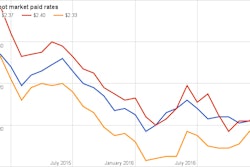

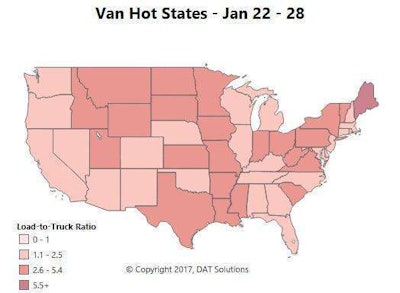

The normal seasonal slow-down has been leading to lower demand and lower rates, but van volumes continue to look solid compared to 2016 in the spot market. In fact, notes Ken Harper, the only early-year period in recent memory with greater volumes was the extraordinary 2014 “Snowpocalypse” that kicked that good year for owner-operators.

Current volumes on DAT Load Boards haven’t dropped off in January like they did around this same time a year ago.

Hot markets: Outbound rates in most major van markets were down last week, which isn’t out of the ordinary for late January. Houston was the one market where rates held steady, but the downward momentum slowed down a lot in Atlanta and Philadelphia. In fact, rates rose in both directions for van shipments between those two cities. Rates were up an average of 19 cents per mile for the round trip.

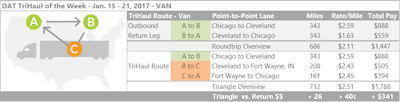

Not so hot: While most lanes paid less last week, the price drops weren’t as sharp as in past Januarys. The biggest declines were scattered throughout the country, though they mostly came from “backhaul” markets, where inbound rates are almost always higher than outbound. For example, the lane from Denver to Phoenix fell 17 cents, and Cleveland to Chicago lost 13 cents.

That lane outbound from Chicago is still averaging $2.59/mile, a pretty good rate for this time of year. Break the Cleveland to Chicago segment into two shorter hauls and you’ll more than make up the revenue difference, based on per-mile averages. Loads from Cleveland to Fort Wayne, Ind., paid $2.43/mile on average last week. From there to Chicago: $2.45/mile. If you can make it work with your schedule, you’d only be adding 26 miles and you’d boost your roundtrip revenue by around $340.

That lane outbound from Chicago is still averaging $2.59/mile, a pretty good rate for this time of year. Break the Cleveland to Chicago segment into two shorter hauls and you’ll more than make up the revenue difference, based on per-mile averages. Loads from Cleveland to Fort Wayne, Ind., paid $2.43/mile on average last week. From there to Chicago: $2.45/mile. If you can make it work with your schedule, you’d only be adding 26 miles and you’d boost your roundtrip revenue by around $340.

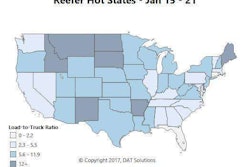

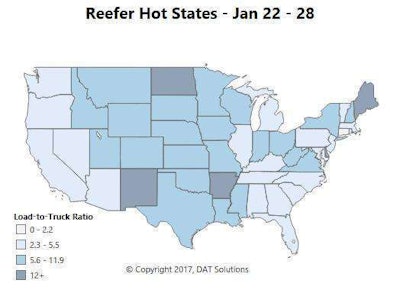

Reefer trends have been similar to vans. Volumes actually improved on the top 72 reefer lanes, which has probably helped slow the normal seasonal decline.

Hot markets: There’s no consistent market driving produce right now, so reefer volumes have been shifting around the country. There were more reefer loads available out of Grand Rapids, Mich., and Lakeland, Fla., but rates were down in both markets on average.

Not so hot: Two of the biggest drops last week were on lanes out of the Midwest: Reefer loads going from Green Bay, Wis., to Joliet, Ill., paid 31 cents less, and the lane rate from Grand Rapids to Atlanta fell an average of 25 cents per mile. Load counts were up slightly in Los Angeles, but there were also more available trucks, so the average outbound rate there fell 7 cents.