The sudden intensification of Hurricane Michael had a dampening effect on freight movement in the Southeast last week and contributed to a 13 percent overall drop in load posts on the DAT network of load boards.

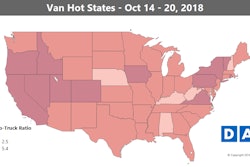

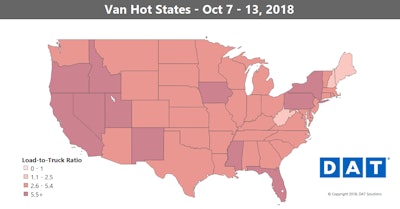

With weaker demand and the number of available trucks up 2 percent for the week ending Oct. 13, national average load-to-truck ratios plunged for all three equipment types:

Vans: 4.7 loads per truck, down 16 percent

Flatbeds: 18.3, down 17 percent

Reefers: 6.3, down 9 percent

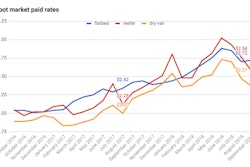

National average spot truckload rates fell as well:

Vans: $2.13/mile, down 4 cents compared to the previous week. Average spot truckload rates fell on 70 of the top 100 van lanes nationwide.

Flatbeds: $2.51/mile, down 2 cents

Reefers: $2.46/mile, down 6 cents

Three trends shaped the week in spot freight:

The sudden storm

Unlike the load lead up to Hurricane Florence, forecast nearly two weeks in advance, Hurricane Michael went from a tropical depression to a Category 4 storm in two days, giving shippers and brokers less time to post freight and find trucks to move it out of the region. Afterward, trucks were stranded in Florida, and road closures halted shipments on major truck routes like I-10 between Houston, New Orleans, and Jacksonville, and I-75 up from Florida to Atlanta.

Notably, prices out of Atlanta ($2.32/mile) and Charlotte ($2.45/mile) were neutral compared to the previous week. Reefer volumes were up 48 percent out of Lakeland, Fla., and rates rose 5 percent. Atlanta to Miami was up 17 cents to $3.07/mile.

Fuel prices keep rising

The national average van rate fell 4 cents to $2.13/mile. That’s an “all-in” rate — a line-haul portion plus an estimated fuel surcharge. The national average price of on-highway diesel rose another penny last week to $3.39 per gallon, which helped push the surcharge portion up 2 cents to 36 cents per mile.

Van rates have been relatively stable in recent months as the industry adapts to the ELD mandate and compromised productivity. That hasn’t been the case yet for reefer freight: many lanes are still seeing volatile price changes from week to week.

Van rates have been relatively stable in recent months as the industry adapts to the ELD mandate and compromised productivity. That hasn’t been the case yet for reefer freight: many lanes are still seeing volatile price changes from week to week.Midwestern rate swings

Despite sharp drops in the rates out of Chicago ($3.06/mile, down 15 cents) and Grand Rapids, Mich. ($3.56/mile, down 9 cents), the Midwest still has some of the highest spot reefer rates in the country. Green Bay to Wilmington, Ill., swung upward 29 cents to $3.78/mile.