This week’s update shows spot market rates up in most of the top lanes for all three major tracked segments (dry van, reefer, flatbed) on DAT Load Boards. Lookin’ good, lookin’ good,” noted DAT’s Ken Harper attendant to this week’s load-to-truck demand maps and intel.

“One downer: fuel surcharges dropped a penny,” Harper adds. “To quote Matthew McConnaghey, ‘All right, all right, all right.'”

“The freight and rate picture from last week benefited from some independents ending early so they could be home with their families,” Harper concludes. “Reduced capacity and end-of-month inventory clearance led to brokers paying a premium for ‘retail vans.'” For produce, whether in vans or reefers, “the hauls got longer, but rates still went up. Rates are approaching or at par with last year’s peaks on certain lanes.”

“The freight and rate picture from last week benefited from some independents ending early so they could be home with their families,” Harper concludes. “Reduced capacity and end-of-month inventory clearance led to brokers paying a premium for ‘retail vans.'” For produce, whether in vans or reefers, “the hauls got longer, but rates still went up. Rates are approaching or at par with last year’s peaks on certain lanes.”

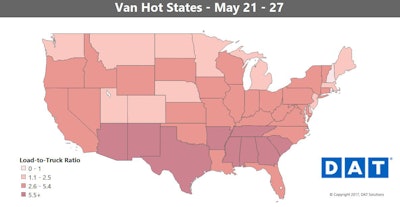

Van overview: Spot market rates on the top 100 van lanes surged last week, with the strongest showing of the year. Freight patterns indicated strong retail trade ahead of the Memorial Day weekend. Some drivers also seemed to finish the week early, which led to tighter capacity.

Hot markets: Memphis van load counts spiked 13 percent last week, and Houston continues to be a powerhouse for freight this spring. In general, markets that feed into the Northeast were up.

Not so hot: Also in general, rates coming out of the Northeast were down. Prices were also down in Seattle and Denver, but only one major lane was down significantly last week. On average, Chicago to Buffalo paid 17 cents less at $2.14 per mile.

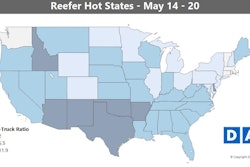

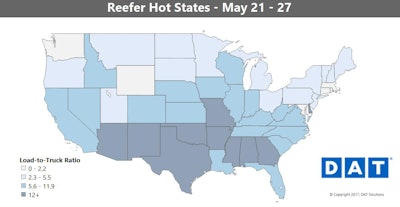

Reefer rates have already matched their June peaks from a year ago in many parts of the country, which could make for a very strong June this year.

Reefer rates have already matched their June peaks from a year ago in many parts of the country, which could make for a very strong June this year.Hot markets: Central California came on strong last week, and reefer rates soared 13 percent out of Fresno. Prices were up out of Nogales, Ariz., and there were surprising, late-season spikes out of Florida.

Not so hot: Southern Idaho was the only produce-shipping market to slip last week. Not many lanes paid less last week, but reefer loads going from the Mexican border market of McAllen, Texas, to Atlanta went for 19 cents less per mile on average. The shorter lanes out of McAllen stayed strong, though.

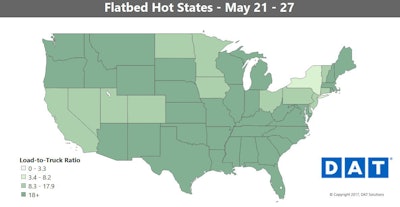

The story was the same for flatbeds as with the other segments: volumes dipped, but rates rose. Load counts are still strong in Texas. Los Angeles had the highest volumes outside of Texas.

The story was the same for flatbeds as with the other segments: volumes dipped, but rates rose. Load counts are still strong in Texas. Los Angeles had the highest volumes outside of Texas.

Hot markets: Demand for flatbeds has been strong all year. And while Texas is still the volume leader, it was the port cities of Los Angeles and Jacksonville that propelled rates last week. Cleveland also finally joined the party. Still, prices have been volatile from one week to the next.

Not so hot: Even with all the increased flatbed activity this year, the steel-producing market of Pittsburgh has been relatively quiet. Volumes are also still soft in Birmingham, Ala., except for local freight. Rates fell in Savannah, Ga., after a two-week spike.