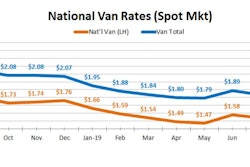

The spot truckload freight market was bustling during Labor Day week as Hurricane Dorian threatened the East Coast. But since the storm passed, so has the sense of urgency that pushed spot van and reefer rates and volumes higher on DAT’s load board network, the company says. Last week, load-to-truck ratios edged lower for vans and reefers — flatbed ratios were up, though, portending rates movement this week as cleanup/recovery efforts continued in earnest.

National average spot rates, September 2019 (through Sept. 15)

**Van: $1.85 per mile, 4 cents higher than the August average

**Flatbed: $2.19 per mile, 1 cent lower than August

**Reefer: $2.18 per mile, 4 cents higher than August

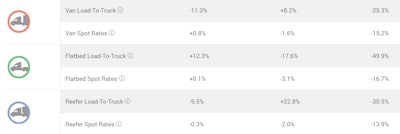

Flatbed’s national metrics via DAT’s load board network (more available via DAT Trendlines) stood out last week for the rise in demand, indicated by shifts in load to truck ratios with volume growth. The left-most numbers represent change in the most recent week. Middle column shows August change versus previous month, the right-most the year over year negatives.

Flatbed’s national metrics via DAT’s load board network (more available via DAT Trendlines) stood out last week for the rise in demand, indicated by shifts in load to truck ratios with volume growth. The left-most numbers represent change in the most recent week. Middle column shows August change versus previous month, the right-most the year over year negatives.Trend to watch: Flatbed freight

As expected, spot flatbed freight activity rose last week as construction supplies and equipment moved into areas along the East Coast affected by Hurricane Dorian. The national average flatbed load-to-truck ratio was 14.4, up from 12.7 the previous week. Increased volume in the wake of Hurricane Dorian pushed several Southeast markets higher, led by Tampa ($1.72 per mile, up 7 cents) and Birmingham, Ala. ($2.44 per mile, up 9 cents).

Less expected was the surge in flatbed freight volume from Houston, a major hub for materials and machinery headed to West Texas and the Permian Basin. The average outbound flatbed rate increased just a penny to $2.38 per mile last week, but freight volume from Houston jumped 67%, and the lane from Houston toward El Paso more than doubled. And that’s before the attacks on the Saudi Aramco facility, which may lead to some elevation in oil prices.

Together, flatbed trends in the Southeast and Texas suggest better times ahead for carriers.

Market to watch: Pacific Northwest

The van load-to-truck ratio averaged 2.4 last week and rates were higher on 35 of the Top 100 biggest van lanes by volume. Fifty-four lanes fell and 11 were unchanged compared to the previous week.

Rates were higher out of Washington and Oregon thanks to rising imports and a strong fall tree-fruit harvest. The average outbound spot rate from Seattle increased 3 cents to $1.54 per mile, with the lane to Eugene and Medford, Oregon, up 19 cents to $2.72/mile, one of last week’s biggest gainers. Portland to Stockton added 11 cents to $1.41/mile.