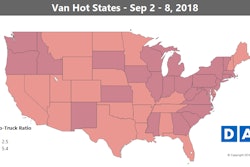

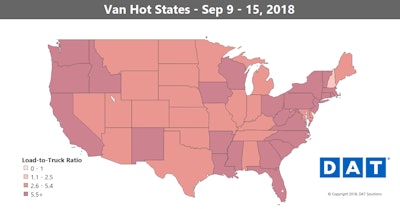

Load-to-truck ratios and spot truckload rates moved lower during the week ending Sept. 15, as Southeast supply chains adjusted to the effects of Hurricane Florence making landfall and, elsewhere, freight markets resumed typical seasonal downward trends.

Van and reefer shipments into storm-impacted areas were heavy leading up to last Friday, when Florence made landfall, consistent with re-stocking store shelves in the storm zone, as well as pre-positioning emergency freight just outside the expected path of the storm.

This week, load-to-truck ratios have been below 1:1 (less than one load post for every truck post) in key Southeastern markets including Roanoke, Va.; Greensboro, Raleigh, and Wilmington, N.C.; and Columbia S.C.

The national average spot van rate fell 4 cents to $2.16/mile after a 6-cent increase the previous week.

The national average spot van rate fell 4 cents to $2.16/mile after a 6-cent increase the previous week.Hot van markets: There were spikes in van rates heading into the Carolinas and Virginia prior to the hurricane’s arrival:

- The average van rate on the lane from Allentown, Pa., to Richmond, Va., jumped up 60 cents to $3.44/mile, very high coming out of the Northeast.

- Atlanta to Charlotte gained 20 cents to $2.96/mile.

- The average outbound rate from Charlotte rose 3 cents to $2.54/mile, as shippers moved goods out of the area ahead of the storm.

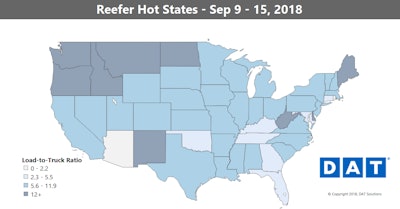

Reefer load posts gained 7 percent and truck posts rose 14 percent compared to the previous week, which included the Labor Day holiday. 20-25 percent might have been more in line with expectations.

Reefer load posts gained 7 percent and truck posts rose 14 percent compared to the previous week, which included the Labor Day holiday. 20-25 percent might have been more in line with expectations.The reefer load-to-truck ratio slipped from 8.3 to 7.7 loads per truck. The national average reefer rate, which gained 8 cents the previous week, fell 3 cents to $2.54/mile.

Hot reefer markets: Average outbound rates from Atlanta (up 6 cents to $2.81/mile) and Los Angeles (up 5 cents to $3.20/mile) bucked an overall trend toward softer rates. The Upper Midwest has been volatile — Grand Rapids, Mich., to Cleveland lost 35 cents at $3.58/mile, while Green Bay, Wisc., to Wilmington, Ill., climbed 36 cents to $4.20/mile on strong volumes.