The number of load posts on the spot truckload freight market declined 21 percent during the week ending Dec. 29, not an unusual figure when you compare a holiday-shortened workweek to a full one. But truck posts were down 47 percent compared to the previous week, and tight capacity helped keep rates firm, said DAT Solutions, which operates the DAT network of load boards.

National average load-to-truck ratios

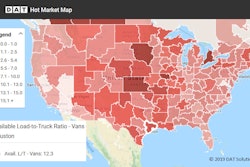

The capacity imbalance produced big gains in national average load-to-truck ratios:

**Van: 8.9, up 74 percent

**Flatbed: 26.1, up 34 percent

**Reefer: 10.5, up 49 percent

National average spot rates

Spot rates ticked up for all three equipment types last week:

**Van: $2.08/mile, up 1 cent

**Flatbed: $2.43/mile, up 1 cent

**Reefer: $2.44/mile, up 2 cents

Rates increased despite a 3-cent decline in the price of diesel to $3.05/gallon. Spot rates include a calculated surcharge.

Trend to watch: Flatbed freight

The number of flatbed load posts dropped 44 percent and truck posts were down even more, 58 percent, in the holiday week — that’s in line with expectations for such a week. But keep an eye on Texas, and in particular Houston, where the average outbound spot flatbed rate increased 16 cents to $2.69/mile and Houston to New Orleans jumped 60 cents to $3.08/mile. Encouraging signs for freight moving to the oilfields.

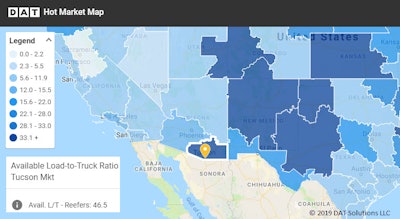

Market to watch: Nogales

Nationally, the number of reefer load posts was down just 9% last week. But truck posts dropped 40%, so it’s no shock that 64 of the 72 top reefer lanes paid better compared to the previous week.

Few reefer markets have been stronger than Nogales, Ariz., where the load-to-truck ratio has popped up to 46.5.

Few reefer markets have been stronger than Nogales, Ariz., where the load-to-truck ratio has popped up to 46.5.Clearly, produce from Mexico did not take a holiday last week, and, with fewer trucks on the board, several high-volume lanes paid well over $2.50/mile:

**Nogales to Chicago gained 48 cents to $2.57/mile (1,750 miles)

**Nogales to Brooklyn, N.Y., was up 5 cents to $2.64/mile (2,425 miles)

**Nogales to Dallas jumped 38 cents to $2.77 (980 miles)

**Nogales to Los Angeles rose 29 cents, to $2.70 (550 miles)