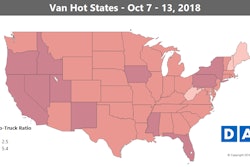

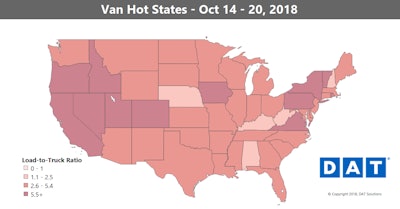

The spot van average rate on loads in the DAT network slipped 2 cents to $2.11/mile, its lowest point so far this year. The combination of more trucks and fewer loads kept load-to-truck ratios from rising compared to the previous week:

Vans: 4.7 loads per truck, unchanged

Flatbeds: 17, down 7 percent

Reefers: 6, down 4 percent

On the top 100 van lanes, 64 lanes showed lower average rates, 29 were higher, and seven were unchanged.

On the top 100 van lanes, 64 lanes showed lower average rates, 29 were higher, and seven were unchanged.The van market to watch: Los Angeles. Ships delayed by Typhoon Mangkhut last month are arriving at the ports of Los Angeles and Long Beach, which receive almost 50 percent of Asian imports to the U.S. Nearly 6,000 van loads were posted last Friday alone.

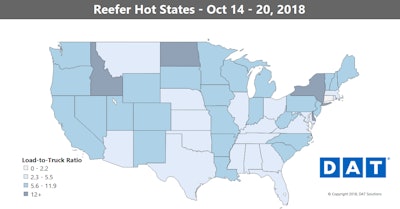

The national average spot reefer rate fell 2 cents to $2.44/mile. Load post counts were down 3 percent last week while truck posts increased 1 percent. On the top 72 lanes, 48 experienced lower prices, 20 were higher, and four were neutral.

The national average spot reefer rate fell 2 cents to $2.44/mile. Load post counts were down 3 percent last week while truck posts increased 1 percent. On the top 72 lanes, 48 experienced lower prices, 20 were higher, and four were neutral.Several reefer lanes were affected by harvests wrapping up:

- Twin Falls to Los Angeles was up 10 cents to $2.26/mile as we near the end of the potato harvest.

- Green Bay to Minneapolis tumbled 40 cents to $2.43/mile. With produce season essentially over in the Upper Midwest, competition for reefer loads is driving rates lower.

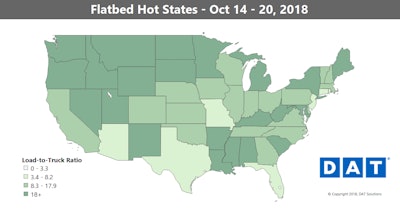

The national average spot flatbed rate was $2.49/mile, down 2 cents. Load posts were down 3 percent from the previous week while truck posts increased 4 percent.

The national average spot flatbed rate was $2.49/mile, down 2 cents. Load posts were down 3 percent from the previous week while truck posts increased 4 percent.Prices on major flatbed lanes were more balanced than they were for vans and reefers: among the top 78 flatbed lanes, 42 lanes moved lower, 35 were higher, and one was neutral.

A key flatbed market last week was Roanoke, Va. It may be that steel foundries and steel and plastic fabrication plants in Roanoke are ramping up to serve manufacturers, including the auto industry. Many U.S.-made steel products are enjoying greater popularity lately because tariffs have made imported steel more expensive. Plastics are a petroleum by-product, and the U.S. is exporting more plastic resins along with oil and gas. Some of these loads move on flatbeds.

- Roanoke to Harrisburg is up 23 cents per mile over the past month and last week averaged $3.43/mile.

- Roanoke to Baltimore is up 14 cents over the past month. The average rate last week was $3.49/mile.