Independent Robert Codding hauls with this 2001 Kenworth W900 and spread-axle 48-foot flatbed. When his wife needed to back out of handling most of the freight contracting and the books for his one-truck operation, he moved to dispatch provider Merge Transit to book loads on the spot market. “I have seen a 15 percent increase in top-line revenue,” he says. “That more than offsets what I pay for the service.”

Independent Robert Codding hauls with this 2001 Kenworth W900 and spread-axle 48-foot flatbed. When his wife needed to back out of handling most of the freight contracting and the books for his one-truck operation, he moved to dispatch provider Merge Transit to book loads on the spot market. “I have seen a 15 percent increase in top-line revenue,” he says. “That more than offsets what I pay for the service.”Since he got his carrier authority in 2010 as Custom Logistics, Robert Codding has pursued a strategy that many at the time advised against: running 100 percent load board freight.

“A lot of people ‘in the know’ said it couldn’t be done,” he recalls, but Codding’s example proved them wrong. Hauling flatbed freight from his home base in Cocoa, Florida, he’s supported his family well up through the recent milestone of his wife’s completion of homeschooling their two children.

Codding’s wife also served as the dedicated dispatcher/load planner for his operation, and with her newly available time, the couple considered buying trucks and hiring drivers. In the end, though, she decided to pursue becoming a 911 dispatch operator.

So Codding looked for ways to handle his dispatching and maintain or hopefully increase his profitability. He chose an independent dispatching service that was investing in technology to boost value to its independent carrier customers.

Such services act as a bridge between those carriers and brokered spot market freight. Instead of dealing directly with brokers, truckers pay for negotiating prowess and access to relationships any good full-time independent dispatcher has built with brokers. In ideal situations such as Codding’s, the additional fees siphoned off to the dispatch service are more than made up for by higher rates.

For Codding today, he’s spending about $50 per load. For a week, that might be $150 total on $7,000-$8,000 in revenue, or around 2 percent of revenue. That’s a significant amount lower than some fees former independent dispatcher Lesa Burton-Lewis saw when she worked principally as a bridge to the spot market for Landstar- and Admiral Merchants-leased owner-operators. Most of the loads in those transactions ended up with a 6 or 7 percent fee coming her way.

Burton-Lewis has seen the dispatcher’s cut as high as 10 to 12 percent, and as low as what Codding is paying under a flat-fee structure with his service, Merge Transit. Merge and other dispatch providers increasingly are positioning themselves less as entities taking their cut of the load in exchange for handling the negotiation and booking process with brokers. Instead, they want to function as broader administrative service providers operating for flat, predictable rates.

Merge’s typical agreement, says company head Justin Taylor, is a flat $125 per week if the owner-operator uses his company 100 percent of the time for dispatch. Merge also is available on a per-load basis: $50 per load at a gross revenue over $1,000, $35 for under $1,000.

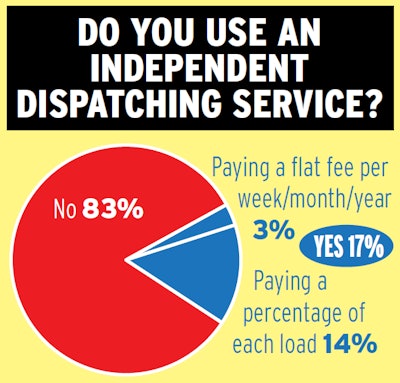

Use of flat-fee dispatch programs by independent owner-operator respondents to Overdrive’s 2018 Compensation Survey is rare. For those using them, predictability in costs is a key attraction, particularly in an environment where rates are rising.

Use of flat-fee dispatch programs by independent owner-operator respondents to Overdrive’s 2018 Compensation Survey is rare. For those using them, predictability in costs is a key attraction, particularly in an environment where rates are rising.Merge’s smartphone application – available for $35 per month – allows its users to access freight-document details and effectively track revenue per mile. “We’re working on the cost section,” Taylor says, which will allow an independent carrier to “put their cost in the system and see their true cost per mile” and analyze net income.

Integration with independents’ accounting software could be the next step, he says, with a seamless connection to products such as QuickBooks. “We’re trying to take all the data entry out of it for the owner-operator so that they can manage everything from their phone.”

The Independent Carrier Group’s “profit optimization” service also has leveraged in-house technology with a smartphone app. ICG head Scott Jordan, based in Peculiar, Missouri, developed the ICG ProfitCalc rate-calculator app as a way for independents to use line-item cost allocation to yield a quick-glance rate calculation. It’s aimed at giving owner-operators confidence in negotiating to ensure an adequate profit margin on any load.

The company‘s principal dispatcher – load and profit “optimizer,” in ICG’s parlance – is Ohio-based former owner-operator Scott Reed. He dispatches four carriers with a total of eight trucks, negotiating spot market loads for each truck. His service costs $250 a week per truck, which isn’t charged if not used.

ICG’s service came about in part as a result of seeing owner-operator friends who “weren’t very good at negotiation,” says Jordan, also owner of small fleet Power House Transportation. “Over in the bulk freight world, I saw people using dispatchers getting rooked for 10 percent” of every load, he says.

With an interest in market health – generally for all truckers and specifically for independents – Jordan saw a way to put his ProfitCalc application to good use. He established a flat-rate administrative service to bring independent owner-operators who might be new to the game of negotiating loads up to speed.

“Hopefully, they learn the process until they don’t need me anymore,” says Jordan. Since joining ICG early this year, Reed says, two owner-operators have gotten to that point after working with him for a time.

Adds Jordan, “The carriers that get into the CEO mentality, we can help them grow.” Having a dispatch provider on board can be an effective way to cover added responsibilities as that growth begins to happen.

As an example, with Merge Transit, Andrew Gonzalez has effectively added another truck to his two-unit OverDrive Transport operation since it began with one truck a few years back, around the time Merge started up. “I trust them with those trucks completely,” he says. Gonzalez is not an operator himself, but rather owns the two-truck company in addition to a construction business near McAllen, Texas.

“When I ran the trucks myself, I like to say I did a pretty good job” working the spot market, Gonzalez says. One unit is Texas intrastate only, the other runs interstate. “But once I jumped on with Merge, they clearly knew the market much better than I did. My revenue skyrocketed immediately from there. Even now, considering we’re on e-logs [for the interstate unit], they’re still doing about the same or a little bit above average in terms of revenue.”

That all comes as a result of their dispatchers having put in the time to “learn the spot market and do their research” on real-time freight demand, Gonzalez says. “They’re not just taking whatever’s on the board or whatever their contacts have,” but rather are being more proactive about taking advantage of good areas.

That strategy’s also evident with Reed and Jordan’s optimization operation, says owner-operator Doug Viaille, who’d used a different dispatch service at 10 percent of the load in the past. “I’m not going to complain about the job they were doing,” Viaille says of that service, though Reed and Jordan “are definitely better at negotiating rates” and also better than Viaille admittedly has been himself.

Goat’s Transport owner Doug Viaille has been running fewer miles at a higher rate and profit margin since switching to Independent Carrier Group as his dispatcher of choice. Viaille, headquartered in Garland, Texas, still occasionally books his own loads.

Goat’s Transport owner Doug Viaille has been running fewer miles at a higher rate and profit margin since switching to Independent Carrier Group as his dispatcher of choice. Viaille, headquartered in Garland, Texas, still occasionally books his own loads.“There’s always something out there that has a profit in it,” says Viaille, owner of Goat’s Transport, headquartered in Garland, Texas. “The trick is to find it. Scott [Reed] is clearly good at doing that, even when I tell him I need to do something or other,” such as get home to Texas. “He’s good at finding a load to make it happen that still has a profit in it.”

During the week of July 4, when capacity metrics tilted negotiation leverage heavily in favor of the trucker, Viaille hit revenue of “$4.96 per mile on all miles,” Reed says.

Since employing ICG, Viaille says, “I’m running overall fewer miles and making more per mile” in profit. The relationship with Reed and Jordan also has had other unexpected benefits.

Viaille had a clutch issue in Zanesville, Ohio, on his way to Wheeling, West Virginia. He’d gotten to a service point, but the fix was going to mean a late delivery. Talking about the situation with Reed, who lives on the other side of the state, Viaille says, “Scott says, ‘Just sit tight.’ Twenty minutes later, I pick up the phone, and he says, ‘I’ve got you a truck.’ He came pulling in later, and we hitched to the trailer” to deliver the load.

That wasn’t the end of it. After all that effort to be on time, the receiver made Viaille return two days later. As the carrier’s representative with the broker, “Scott’s arguing with the broker the whole time to pay detention and layover,” Viaille says, and “we ended up with an extra $1,600 out of the deal. I know I wouldn’t have done all that myself. That’s dedication.”

Small-fleet owner Gonzalez speaks highly of his relationship with Taylor and others at Merge, which has helped him develop his own sense of the freight spot market.

“I can say I’ve learned as much from them as I did actually sitting down and doing the job myself,” Gonzalez says. “They take the time to explain to you where the money is. I’ve heard stories of other companies where like as not you’ve got three to four people you’re dealing with, and you don’t know who you’re talking to half the time.”

Merge also helped Gonzalez with a driver referral in the past. If Taylor “sees a company with Merge that needs a driver, he’ll get out there and post ads and such” via the company’s and his own social media presence. “You can definitely say he’s gone above and beyond what a dispatching service does.”

Next in this series: Income distribution with/without an independent dispatcher, and service-evaluation tips