fairly flat

Flatbed: $70,464, more than $10K above 2014 number

This is all in spite of what happened in the second part of the year, as spot market rates lost a lot of the heat they had gained over the prior years. It was, no doubt, “difficult in the second half of the year,” Amen says, speaking as part of ATBS’ annual Independent Contractor Benchmarking online seminar Thursday, April 7. “Spot market rates plummeted.”

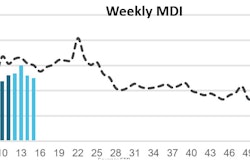

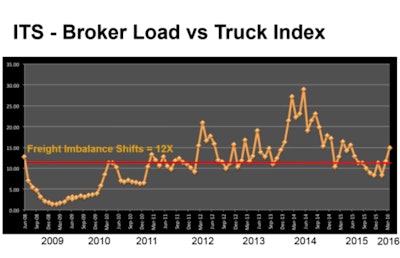

ATBS’ Amen sees a load-to-truck ratio of 12 in the Internet Truckstop Group’s market demand index as representative of a balanced market. “When we’re above that line,” he says, “things are good for truckers.” Though levels didn’t fall last year to those seen during the depths of the last recession, “get over to 2015 halfway through the year,” he adds, and “we’re not in recession, but things were tough from a freight perspective. … This index, recently, was back up since 2015 began. It might be a glimmer of hope that freight’s picking up and things will get better.”

ATBS’ Amen sees a load-to-truck ratio of 12 in the Internet Truckstop Group’s market demand index as representative of a balanced market. “When we’re above that line,” he says, “things are good for truckers.” Though levels didn’t fall last year to those seen during the depths of the last recession, “get over to 2015 halfway through the year,” he adds, and “we’re not in recession, but things were tough from a freight perspective. … This index, recently, was back up since 2015 began. It might be a glimmer of hope that freight’s picking up and things will get better.”At once, rates didn’t fall as fast as diesel prices, which shielded contractors’ and independents’ income from the freight-market issues to one degree or another, making, for instance, faster speeds less of a hit to net income, Amen says.

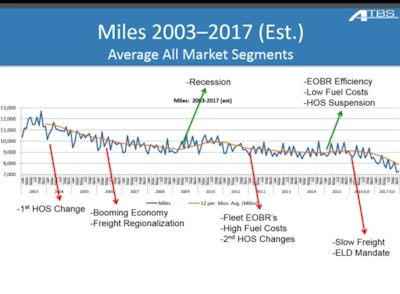

Looking out into the next couple of years, however, Amen believes a miles reduction could be in the offing as regulations — most significantly, mandated electronic logging devices — among other pressures, come into play.

Amen modeled this prediction for average miles figures through 2017 with a historical and projected look at owner-operator business trends. “We won’t see miles going down as drastically as this chart shows for individual drivers,” he says, “as capacity will be reduced as we have the ELD mandate.” Amen estimates well over half, “maybe 75 percent,” of Class 8 trucks on the road today are running under a paper system today.

Amen modeled this prediction for average miles figures through 2017 with a historical and projected look at owner-operator business trends. “We won’t see miles going down as drastically as this chart shows for individual drivers,” he says, “as capacity will be reduced as we have the ELD mandate.” Amen estimates well over half, “maybe 75 percent,” of Class 8 trucks on the road today are running under a paper system today.As for the eventual capacity situation mandated ELDs could bring about, Amen believes “rates will have to go up to compensate for less trucks. That could be a good thing for drivers and fleets and everybody in this business.”

The most important thing to consider in the present moment is that “shippers are expecting rate reductions right now,” he adds. “It’s an important time to have a strong backbone and maintain the rates that we have.”

How was your 2015? If you’re reading on a smartphone, tap the image to call and leave us a message to weigh in. We’ll round up responses in a special mailbag podcast. Alternately, drop a comment below. If you’re on a desktop, call 530-408-6423. Make sure to tell us your name and state of residence.

How was your 2015? If you’re reading on a smartphone, tap the image to call and leave us a message to weigh in. We’ll round up responses in a special mailbag podcast. Alternately, drop a comment below. If you’re on a desktop, call 530-408-6423. Make sure to tell us your name and state of residence.Amen covered a variety of other trends, spelled out below:

Macroeconomic outlook

While it “doesn’t feel like we’re as low as 2009 from a freight perspective,” Amen says, “some do believe that. … Maybe this is the start of a recession.”

Maintenance

Long-term trends in maintenance show growing costs for those with owner-operated trucks. In 2003, owner-operators spent about 7-8 cents a mile to maintain a truck. “We have seen maintenance cost per mile creep up every single year but for the recession, due to deferred maintenance,” Amen says. The good news is that costs have leveled off to around 10-11 cents per mile after the years of rising costs.

Fleet owner-operator programs

Given marked decline in spot rates, Amen noted believes many independents are likely looking around for a solid fleet partner in this climate, citing a 42-cents/mile revenue premium an independent needs to earn to financially break even over the rate cut that comes with leasing to a fleet.

“In 2016 we’re for sure below that 42-cent-a-mile break-even,” he says. “Independents are looking for a place with contracts with shipeprs because the spot market has dried up.” Whereas in 2014, there was an almost $80,000 average revenue differential between being leased and independent “at the peak of the spot market.”