Owner-operators and small fleets reading the tea leaves in freight market data might be heartened by recent spot performance for vans and reefers, particularly the last couple weeks. The national van average rate shot back up well above $2/mile last week, and reefer sat at its highest all-in rate average in two years at $2.76, even as fuel prices dropped a couple dimes per gallon.

Yet Avery Vise, FTR Transportation Intelligence's Vice President of Trucking, speaking in a Thursday edition of the company's State of Freight online seminar series, cautioned against reading too much into the recent gains. It's pretty typical for the post-Thanksgiving period for both segments, he said, and historically, the current week "is one where we see rates drop for both dry van and refrigerated" after running up. "I'm going to withhold judgement on it as yet ... until we get down the road a couple more weeks" into December.

Seasonal volatility isn't near as impactful for flatbed carriers in the spot market, he added, along the way delivering insight on how regulatory moves around non-domiciled CDLs, and increased out-of-service English-language enforcement, could reduce overall trucking capacity, boosting demand metrics.

Overall, Vise said, today's state of freight delivers a "mixed picture" by the numbers, equal parts encouraging and worrisome.

Short-term, here's our updated spot market chart showing the three principal OTR segments with the latest weeks' updates from Truckstop.com/FTR's Spot Market Insights dashboard.

What's the bump worth to the average owner-operator in a dry van? Using a fixed-cost figure based on a conservative 220 days worked annually, the average ATBS client owner-operator needs to cover $262 worth in fixed expense daily, likewise 69 cents/mile in variable cost. Plugging those numbers into Overdrive's Load Profit Analyzer tool, we compared a 950-mile, two-day run between Dallas and Chicago at last week's $2.16/mile van rate average and the $1.89/mile low point for van rates seen in September.

[Related: Overdrive's Load Profit Analyzer: How to use to assess rates, costs]

History's precedents may well hold, of course: if demand's cooled this week for vans and reefers, as Vise suggested, trucking's "still in a very seasonally volatile part of the year, returning later in the month, too," around Christmas.

Cross your fingers for some sustained strength into the new year after what's generally been another tough year for spot rates and trucking overall.

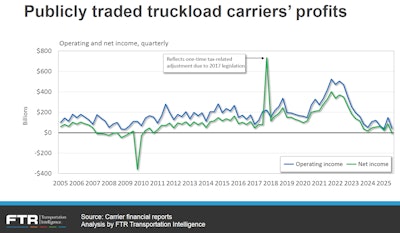

That's right, owner-ops aren't alone in trucking-business difficulty. Vise's part of FTR's State of Freight presentation, which also featured rail/intermodal market updates, showed 2025's been tough for big publicly traded carriers, too, based on their quarterly financials reporting.

Operating and net income have ticked along considerably lower than pre-pandemic levels the last couple years, net dipping negative with the most recent data available. It's a "very small $7 million negative" all things considered, Vise noted, yet "that is significant. We've not seen that since 2010," coming out of the Great Recession.

At the same time, U.S. Census Bureau and other data showed gains reflecting the broader trucking sector over the same time period captured in the above chart. "Revenues for the entire trucking sector," Vise noted, seem relatively strong, up 3.5% for the third quarter over the prior, and 4.2% year over year. "It's some strong performance in what is still a sluggish sector" generally speaking.

And it also means the broader trucking industry work, including plenty small and mid-size carriers, "outperformed the publicly traded carriers" for the third quarter, Vise said, calling it "something to be encouraged by."

[Related: 'Foreign driver capacity' hit incoming? Fleets watch, as owner-op income back on a slow rise]

The 'capacity reductions' so many hope for

Vise has long compared new trucking authorities granted to those revoked by the Federal Motor Carrier Safety Administration, and since the big run-up in new carriers during the COVID-19 pandemic boom, "we're kind of in a stable environment" now, he said, just as "we were prior to the pandemic."

For those watching trucking capacity for signs of reduction, and better demand for carriers still in business, Vise noted November new entries were at their lowest monthly point since May of 2020, the depths of the worst of the early pandemic period. November numbers "could be an outlier," he said, but could "also reflect cost and enforcement issues that could be putting a lid on new-carrier creation."

A well-documented uptick in English-language-proficiency enforcement since the return of ELP violations to the out-of-service criteria, the ongoing pressure on states around the country with respect to their non-domiciled CDL programs for non-citizens: both stood the chance of further limiting new-carrier entry into the market and fueling exits -- the capacity reduction so many around trucking hope to see to boost demand for their own hauling (so long as they're not reduced themselves, as it were).

[Related: How owner-operators can avoid joining the 'capacity reduction' ranks]

Vise noted capacity dynamics are such that the total carrier population is still much larger than it was pre-pandemic. He dug into ELP violations and found a huge majority of the OOS variants of the violation issued were just single violations, i.e. not associated with the same vehicle VIN number on any inspection report more than once. It's not an exact proxy for a driver exiting the market after an ELP OOS order, of course, he said. And "it's not always true that they would have totally left the market."

Yet extrapolating from the peak period for ELP enforcement -- August-September, he said, after the notorious crash in Florida of non-domiciled CDL holder Harjinder Singh and subsequent ELP publicity -- he calculated roughly 25K-27K drivers annually "might be taken off the road" by such enforcement. "In my experience, a driver isn't deterred by something that might happen, but something that does happen," Vise added. "Even if you bump it up to 35,000 -- that's not a market-moving number."

[Related: Trucking English language enforcement: Toughest and most-lax states]

Federal changes to non-domiciled CDL eligibility rules for non-citizens could "have a much bigger impact," Vise said, to reduce trucking capacity. That'd be particularly true if the FMCSA's own estimate of 194,000 current CDL holders adversely impacted by the rule bears out. (It's worth noting not all those 194,000 work in over-the-road trucking.)

As regular readers well know, the rule for now is on hold under order of the Washington, D.C., circuit federal appeals court, and ultimate impact is uncertain. Yet Vise's viewpoint on bigger impacts, if it's allowed to take full effect as written, are reflected broadly among Overdrive readers as well.

The results above from our recent survey of more than 5,000 readers showed 7 in 10 predicting a rate increase with implementation of the non-domiciled CDL rule, whether large or marginal. Vise made note of the rule's halting by the court, and the reality reported by Overdrive, too, that "FMCSA does seem to be trying to work around that by going after individual states," he said. New York is the latest put on notice by the DOT over alleged non-domiciled CDL lapses.

[Related: New York the 'worst offender' for improper non-domiciled CDLs: DOT]

And none of the states Overdrive's consulted with since the court-ordered stay have restarted non-domiciled CDL issuance. (The FMCSA's emergency rule in September ordered those programs paused pending review and compliance with its changes.)

Thus time, future court rulings, and individual states' behavior around licensing will ultimately determine how potential freight impacts play out. Access more reader opinion on the rule via the special report from Overdrive's survey below.

You can get on FTR's State of Freight notification list for future sessions via this link.