The dip is in line with seasonal trends for early April and is a resettling of the market following the large jump in spot market activity from the week prior, says Truckstop.com’s Director of Research Roxanne Bullard.

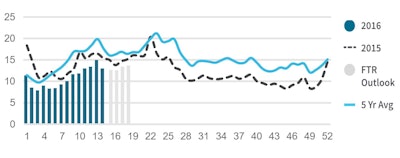

The number of available loads posted on the spot market, per Truckstop.com data, fell in the week, while the number of available trucks climbed, pushing the index down to a reading of 13 — just below the 15-20 range deemed to be a neutral market.

The MDI measures market favorability based on the number of available loads and the number of available trucks, a calculation of supply vs. demand. A reading below 15 signals a market that favors brokers in rate and load negotiations, while a reading above 20 signals a spot market favoring carriers. For the index reading to move higher, the ratio of loads to trucks needs to fall, either due to an influx of loads or a drop in available trucks.

The MDI is the weekly anchor for Truckstop.com’s Trans4Cast report, which also offers an MDI reading for the major truckload segments, among other key metrics from the week prior. Click here to sign up to receive and view the Trans4Cast report. Overdrive, in partnership with Truckstop.com, will be offering a weekly snapshot of the overall MDI or a trend within a segment worth highlighting from the previous week.