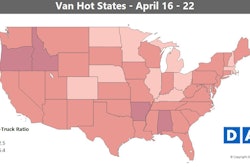

Last week’s load-to-truck ratios for dry vans around the nation are shown on the map from DAT Load Boards up top (darker states on the map represent better conditions for truckers). DAT’s Ken Harper notes the freight-volume picture was more or less the same as in March to close out the month. The final week of April, “we had expected a bigger bump with the usual end-of-month inventories being cleared, but the bump didn’t happen,” Harper says. “I’ve read in several places that higher-than-expected inventories in markets ranging from retail to autos had a dampening effect on GDP and economic forecasts.”

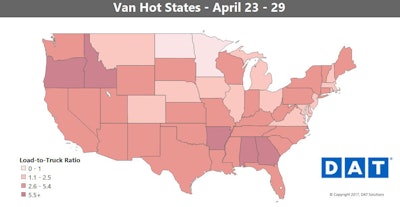

At once, the national van rate average was up 4 cents. “Atlanta is the place to be for both van and reefer loads, ranking No. 1 and 3, respectively, for those freight types,” says Harper.

More promising news: California van volumes are up, as are rates out of L.A.

Not so hot last week: Chicago volumes are still off, while outbound rates from Philadelphia had the biggest decline. The good news was that most other drops in rates were slight.

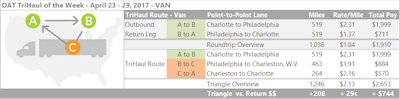

Charlotte has been a major source of van loads on DAT load boards this spring, and the lane to Philadelphia paid an average of $2.31/mile last week. But volumes are down coming back out of Philly, and the lane to Charlotte is a low-paying one by and large – averaging just $1.37/mile. Split the return with a leg from Philly to Charleston, W.Va. ($1.91/mile average lately), then another from there to Charlotte ($2.16/mile). Not counting deadhead, the extra drop and pick would add a little more than 200 miles and more than $740 in revenue, figuring the averages, if you can make it work with your hours.

Charlotte has been a major source of van loads on DAT load boards this spring, and the lane to Philadelphia paid an average of $2.31/mile last week. But volumes are down coming back out of Philly, and the lane to Charlotte is a low-paying one by and large – averaging just $1.37/mile. Split the return with a leg from Philly to Charleston, W.Va. ($1.91/mile average lately), then another from there to Charlotte ($2.16/mile). Not counting deadhead, the extra drop and pick would add a little more than 200 miles and more than $740 in revenue, figuring the averages, if you can make it work with your hours.

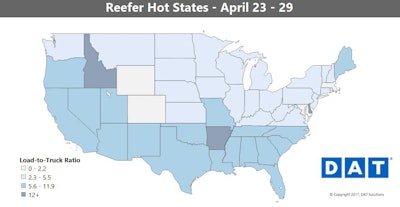

Reefer overview: Markets close to the Mexican border posted high load-to-truck ratios last week thanks to cross-border produce, including Nogales, Ariz., and Laredo, Texas. Volumes soared 64 percent in McAllen, Texas.

Hot markets: Central Florida is hitting peak season, and reefer loads going from Lakeland to Baltimore paid 24 cents better last week at an average of $2.24 per mile. Miami to Northern New Jersey had the second biggest jump, up 17 cents to $2.26 per mile.

Not so hot: An unusually wet winter in California led to delays in planting, which has caused some shipping gaps recently. Produce shipments from the state should gain strength in the coming weeks, but in the meantime, rates from Sacramento to Denver dropped 14 cents on average.