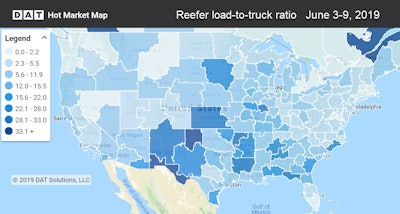

National average spot truckload rates and load-to-truck ratios jumped last week, which included the three-day Roadcheck inspection blitz, said DAT Solutions, operator of the DAT network of load boards. While fewer Overdrive readers than in years past signaled they’d be taking the week off, as previously reported, measurable spot-market participation on the truck side was down in DAT’s load metrics, pushing demand indicators and average rates up.

Southwest ports of entry were stacked with reefer freight last week. There were 22 loads for every available truck in Nogales, Ariz.

Southwest ports of entry were stacked with reefer freight last week. There were 22 loads for every available truck in Nogales, Ariz.National average spot rates, June to date

**Van: $1.93/mile, 14 cents higher than the May average

**Reefer: $2.29/mile, 14 cents higher than May

**Flatbed: $2.27/mile, 6 cents higher than May

Diesel fell 3 cents to $3.10/gallon as a national average.

Trend to watch: Post-Roadcheck capacity

Spot truckload rates were higher on 90 of the top 100 van lanes in the United States and there were more loads posted than during any other single week since September 2018. The van load-to-truck ratio increased from 2.6 to 3.8, two full points higher than the May average. Of course, Roadcheck typically has an impact on available capacity, rates, and load-to-truck ratios that doesn’t always sustain itself for long. Time will tell.

Market to watch: Nogales, Arizona

Part of the Tucson market, Nogales is one of the busiest ports of entry on the U.S.-Mexico border. Last week, Nogales had more than 1,500 load posts versus just 73 truck posts on the DAT network. That makes for a load-to-truck ratio of 22.

Spot rate trends follow the direction of the load-to-truck ratio, sometimes within days or hours. Spot market players are typically negotiating rates for loads that are picked up within a day or two. So it was no surprise to see the average outbound spot reefer rate jump 29 cents to $2.50/mile last week, with much of the traffic heading east. For instance, Nogales to Brooklyn gained 54 cents to $2.96/mile.

McAllen, Texas—another key entry point—had a 16% increase in load volume and a 7-cent bump in the average outbound rate to $2.34/mile compared to the previous week. Long story short, there’s freight to be had on the U.S.-Mexico border.