Spot market demand tends to slow down in the middle of January, so it wasn’t a surprise to see load posts down by 4 percent overall on DAT load boards last week. It was actually the first decline since mid-November that wasn’t related to a holiday-shortened work week.

Normal seasonal declines in load posting activity have been occurring at a much slower pace than the pace of marked “increases after the ELD mandate went into effect,” says DAT’s Matt Sullivan. “So even though load posts, load-to-truck ratios, and national average rates were down” this week, “prices are still very elevated in many parts of the country.”

Prices fell on most of the high-traffic reefer lanes last week, but the impact of the ELD mandate is evident on the spot market. Reefer rates are still higher than they were a month ago, and just like with van rates, the rate of decline has been slow compared to how quickly prices spiked after the new regulations went into effect – even during the off-season for reefers.

Prices fell on most of the high-traffic reefer lanes last week, but the impact of the ELD mandate is evident on the spot market. Reefer rates are still higher than they were a month ago, and just like with van rates, the rate of decline has been slow compared to how quickly prices spiked after the new regulations went into effect – even during the off-season for reefers.Hot reefer markets: Produce out of California’s Imperial and Coachella Valleys boosted reefer volumes out of the Southern part of the state last week, which could soon lead to higher prices out of Ontario and other nearby markets. Volumes also soared 38 percent in Elizabeth, N.J. Weather may have been a factor on the lane from Green Bay, Wis., to Philadelphia, as the average rate shot up 78 cents to $4.73 per mile.

Not so hot: The produce coming out of Southern California coincided with reduced demand for Mexican produce, which led to a sharp downturn in rates and volumes out of Nogales, Ariz. On the other side of the country, the average reefer rate on the lane from Atlanta to Philadelphia dropped 47 cents to an average $2.59 per mile.

Rates were down on most of the top 100 van lanes, but rate dynamics mentioned above for reefers ruled the day — rates are still extremely high in many markets and on many lanes.

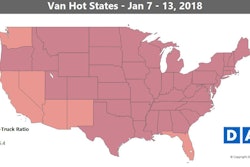

Rates were down on most of the top 100 van lanes, but rate dynamics mentioned above for reefers ruled the day — rates are still extremely high in many markets and on many lanes.Van hot markets: Philadelphia hit an all-time high last week, with an average outbound rate of $2.43 per mile. The energy sector is also hot right now, which added pressure on prices to go up out of Houston. Some of that demand could also result from rescheduled deliveries after snow and ice shut down bridges and on-ramps around the city. Weather could have also been a factor in Chicago, where the average van rate topped $3 per mile.

Not so hot: Rates were down all along the West Coast, where weather hasn’t been much of a factor. Seattle rates have fallen farthest in the past month, and volumes were way down last week. Rates also fell out of Allentown, Pa., but those prices are coming down from a very high point. All of this is typical for this time of year.

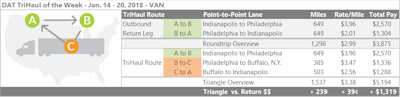

The pricing increases out of Philadelphia are making for many good-paying round trips out of and back into the city lately, but it also opens up some opportunities to make even more money on three-leg run through that market. For this example, we start out of Indianapolis, where van rates to Philly soared to an average of $3.96 per mile last week. The return trip from Philly to Indy averaged $2.01, for $2.99/mile for the whole trip. That’s not bad, but if you’re having trouble finding loads heading back on that lane, you might look to go from Philly to Buffalo, N.Y., instead. That lane paid $3.47/mile on average last week. The final leg of the trip would be Buffalo to Indy, which averaged $2.56/mile. One advantage is that the 650-mile length of haul from Indianapolis to Philly is one of those “dangerous lanes,” more challenging to complete in a single day with ELDs. The three-leg round might enable you to add miles that round out that third day for more productive better use of the truck and driving hours. It adds 240 miles compared to the standard round-trip, not counting any deadhead miles. It’d boost revenue, based on last week’s rate averages, up to $3.38/mile, or about $5,200 for the total trip, compared to $3,900 without the extra delivery and pickup.

The pricing increases out of Philadelphia are making for many good-paying round trips out of and back into the city lately, but it also opens up some opportunities to make even more money on three-leg run through that market. For this example, we start out of Indianapolis, where van rates to Philly soared to an average of $3.96 per mile last week. The return trip from Philly to Indy averaged $2.01, for $2.99/mile for the whole trip. That’s not bad, but if you’re having trouble finding loads heading back on that lane, you might look to go from Philly to Buffalo, N.Y., instead. That lane paid $3.47/mile on average last week. The final leg of the trip would be Buffalo to Indy, which averaged $2.56/mile. One advantage is that the 650-mile length of haul from Indianapolis to Philly is one of those “dangerous lanes,” more challenging to complete in a single day with ELDs. The three-leg round might enable you to add miles that round out that third day for more productive better use of the truck and driving hours. It adds 240 miles compared to the standard round-trip, not counting any deadhead miles. It’d boost revenue, based on last week’s rate averages, up to $3.38/mile, or about $5,200 for the total trip, compared to $3,900 without the extra delivery and pickup.