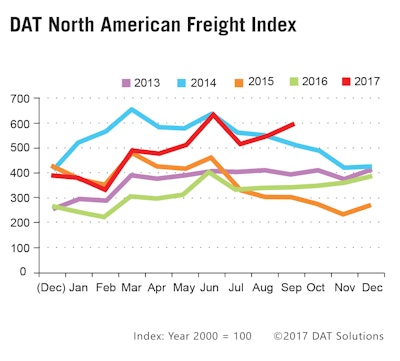

As noted by the red line here, DAT’s Freight Index shows soaring freight activity on the spot market in September compared to recent years.

As noted by the red line here, DAT’s Freight Index shows soaring freight activity on the spot market in September compared to recent years.Shippers fear “double-digit,” by percentage, rate increases loom in the coming months as trucking capacity continues to tighten and spot market freight activity — and rates — continue to gain ground. Spot market rates have soared in recent months, and the contract market could be next, says FTR analyst and Chief Operating Officer Jonathan Starks.

“Spot market rates are a leading indicator. And, although there is a lag, contract markets are starting to follow suit. Shippers are now taking notice and are getting worried about dealing with double-digit rate increases as we head towards bid season,” he says.

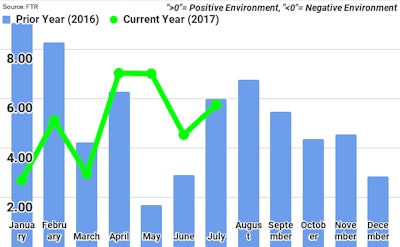

A look at FTR’s monthly Trucking Conditions Index compared to last year. The green line represents 2017 monthly readings, and the blue bars are 2016’s monthly readings.

A look at FTR’s monthly Trucking Conditions Index compared to last year. The green line represents 2017 monthly readings, and the blue bars are 2016’s monthly readings.These notes come from FTR’s monthly Trucking Conditions Index report. The most recent TCI is from August, which shows modestly positive conditions for carriers. August’s reading isn’t “wholly reflective of the current environment for truckers,” FTR notes, because it doesn’t include the supply chain disruptions caused in September by hurricanes Harvey or Irma, nor does it fully reflect the ballooning spot market.

“The truck market is currently in the middle of a significant change in conditions,” Starks says. “While the recent weather events made it feel like it happened all at once, spot markets have actually been moving in this direction for the past year. Load activity was rising, truck availability was falling, and rates were already up 20 percent year over year before the storms hit.”

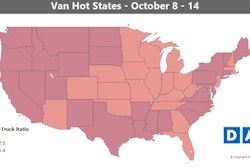

Loadboard DAT Solutions last week reported strong spot market gains in September from August and record-setting year-over-year growth.

Available loads on DAT’s loadboard were 74 percent higher than the same month last year, DAT reported.

The dry van segment in particular saw major gains, with freight activity climbing 15 percent from August and up 80 percent from September 2016. Rates, meanwhile, gained 19 cents a mile from August and were up 35 cents from last September, DAT reported. The load-to-truck ratio hit 6.6 to 1 — the highest average in 8 years.

Reefer demand grew 4 percent from August and 70 percent from last September, pushing rates up 15 cents from August. DAT says harvest season in the pacific northwest and upper midwest, as well as late harvests in California, drove the segment’s surge.

The number of flatbed loads grew 3 percent from August. Though flatbed freight activity typically declines in September, recovery and rebuilding efforts in storm-stricken areas helped boost the segment this year, DAT says. Rates in the segment climbed 8 cents in September.

DAT says it expects the elevated spot market activity to continue at least until February.