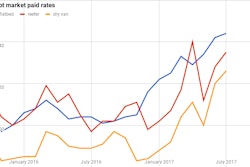

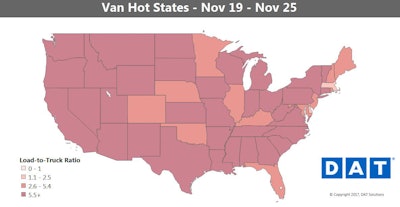

There was less freight moving, and fewer trucks operating, during the Thanksgiving week on the whole. Yet, notes DAT’s Ken Harper with this week’s spot market demand update, the week leading into Thanksgiving saw a record number of loads moving on the top 100 van lanes — van demand, measured by the ratio of posted loads to posted trucks on DAT Load Boards, remained sky high.

On 73 of the top 100 van lanes, Harper noted, activity was actually higher last week and national average van rates actually rose given the premium shippers/brokers paid for loads right around Thanksgiving. For the week in full, that average stood at $2.07 per mile.

Flats and reefers also saw positive rate growth, which you’ll see in below the charts.

“These should be happy holidays for the trucking community” when it comes rates, says Harper, “especially owner-operators. Looking farther out, the prognosis is still good, although there are reports of a slowing economy. We shall see.”

“These should be happy holidays for the trucking community” when it comes rates, says Harper, “especially owner-operators. Looking farther out, the prognosis is still good, although there are reports of a slowing economy. We shall see.”Hot van markets: A whopping 73 of the top 100 van lanes had higher rates last week. The West Coast has led these trends: As a percentage, outbound rates from Los Angeles, Seattle and Stockton, Calif., rose the most in November. Dallas joined the party last week, with a 6 percent uptick on outbound rates on average. Several high-traffic lanes out of Chicago also had big increases.

Not so hot: There weren’t many declines last week. And for the most part, the lanes that paid less fell only slightly. The biggest drop was on the lane from Los Angeles to Dallas, which fell 15 cents to an average of $2.40 per mile – still high for a lane on which rail is a heavy competitor.

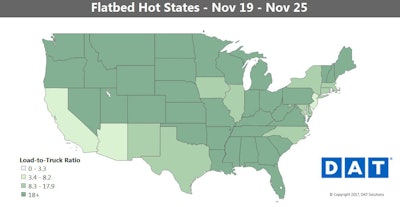

“With a less frenetic push for hurricane relief, flatbed traffic has slowed down” a bit, Harper says. At once, “this is the time of year when flats in many parts of the country are loaded with Christmas trees with corresponding increases in demand and rates.”

“With a less frenetic push for hurricane relief, flatbed traffic has slowed down” a bit, Harper says. At once, “this is the time of year when flats in many parts of the country are loaded with Christmas trees with corresponding increases in demand and rates.”Flatbed overview: Flatbed rates were stable in November, despite falling seasonal volumes. Some of the craziness we saw after Hurricanes Harvey and Irma is gone, and there’s the normal decline in construction activity that happens this time of year. Still, pricing hasn’t dimmed all that much, and the looming ELD mandate probably factors into that.

Hot markets: The relatively brief Christmas tree season has turned regions like Michigan and the Pacific Northwest dark in the Hot States Map for flatbeds. For the month of November, Los Angeles and Savannah, Ga., had the biggest increases in outbound rates, each up 9 percent from the previous month.

Not so hot: Regional trends have been mixed. For instance, three Southeast markets posted biggest gains last week: Memphis, Roanoke, Va., and Savannah, Ga. On the other hand, Atlanta rates were down the most in November, tied with Phoenix.

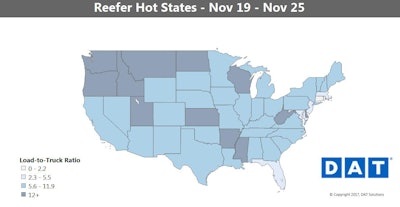

“With turkeys, meats, and frozen foods moving into grocery chains,” Harper says, national average reefer rates last week “jumped to $2.43/mile, the highest they’ve been in 3 years.”

“With turkeys, meats, and frozen foods moving into grocery chains,” Harper says, national average reefer rates last week “jumped to $2.43/mile, the highest they’ve been in 3 years.”Reefer overview: The refrigerated market this month looked more like June than November, with the national average rate rising again above three-year highs. The market loosened last week compared to where load-to-truck ratios had been in recent weeks, but urgent shipments that had to move around Thanksgiving kept prices high.

Hot markets: Even though last week was short work due to Thanksgiving, reefer load counts were actually higher in Grand Rapids, Mich., compared to the week before. That’s a hub for some meat and poultry shippers, so that suggests there was a rush to restock grocery stores right before the holiday. Prices kept climbing out of Los Angeles, too, and there was a 12 percent jump in outbound reefer rates from Miami, likely due to demand at the port.

Not so hot: We’ll have to wait and see how rates and demand adjust now that Thanksgiving is behind us, but Denver and Elizabeth, N.J., were the only major reefer markets with lower outbound rates in November compared to October.