“Even if you’re not planning to go anywhere near Texas or Louisiana, you might be affected by Hurricane Harvey,” notes DAT rep Peggy Dorf with this week’s routine spot market update.

With the difficulty getting into or out of the massive freight hub of Houston, at least six states typically served by distribution centers in Houston for now will have to be re-supplied from a different direction. For example, you can expect to see a lot more than the usual number of westbound dry van loads out of Atlanta, Greenville, S.C., and Charlotte in the next week or two. There will be other ripple effects, too, and you may want to take that into account when you negotiate rates this week and next.

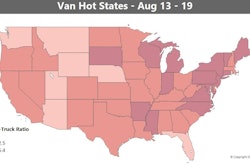

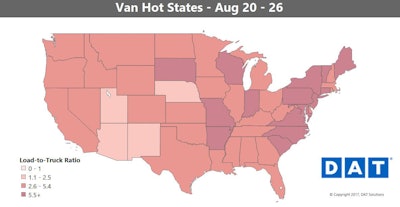

The demand map for the dry van segment — darker shaded areas indicate higher load-to-truck ratios on the board — continued to be on the darker side in the last week, part of a somewhat uncommon trend in the spot market for this time of year. Run through the shifting sands of van demand between March and the most recent week in the video at the top of this post.

The demand map for the dry van segment — darker shaded areas indicate higher load-to-truck ratios on the board — continued to be on the darker side in the last week, part of a somewhat uncommon trend in the spot market for this time of year. Run through the shifting sands of van demand between March and the most recent week in the video at the top of this post.Van hot markets: Even before the storm hit, load-to-truck ratios were up last week for vans, and capacity will likely continue to tighten, putting pressure on rates to rise in the Northeast and Midwest. Buffalo outbound rates were still trending up. Chicago also had a good week. There is extraordinarily high demand for trucks in Minneapolis and Grand Rapids, Mich., as well as Green Bay, Wis., as many carriers are responding to the urgent need in the South Central region in Harvey’s wake.

Looking ahead, you can expect to see rates rising in the Southeast, too, including Atlanta, Memphis, and the port cities of Miami, Savannah, Ga., and Charleston, S.C., as cargo ships are diverted to the East Coast from Houston’s deep water port on the Gulf of Mexico.

Not so hot: Seattle lost traction last week, with high-volume outbound rates paying less, due largely to a transition in the California and Pacific Northwest produce season.

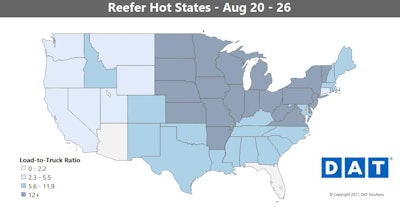

The national average for reefer rates stayed put last week at $2.07 per mile, but pricing got rearranged by region.

The national average for reefer rates stayed put last week at $2.07 per mile, but pricing got rearranged by region.Reefer hot markets: Demand for reefers continues to accelerate in the Midwest, which is a normal trend for this time of year. In addition to van demand, there are more reefer loads moving out of the Grand Rapids, Mich., market, which is known for apples, while Green Bay, Wis. is harvesting potatoes. More loads left Fresno, Calif. last week, too, but the volume hasn’t been high enough to change pricing very much so far.

Not so hot: On the downside, Nogales, Ariz. rates slipped lower, although that may change in the coming weeks as there are fewer available routes out of the Mexican border market of McAllen, Texas. Sacramento, Calif., gave up the previous week’s gains in rates and volume. Miami rates also dropped 4 cents per mile, but rates and volume there are likely to increase in the coming weeks, as ships full of South American produce are diverted from Houston to Miami’s deep-water port.