The trend for fleets with California operations to shy away from leasing owner-operators in California is continuing and appears to be in the works at one of the nation’s largest carriers.

One alternative to leasing relies on brokered loads to new independents instead of contracting with them under the traditional leasing model. The practice is seen as a work-around following a California court decision that casts doubt on the legality of owner-operator leasing in the state.

The trend is affecting carriers of all sizes, says Joe Rajkovacz, head of government affairs for the Western States Trucking Association.

That might include Swift Transportation, a wing of the Knight-Swift conglomerate that operates upwards of 30,000 trucks, including nearly 5,000 owner-operators. Officials from Swift and its parent company, Knight-Swift Holdings, did not respond to Overdrive’s inquiries on the topic.

Swift is reportedly ending its arrangements with leased owner-operators based in California, if they do not satisfy certain conditions. Some are being encouraged to transition to independents, say Rajkovacz and two Swift owner-operators.

Rajkovacz says his group is helping some operators obtain their authority as they transition to an independent operation.

Two owner-operators affected by the move confirmed they have received notice from Swift that they must make a decision by March 2. Both operators declined to speak for attribution.

It’s unclear how many owner-operators such a policy could affect, and if the policy would apply to all owner-operators based in California and leased to Swift or any of its sister companies, such as Knight and Barr-Nunn. Rajkovacz estimates that, given Swift’s and Knight’s heavy presence in the West, it could be as high as 20 percent of the companies’ owner-operators – about 1,000 of the 5,000 total.

One owner-operator, who owns his truck outright, told Overdrive he was presented with options by management at his Los Angeles-area operation to either become a company driver to continue working the dedicated, local/regional account he typically serviced, or to obtain an out-of-state address and run more than 50 percent of his miles outside of California.

He said he’d heard that lease-purchase drivers were offered $2,500 to buy out their lease before becoming company drivers. They also received the option to finance the remaining portion of their truck and exercise the same out-of-state address option available to those who own their trucks.

An operations employee of Swift in Southern California, not speaking for attribution, confirmed some of these details before referring further questions elsewhere. The employee also says the move reflects the company’s response to the California high court’s Dynamex v. Superior Court of Los Angeles decision last year. The court used the so-called ABC test for determining appropriate independent contractor classification.

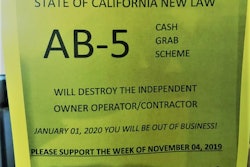

While use of the ABC test is being challenged both in the courts and through the California state legislature, the terms of its application are sufficiently broad to put in jeopardy independent contractor relationships between owner-operators and carriers who also own and operate their own trucks.

What contractors were told in his location, says the Swift-leased owner-operator who owns his truck outright: “March 2 would be our last day as owner-operators” leased to the company, unless moves out of state were undertaken. The owner-operator, who’s been in a leased arrangement with Swift for nearly two decades, and employing drivers at times, has since been moving toward getting his authority.

“I can’t go back to being a company driver” over the road, he says, and with small children he doesn’t consider a move out of state a viable option.

A group of Swift drivers he’s not a part of has been talking with a lawyer about their options, he says, but he wants no part of that. From a contractual standpoint, he said he believed “they have the right to get rid of us whenever they want, just like we have the right to leave whenever we want.”

The move also follows the U.S. Supreme Court ruling in the case of New Prime v. Oliveira, in which the nation’s high court ruled that carriers can’t force legal disputes, such as those arising over employment status in California and elsewhere, into private arbitration. Instead, such disputes, including when arbitration clauses exist in contracts, can start in court, which some see as a venue in which outcomes often tilt toward to classifying leased owner-operators as employees instead of independent contractors.

Combined with the Dynamex decision, the rulings create a difficult legal environment for independent contractor-type relationships in California.

The Western States Trucking Association is one of two California-based associations challenging the Dynamex ruling and the ABC test in court.

The carrier work-around “is really disappointing to me,” Rajkovacz says. “As this trend takes hold, it is very much going to limit the number of owner-operators in the marketplace.”

He points to the cost of insurance, particularly for newly independent owner-operators with authority, as a huge limiting factor for leased operators trying to make the change. “With some of our members operating 50 trucks under their company policy, an average annualized cost for liability insurance is around $5,000,” per truck, Rajkovacz says.

A formerly leased owner-operator changing to independent could easily spend $15,000 or more annually on liability, he says. “Some won’t even be insurable, some of that for no fault of their own,” given how insurance companies increasingly seem to be viewing even not-at-fault accidents as a matter of a driver’s record.