Spot truckload freight volume increased 1.2% during the week ending August 11, with the availability of spot reefer and flatbed freight making up for a decline in van loads, said DAT Solutions, which operates the DAT network of load boards. Nationally, the number of available trucks increased 3.7% compared to the previous week. Average spot rates in August remain below July averages.

National average spot rates, through August 11

**Van: $1.81 per mile, 3 cents lower than the July average

**Flatbed: $2.28 per mile, 5 cents lower

**Reefer: $2.14 per mile, 5 cents down

Trend to watch: Sagging van volumes in the Southeast

Van volume slipped 3% last week nationally, and 57 of DAT’s top 100 van lanes by volume had lower rates. The availability of van loads has been sliding over the past four weeks, especially in big Southeastern freight hubs:

**Atlanta, down 8% over four weeks

**Charlotte, down 5%

**Memphis, down 7%

**Houston, down 5%

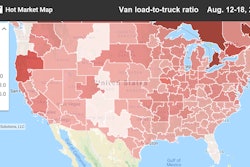

The national average van load-to-truck ratio dropped from 2.2 to 2.1. That’s nearly a full point lower than the August 2018 average. There’s still uncertainty over how shippers will react to shifting tariff deadlines on Chinese imports. So far in August, spot van volumes indicate a lack of urgency to move goods ahead of the Sept. 1 deadline for additional taxes to take effect.

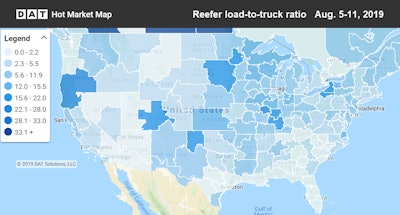

Market to watch: Grand Rapids reefers

Demand for reefers trailed off in the West and shifted to Michigan, Minnesota, and other Midwest markets.

Demand for reefers trailed off in the West and shifted to Michigan, Minnesota, and other Midwest markets.There were signs of reefer demand shifting northward as higher volumes from Denver (up 34%) and Grand Rapids (up 71%) market areas helped elevate the national average reefer load-to-truck ratio from 4.2 to 4.3 last week. While apple harvests won’t really kick in until the end of August, demand for trucks increased—and sent rates higher—on key Midwestern lanes:

**Grand Rapids to Cleveland surged 62 cents to $3.71 per mile

**Grand Rapids to Atlanta added 31 cents to $2.59 per mile

**Chicago to Atlanta rose 20 cents to $2.77 per mile

**Chicago to Philadelphia was up 16 cents to $3.03 per mile

**Chicago to Denver increased 13 cents to $2.40 per mile

That’s good news for truckers migrating away from California, where demand has declined. Load volume from Los Angeles fell 10%, Sacramento was down 5%, and Ontario lost 3% last week.