Load posts on DAT load boards have risen steadily since the second week in November, and they were up another 17 percent last week.

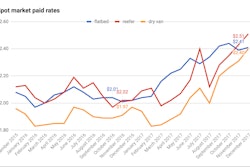

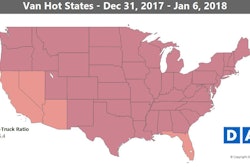

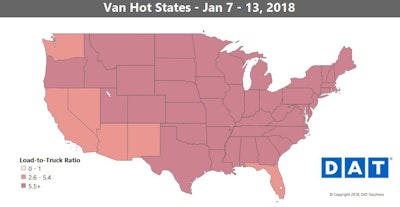

Load posts on DAT load boards have risen steadily since the second week in November, and they were up another 17 percent last week.With a big rise in load posts, truck posts also surged 52 percent last week, suggesting more owner-operators returning from the holidays or getting back in action after a lull post-December 18, when the ELD mandate went into effect. In fact, last week was the first time that the van load-to-truck ratio declined since the new regulation went into effect. The ratio was still 10.7 van loads per truck, though, way above what’s typical for any time of year, let alone the middle of winter. Demand, winter weather and higher fuel costs kept rates elevated in many parts of the country.

Hot markets: Winter storms disrupted shipments in the Northeast and pushed rates higher, especially out of Allentown, Pa., where outbound prices jumped up 10 percent. Buffalo, N.Y., got an 8 percent bump, followed next by Charlotte at 4 percent. Strong volumes out of Chicago pushed the average outbound rate there to nearly $3 per mile.

Not so hot: Rates continue to fall out of Dallas and Los Angeles, which is normal for this time of year, and weather wasn’t a big factor in either market last week. Seattle and Stockton, Calif., have both weakened in January, but there are still many markets around the country where the average outbound rate was upward of $2 per mile.

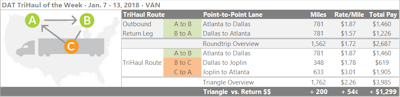

Van rates out of Dallas have been falling a bit in seasonal fashion, so if you’re making a delivery in North Texas, you might look to break up your return trip into two shorter hauls to boost your average rate per mile and get better use of the equipment. Based on last week’s prices, van loads going from Atlanta to Dallas paid an average of $1.87 per mile, while the return trip was down to $1.57. Break that return with a run through Joplin, Mo., where the load-to-truck ratio is still well above the national average. The average per-mile Dallas to Joplin was $1.78 per mile last week, an improvement over averages straight back to Atlanta. The big boost comes on the 350-mile trip from Joplin to Atlanta, where the average rate has surged up to $3.01 per mile. The extra leg on the trip adds about 200 miles to the total, not counting deadhead, and would increase your average rate per loaded mile from $1.72 to $2.26, if you can make it work with your hours.

Van rates out of Dallas have been falling a bit in seasonal fashion, so if you’re making a delivery in North Texas, you might look to break up your return trip into two shorter hauls to boost your average rate per mile and get better use of the equipment. Based on last week’s prices, van loads going from Atlanta to Dallas paid an average of $1.87 per mile, while the return trip was down to $1.57. Break that return with a run through Joplin, Mo., where the load-to-truck ratio is still well above the national average. The average per-mile Dallas to Joplin was $1.78 per mile last week, an improvement over averages straight back to Atlanta. The big boost comes on the 350-mile trip from Joplin to Atlanta, where the average rate has surged up to $3.01 per mile. The extra leg on the trip adds about 200 miles to the total, not counting deadhead, and would increase your average rate per loaded mile from $1.72 to $2.26, if you can make it work with your hours. Reefer load counts stayed high through the second week of January as well, with temperature-controlled trailers being used in many areas to keep freight from freezing in the cold weather. The weather wasn’t the only reason rates stayed high, though.

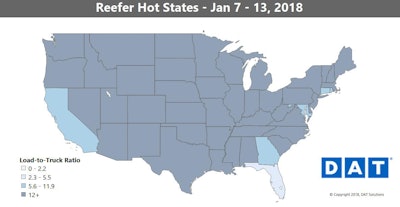

Reefer load counts stayed high through the second week of January as well, with temperature-controlled trailers being used in many areas to keep freight from freezing in the cold weather. The weather wasn’t the only reason rates stayed high, though.Hot reefer markets: The biggest rate increases for the month have been along the Mexican border in McAllen, Texas, and Nogales, Ariz. Prices on several lanes out of those markets soared last week, like the lane from McAllen to Chicago, which shot up 77 cents to an average of $2.73 per mile.

Not so hot: Reefer rates continued to slide out of Florida and California, with the exception of Sacramento. The biggest drop of the week was on the lane from Lakeland, Fla., to Baltimore, which lost 69 cents at an average of $2.23 per mile.